Electrification

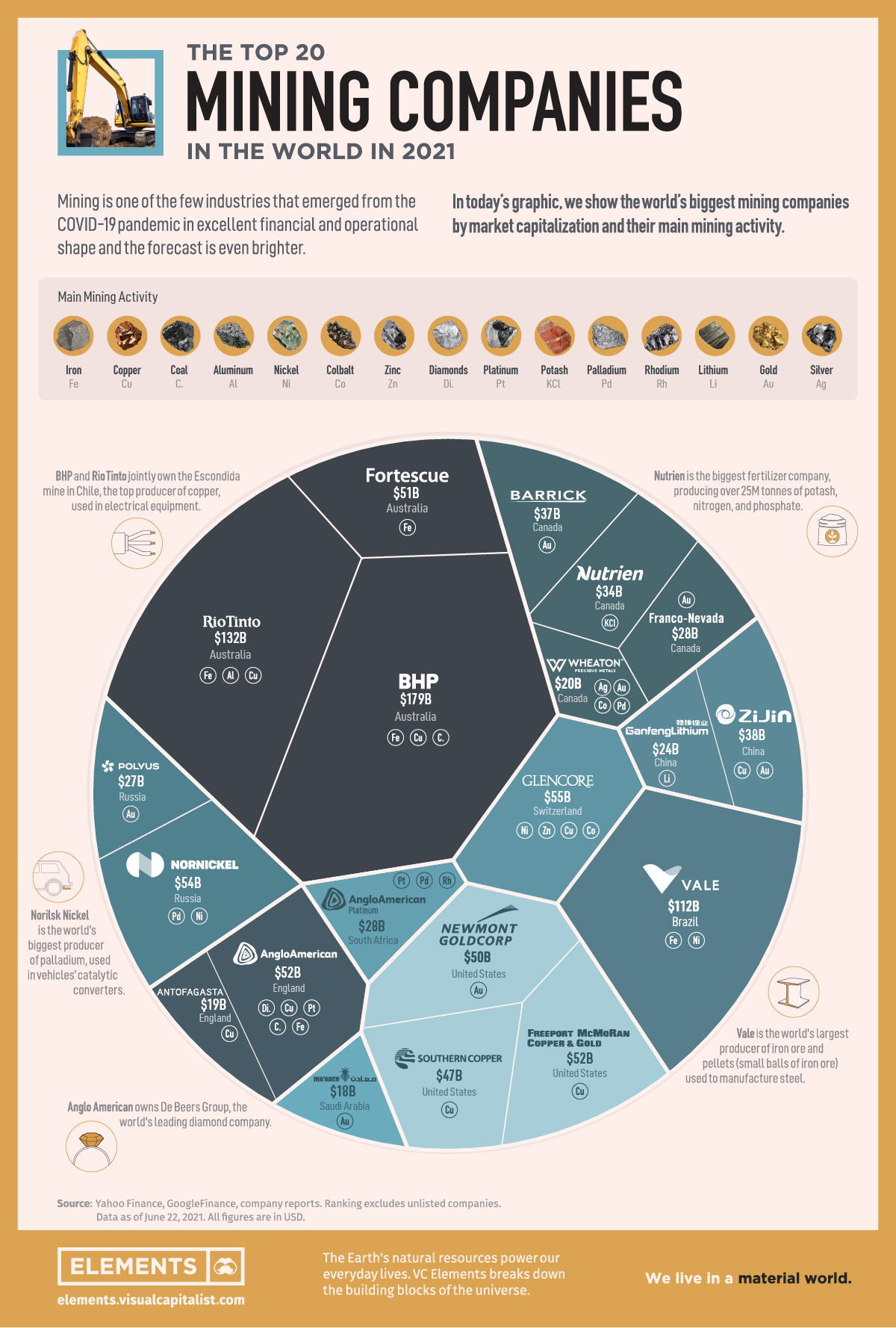

The Biggest Mining Companies in the World in 2021

Ranked: The Top 20 Mining Companies

Mining companies have emerged from the COVID-19 pandemic in excellent financial and operational shape and the forecast is even brighter as the economy recovers.

The market is expected to reach a value of nearly $1.86 trillion by 2022, with the increasing demand for minerals for power generation and renewables technology.

