Real Assets

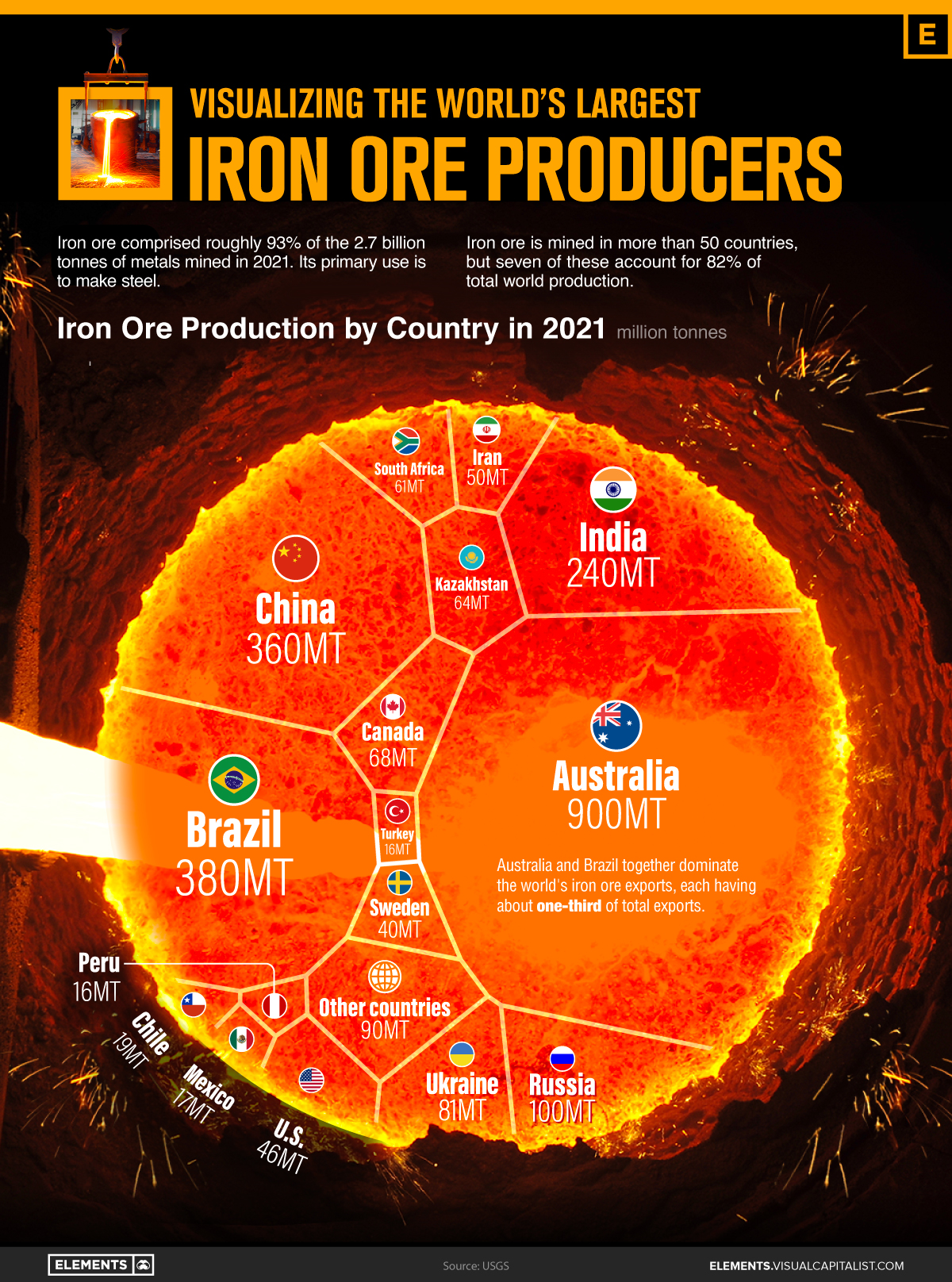

Visualizing the World’s Largest Iron Ore Producers

Visualizing the World’s Largest Iron Ore Producers

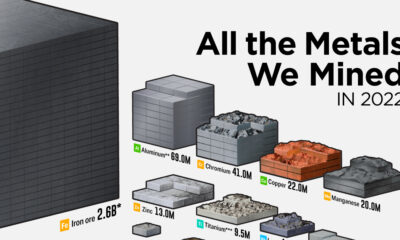

Iron ore comprised roughly 93% of the 2.7 billion tonnes of metals mined in 2021.

It is used primarily (98%) to make steel, with the remaining 2% becoming magnets, auto parts, and catalysts.

Using data from the U.S. Geological Survey, the above infographic lists the world’s largest iron ore producers in 2021.

Pilbara and Carajás Iron Ore

Iron is the fourth most abundant element on the planet after oxygen, silicon, and aluminum, constituting about 5% of the Earth’s crust.

Australia produced 35% of the iron ore mined last year. Almost 90% of identified iron ore resources in the country occur in Western Australia, especially in the Pilbara region.

The large and dry region is known for its Aboriginal peoples and also for its red earth as a result of a chemical reaction of iron exposed to air and water. The three major Pilbara iron ore producers are also among the top mining companies in the world: BHP Group, Rio Tinto Ltd, and Fortescue Metals.

| Country | 2021 Production (Tonnes) |

|---|---|

| 🇦🇺 Australia | 900,000,000 |

| 🇧🇷 Brazil | 380,000,000 |

| 🇨🇳 China | 360,000,000 |

| 🇮🇳 India | 240,000,000 |

| 🇷🇺 Russia | 100,000,000 |

| 🇺🇦 Ukraine | 81,000,000 |

| 🇨🇦 Canada | 68,000,000 |

| 🇿🇦 South Africa | 61,000,000 |

| 🇰🇿 Kazakhstan | 64,000,000 |

| 🇮🇷 Iran | 50,000,000 |

| 🇺🇸 United States | 46,000,000 |

| 🇸🇪 Sweden | 40,000,000 |

| 🇨🇱 Chile | 19,000,000 |

| 🇲🇽 Mexico | 17,000,000 |

| 🇵🇪 Peru | 16,000,000 |

| 🇹🇷 Turkey | 16,000,000 |

| 🌐 Other countries | 90,000,000 |

After Australia, Brazil is the second biggest producer, with iron ore accounting for 80% of the country’s mining exports.

Brazil’s biggest public company, Vale, is the world’s largest producer of iron ore and nickel. The company runs the Carajás mine, the largest iron ore mine in the world. Located in the state of Pará, in the north of the country, the mine is operated as an open-pit mine and is estimated to contain roughly 7.2 billion metric tons of iron ore.

Together, Australia and Brazil dominate the world’s iron ore exports, each having about one-third of total exports.

China is the largest consumer of iron ore, used to feed its steel industry.

Despite being the third largest producer, China still imports around 80% of the iron ore it uses each year. The country brought in 1.12 billion tonnes of the commodity last year.

Iron Ore’s Role in the Green Economy

Iron ore demand is expected to rise in the coming years as steel plays a crucial role in producing and distributing energy.

Steel is used extensively in agriculture, solar and wind power, and also in infrastructure for hydroelectric.

Furthermore, steel is used for the production of transformers, generators, and electric motors, along with ships, trucks, and trains.

Real Assets

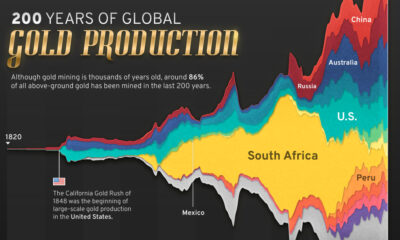

Visualizing Global Gold Production in 2023

Gold production in 2023 was led by China, Australia, and Russia, with each outputting over 300 tonnes.

Visualizing Global Gold Production in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Over 3,000 tonnes of gold were produced globally in 2023.

In this graphic, we list the world’s leading countries in terms of gold production. These figures come from the latest USGS publication on gold statistics (published January 2024).