In the graphic above, we show the world’s top companies by market capitalization as of June 22, 2021, and the metals they mine.

The Bottom Line: From Smartphones to Food

From roads, hospitals, automobiles, houses, computers, satellites, and even fertilizer for crops, mining provides many of the materials we interact with every day. Copper, iron, rare earth metals, aluminum, and phosphate are just a handful of the mined materials that make modern life and feed the bottom line for mining companies.

The two biggest by market capitalization, BHP ($179B) and Rio Tinto ($132B), both produce a range of commodities, mainly iron ore and copper. The next on the list is also the biggest company in Brazil, Vale ($112B). The miner is the world’s largest producer of iron ore and pellets (small balls of iron ore) used to manufacture steel.

| Company | Market Cap (USD) | Country | Main Mining Activity |

|---|---|---|---|

| BHP | $179B | 🇦🇺 Australia | iron ore, copper, coal |

| Rio Tinto | $132B | 🇦🇺 Australia | iron ore, aluminum, copper |

| Vale | $112B | 🇧🇷 Brazil | iron ore, nickel |

| Glencore | $55B | 🇨🇭 Switzerland | copper, cobalt, zinc, nickel |

| Norilsk Nickel | $54B | 🇷🇺 Russia | palladium, nickel |

| Freeport-McMoRan | $52B | 🇺🇸 United States | copper |

| Anglo American | $52B | 🇬🇧 United Kingdom | diamonds, copper, platinum, iron ore, coal |

| Fortescue Metals | $51B | 🇦🇺 Australia | iron ore |

| Newmont Goldcorp | $50B | 🇺🇸 United States | gold |

| Southern Copper | $47B | 🇺🇸 United States | copper |

| Zijin Mining Group | $38B | 🇨🇳 China | gold, copper |

| Barrick Gold | $37B | 🇨🇦 Canada | gold |

| Nutrien | $34B | 🇨🇦 Canada | potash |

| Anglo American Platinum | $28B | 🇿🇦 South Africa | platinum, palladium, rhodium |

| Franco-Nevada | $28B | 🇨🇦 Canada | gold |

| Polyus | $27B | 🇷🇺 Russia | gold |

| Ganfeng Lithium | $24B | 🇨🇳 China | lithium |

| Wheaton Precious Metals | $20B | 🇨🇦 Canada | gold, silver, palladium, cobalt |

| Antofagasta | $19B | 🇬🇧 United Kingdom | copper |

| Ma’aden | $18B | 🇸🇦 Saudi Arabia | gold |

A $57 billion gap separates the top 3 from the rest of the group. In fourth place comes Glencore ($55B) with its mixed operations of trading and mining metals, agricultural products, and oil and gas.

The automotive industry is a big consumer of metals, which explains Norilsk Nickel’s ($54B) fifth place. The company, owned by the wealthiest man in Russia, is the world’s biggest producer of palladium, used in vehicles’ catalytic converters.

Miners also serve the luxury market, with precious metals like gold, silver, and gemstones. Number six on the list, Anglo American ($52B) is one of the world’s leading diamond companies.

In terms of countries, Canada leads the ranking with 4 miners on the list. The United States and Australia come next with 3 companies each.

Charging and Changing the Future of Mining Companies

The United States, Europe, and Asia are making big investments in electrification and power generation. By 2024, almost 33% of the world’s electricity is forecast to come from renewables.

This shift from fossil fuels will require a lot of copper, cobalt, and lithium for batteries. Mining companies are in a position to capitalize as the market expands.

For example, no. 17 in the list, China’s Ganfeng Lithium, the world’s third-largest producer of lithium chemicals for batteries, saw its market capitalization grow more than 25% in 2021.

The energy transition is just beginning, and the materials used in building a more sustainable future will also build up the largest mining companies of tomorrow.

Electrification

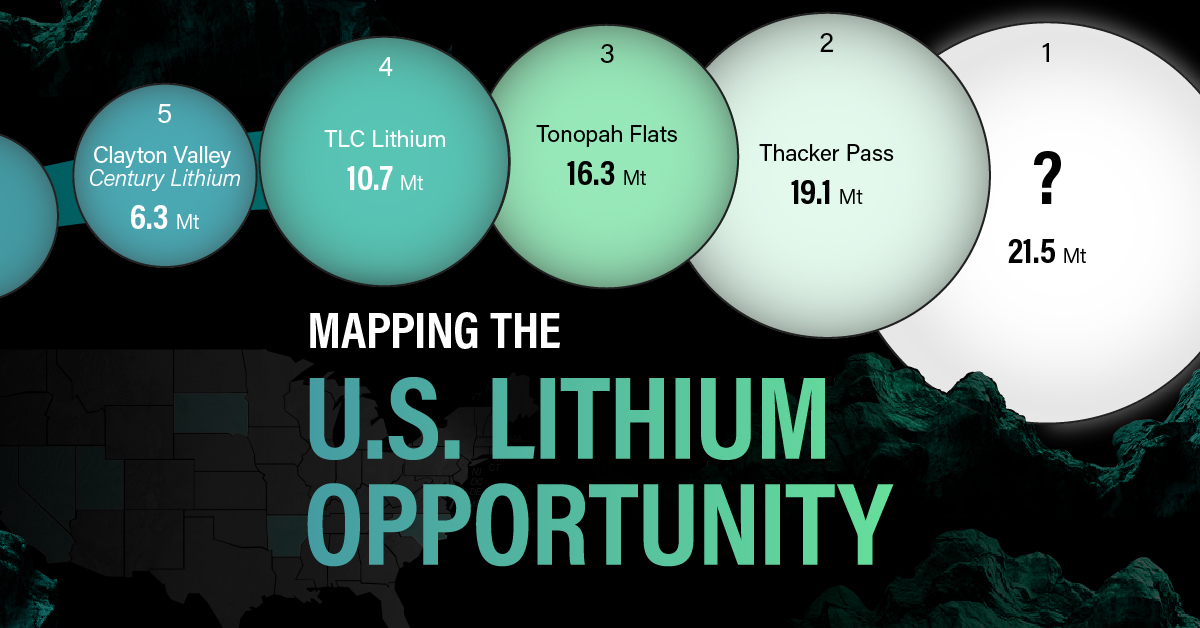

White Gold: Mapping U.S. Lithium Mines

In this graphic, Visual Capitalist partnerered with EnergyX to explore the size and location of U.S. lithium mines.

White Gold: Mapping U.S. Lithium Mines

The U.S. doubled imports of lithium-ion batteries for the third consecutive year in 2022, and with EV demand growing yearly, U.S. lithium mines must ramp up production or rely on other nations for their supply of refined lithium.

To determine if the domestic U.S. lithium opportunity can meet demand, we partnered with EnergyX to determine how much lithium sits within U.S. borders.

U.S. Lithium Projects

The most crucial measure of a lithium mine’s potential is the quantity that can be extracted from the source.

For each lithium resource, the potential volume of lithium carbonate equivalent (LCE) was calculated with a ratio of one metric ton of lithium producing 5.32 metric tons of LCE. Cumulatively, existing U.S. lithium projects contain 94.8 million metric tons of LCE.

| Rank | Project Name | LCE, million metric tons (est.) |

|---|---|---|

| 1 | McDermitt Caldera | 21.5 |

| 2 | Thacker Pass | 19.1 |

| 3 | Tonopah Flats | 18.0 |

| 4 | TLC Lithium | 10.7 |

| 5 | Clayton Valley (Century Lithium) | 6.3 |

| 6 | Zeus Lithium | 6.3 |

| 7 | Rhyolite Ridge | 3.4 |

| 8 | Arkansas Smackover (Phase 1A) | 2.8 |

| 9 | Basin Project | 2.2 |

| 10 | McGee Deposit | 2.1 |

| 11 | Arkansas Smackover (South West) | 1.8 |

| 12 | Clayton Valley (Lithium-X, Pure Energy) | 0.8 |

| 13 | Big Sandy | 0.3 |

| 14 | Imperial Valley/Salton Sea | 0.3 |

U.S. Lithium Opportunities, By State

U.S. lithium projects mainly exist in western states, with comparatively minor opportunities in central or eastern states.

| State | LCE, million metric tons (est.) |

|---|---|

| Nevada | 88.2 |

| Arkansas | 4.6 |

| Arizona | 2.5 |

| California | 0.3 |

Currently, the U.S. is sitting on a wealth of lithium that it is underutilizing. For context, in 2022, the U.S. only produced about 5,000 metric tons of LCE and imported a projected 19,000 metric tons of LCE, showing that the demand for the mineral is healthy.

The Next Gold Rush?

U.S. lithium companies have the opportunity to become global leaders in lithium production and accelerate the transition to sustainable energy sources. This is particularly important as the demand for lithium is increasing every year.

EnergyX is on a mission to meet U.S. lithium demands using groundbreaking technology that can extract 300% more lithium from a source than traditional methods.

You can take advantage of this opportunity by investing in EnergyX and joining other significant players like GM in becoming a shareholder.

Electrification

Will Direct Lithium Extraction Disrupt the $90B Lithium Market?

Visual Capitalist and EnergyX explore how direct lithium extraction could disrupt the $90B lithium industry.

Will Direct Lithium Extraction Disrupt the $90B Lithium Market?

Current lithium extraction and refinement methods are outdated, often harmful to the environment, and ultimately inefficient. So much so that by 2030, lithium demand will outstrip supply by a projected 1.42 million metric tons. But there is a solution: Direct lithium extraction (DLE).

For this graphic, we partnered with EnergyX to try to understand how DLE could help meet global lithium demands and change an industry that is critical to the clean energy transition.

The Lithium Problem

Lithium is crucial to many renewable energy technologies because it is this element that allows EV batteries to react. In fact, it’s so important that projections show the lithium industry growing from $22.2B in 2023 to nearly $90B by 2030.

But even with this incredible growth, as you can see from the table, refined lithium production will need to increase 86.5% over and above current projections.

| 2022 (million metric tons) | 2030P (million metric tons) | |

|---|---|---|

| Lithium Carbonate Demand | 0.46 | 1.21 |

| Lithium Hydroxide Demand | 0.18 | 1.54 |

| Lithium Metal Demand | 0 | 0.22 |

| Lithium Mineral Demand | 0.07 | 0.09 |

| Total Demand | 0.71 | 3.06 |

| Total Supply | 0.75 | 1.64 |

The Solution: Direct Lithium Extraction

DLE is a process that uses a combination of solvent extraction, membranes, or adsorbents to extract and then refine lithium directly from its source. LiTASTM, the proprietary DLE technology developed by EnergyX, can recover an incredible 300% more lithium per ton than existing processes, making it the perfect tool to help meet lithium demands.

Additionally, LiTASTM can refine lithium at the lowest cost per unit volume directly from brine, an essential step in meeting tomorrow’s lithium demand and manufacturing next-generation batteries, while significantly reducing the footprint left by lithium mining.

| Hard Rock Mining | Underground Reservoirs | Direct Lithium Extraction | |

|---|---|---|---|

| Direct CO2 Emissions | 15,000 kg | 5,000 kg | 3.5 kg |

| Water Use | 170 m3 | 469 m3 | 34-94 m3 |

| Lithium Recovery Rate | 58% | 30-40% | 90% |

| Land Use | 464 m2 | 3124 m2 | 0.14 m2 |

| Process Time | Variable | 18 months | 1-2 days |

Providing the World with Lithium

DLE promises to disrupt the outdated lithium industry by improving lithium recovery rates and slashing emissions, helping the world meet the energy demands of tomorrow’s electric vehicles.

EnergyX is on a mission to become a worldwide leader in the sustainable energy transition using groundbreaking direct lithium extraction technology. Don’t miss your chance to join companies like GM and invest in EnergyX to transform the future of renewable energy.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

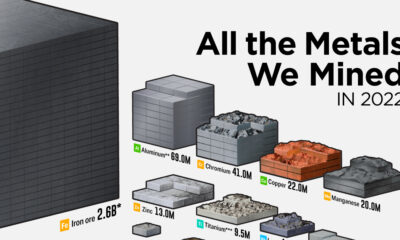

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Electrification3 years ago

Electrification3 years agoHow Much Land is Needed to Power the U.S. with Solar?