China, Australia, and Russia Produced the Most Gold in 2023

China was the top producer in 2023, responsible for over 12% of total global production, followed by Australia and Russia.

| Country | Region | 2023E Production (tonnes) |

|---|---|---|

| 🇨🇳 China | Asia | 370 |

| 🇦🇺 Australia | Oceania | 310 |

| 🇷🇺 Russia | Europe | 310 |

| 🇨🇦 Canada | North America | 200 |

| 🇺🇸 United States | North America | 170 |

| 🇰🇿 Kazakhstan | Asia | 130 |

| 🇲🇽 Mexico | North America | 120 |

| 🇮🇩 Indonesia | Asia | 110 |

| 🇿🇦 South Africa | Africa | 100 |

| 🇺🇿 Uzbekistan | Asia | 100 |

| 🇬🇭 Ghana | Africa | 90 |

| 🇵🇪 Peru | South America | 90 |

| 🇧🇷 Brazil | South America | 60 |

| 🇧🇫 Burkina Faso | Africa | 60 |

| 🇲🇱 Mali | Africa | 60 |

| 🇹🇿 Tanzania | Africa | 60 |

| 🌍 Rest of World | - | 700 |

Gold mines in China are primarily concentrated in eastern provinces such as Shandong, Henan, Fujian, and Liaoning. As of January 2024, China’s gold mine reserves stand at an estimated 3,000 tonnes, representing around 5% of the global total of 59,000 tonnes.

In addition to being the top producer, China emerged as the largest buyer of the yellow metal for the year. In fact, the country’s central bank alone bought 225 tonnes of gold in 2023, according the World Gold Council.

Estimated Global Gold Consumption

Most of the gold produced in 2023 was used in jewelry production, while another significant portion was sold as a store of value, such as in gold bars or coins.

- Jewelry: 46%

- Central Banks and Institutions: 23%

- Physical Bars: 16%

- Official Coins, Medals, and Imitation Coins: 9%

- Electrical and Electronics: 5%

- Other: 1%

According to Fitch Solutions, over the medium term (2023-2032), global gold mine production is expected to grow 15%, as high prices encourage investment and output.

Real Assets

Charted: The Value Gap Between the Gold Price and Gold Miners

While gold prices hit all-time highs, gold mining stocks have lagged far behind.

Gold Price vs. Gold Mining Stocks

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Although the price of gold has reached new record highs in 2024, gold miners are still far from their 2011 peaks.

In this graphic, we illustrate the evolution of gold prices since 2000 compared to the NYSE Arca Gold BUGS Index (HUI), which consists of the largest and most widely held public gold production companies. The data was compiled by Incrementum AG.

Mining Stocks Lag Far Behind

In April 2024, gold reached a new record high as Federal Reserve Chair Jerome Powell signaled policymakers may delay interest rate cuts until clearer signs of declining inflation materialize.

Additionally, with elections occurring in more than 60 countries in 2024 and ongoing conflicts in Ukraine and Gaza, central banks are continuing to buy gold to strengthen their reserves, creating momentum for the metal.

Traditionally known as a hedge against inflation and a safe haven during times of political and economic uncertainty, gold has climbed over 11% so far this year.

According to Business Insider, gold miners experienced their best performance in a year in March 2024. During that month, the gold mining sector outperformed all other U.S. industries, surpassing even the performance of semiconductor stocks.

Still, physical gold has outperformed shares of gold-mining companies over the past three years by one of the largest margins in decades.

| Year | Gold Price | NYSE Arca Gold BUGS Index (HUI) |

|---|---|---|

| 2023 | $2,062.92 | $243.31 |

| 2022 | $1,824.32 | $229.75 |

| 2021 | $1,828.60 | $258.87 |

| 2020 | $1,895.10 | $299.64 |

| 2019 | $1,523.00 | $241.94 |

| 2018 | $1,281.65 | $160.58 |

| 2017 | $1,296.50 | $192.31 |

| 2016 | $1,151.70 | $182.31 |

| 2015 | $1,060.20 | $111.18 |

| 2014 | $1,199.25 | $164.03 |

| 2013 | $1,201.50 | $197.70 |

| 2012 | $1,664.00 | $444.22 |

| 2011 | $1,574.50 | $498.73 |

| 2010 | $1,410.25 | $573.32 |

| 2009 | $1,104.00 | $429.91 |

| 2008 | $865.00 | $302.41 |

| 2007 | $836.50 | $409.37 |

| 2006 | $635.70 | $338.24 |

| 2005 | $513.00 | $276.90 |

| 2004 | $438.00 | $215.33 |

| 2003 | $417.25 | $242.93 |

| 2002 | $342.75 | $145.12 |

| 2001 | $276.50 | $65.20 |

| 2000 | $272.65 | $40.97 |

Among the largest companies on the NYSE Arca Gold BUGS Index, Colorado-based Newmont has experienced a 24% drop in its share price over the past year. Similarly, Canadian Barrick Gold also saw a decline of 6.5% over the past 12 months.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity