Electrification

The World’s Largest Nickel Mining Companies

The World’s Top 10 Nickel Mining Companies

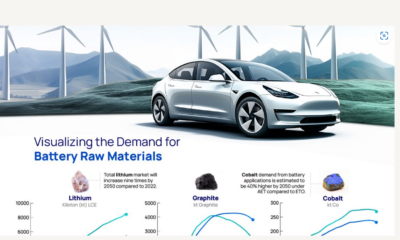

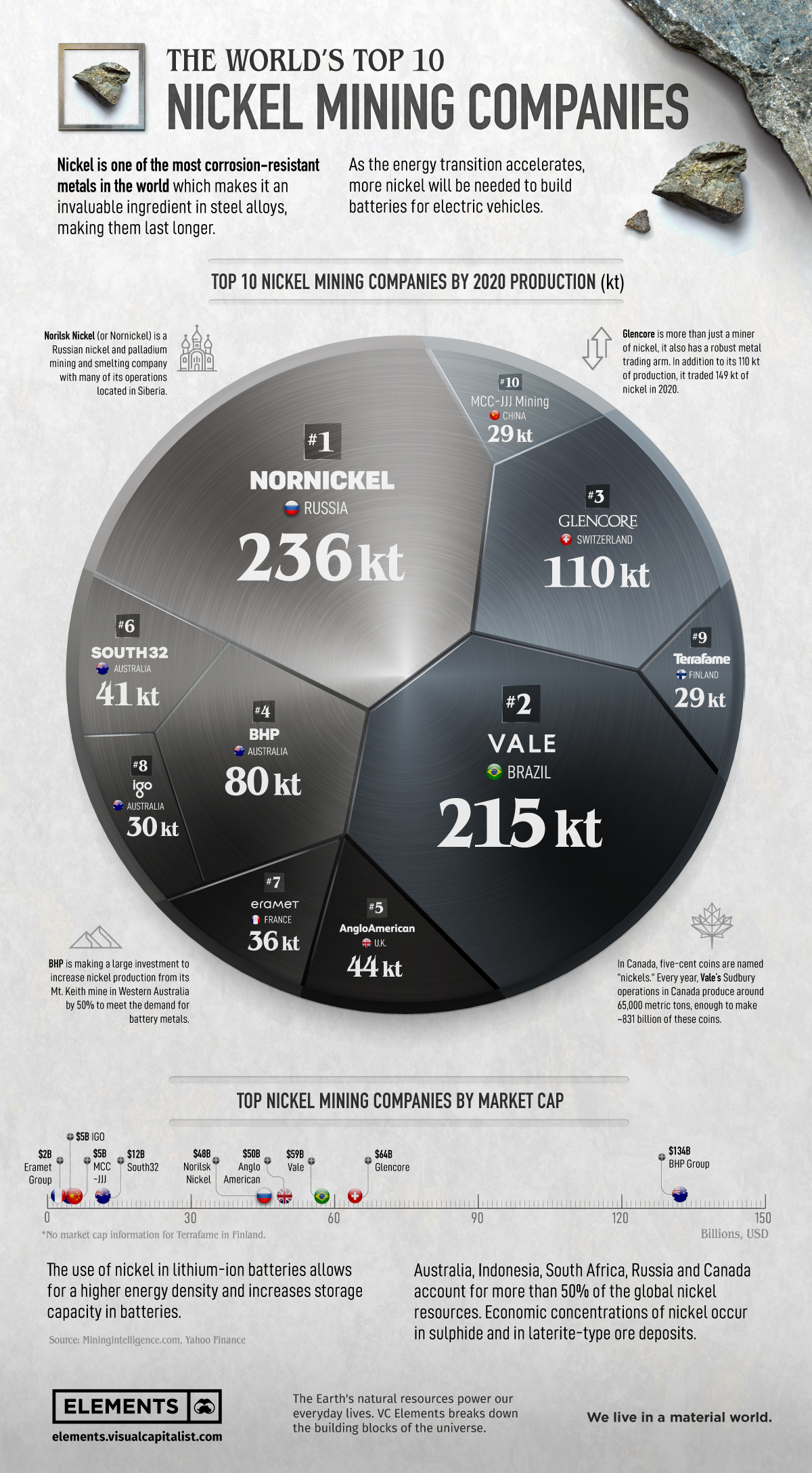

As the world transitions towards electric vehicles and cleaner energy sources, nickel has emerged as an essential metal for this green revolution.

Needed for the manufacturing of electric vehicles, wind turbines, and nuclear power plants, nickel is also primarily used to make stainless steel alloys more resistant to corrosion and extreme temperatures.

Using data from Mining Intelligence, this graphic shows the top 10 companies by nickel production along with their market cap.

The Biggest Nickel Miners by Production in 2020

Nickel has long been an important mineral for batteries, plating, and steelmaking, but it was only recently added to the USGS’s proposed critical minerals list.

As countries and industries realize the importance of nickel for the development of sustainable technologies, nickel mining companies will be at the forefront of supplying the world with the nickel it needs.

The 850 kt of nickel mined by the top 10 nickel mining companies is worth around $17.3B, with both production and price expected to grow alongside nickel demand.

| Company | Market Cap | Production |

|---|---|---|

| Nornickel | $48B | 236.0 kt |

| Vale | $59B | 214.7 kt |

| Glencore | $64B | 110.2 kt |

| BHP | $134B | 80.0 kt |

| Anglo American | $50B | 44.0 kt |

| South32 | $12B | 41.0 kt |

| Eramet | $2B | 36.0 kt |

| IGO | $5B | 30.0 kt |

| Terrafame | n/a | 29.0 kt |

| MCC | $5B | 29.0 kt |

Source: Miningintelligence.com, Yahoo Finance

Nickel and palladium miner and smelter Nornickel leads the list with 236 kt of nickel produced in 2020, the majority coming from its Norilsk division of flagship assets in Russia.

With 46% of Nornickel’s energy mix sourced from renewable power, the company is pushing the development of carbon neutral nickel, starting with reducing carbon dioxide emissions by 60,000-70,000 tons in 2022.

Vale follows closely behind in production and in its carbon footprint goals. The Brazil-based company’s Long Harbour processing plant in Newfoundland and Labrador produces nickel with a carbon footprint about a third of the industry average–4.4 tonnes of CO2 equivalent per tonne of nickel compared to Nickel Institute’s average of 13 tonnes of CO2 equivalent.

With the top two companies producing more than half of the nickel produced by the top 10 miners, their efforts in decarbonization will pave the way for the nickel mining industry.

The Need for Nickel in the Energy Transition

Alongside the decarbonization of the nickel mining process, nickel itself powers many of the technologies crucial to the energy transition. Vehicle electrification is highly dependent on nickel, with a single electric car requiring more than 87 pounds of nickel, making up almost 1/5th of all the metals required.

With a history of being used in nickel cadmium and nickel metal hydride batteries, nickel is now being increasingly used in lithium-ion batteries for its greater energy density and lower cost compared to cobalt. Alongside the increase in usage, not all nickel is suitable for lithium-ion battery production, as batteries require the rarer form of the metal’s deposits known as nickel sulphides.

The more common form of the metal, nickel laterites, are still useful in forming the alloys that make up the frames and various gears of wind turbines.

Nickel is also essential to nuclear power plants, making up nearly a quarter of the metals needed per megawatt generated.

The Future of Nickel Mining and Processing

With nickel in such high demand for batteries and cleaner energy infrastructure, it’s no wonder that global nickel demand is expected to outweigh supply by 2024. The scarcity of high grade nickel sulphide deposits and the carbon intensity to mine them has also incentivized the exploration of new methods of harvesting the metal.

Agro-mining uses plants known as hyperaccumulators to absorb metals found in the soil through their roots, resulting in their leaves containing up to 4% nickel in dry weight. These plants are then harvested and incinerated, with their ash processed to recover the nickel “bio-ore”.

Along with providing us with metals like nickel, lead, and cobalt through a less energy intensive process, agro-mining also helps decontaminate polluted soil.

While new processes like agro-mining won’t replace traditional mining, they’ll be a helpful step forward in closing the future nickel supply gap while helping reduce the carbon footprint of the nickel processing industry.

Electrification

White Gold: Mapping U.S. Lithium Mines

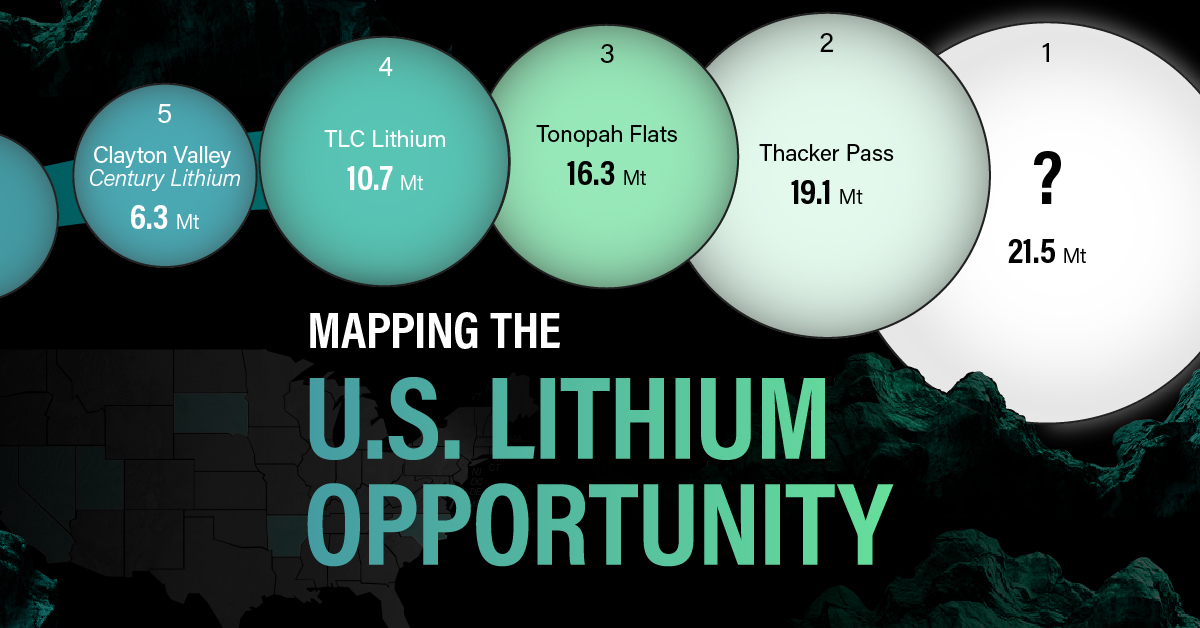

In this graphic, Visual Capitalist partnerered with EnergyX to explore the size and location of U.S. lithium mines.

White Gold: Mapping U.S. Lithium Mines

The U.S. doubled imports of lithium-ion batteries for the third consecutive year in 2022, and with EV demand growing yearly, U.S. lithium mines must ramp up production or rely on other nations for their supply of refined lithium.

To determine if the domestic U.S. lithium opportunity can meet demand, we partnered with EnergyX to determine how much lithium sits within U.S. borders.

U.S. Lithium Projects

The most crucial measure of a lithium mine’s potential is the quantity that can be extracted from the source.

For each lithium resource, the potential volume of lithium carbonate equivalent (LCE) was calculated with a ratio of one metric ton of lithium producing 5.32 metric tons of LCE. Cumulatively, existing U.S. lithium projects contain 94.8 million metric tons of LCE.

| Rank | Project Name | LCE, million metric tons (est.) |

|---|---|---|

| 1 | McDermitt Caldera | 21.5 |

| 2 | Thacker Pass | 19.1 |

| 3 | Tonopah Flats | 18.0 |

| 4 | TLC Lithium | 10.7 |

| 5 | Clayton Valley (Century Lithium) | 6.3 |

| 6 | Zeus Lithium | 6.3 |

| 7 | Rhyolite Ridge | 3.4 |

| 8 | Arkansas Smackover (Phase 1A) | 2.8 |

| 9 | Basin Project | 2.2 |

| 10 | McGee Deposit | 2.1 |

| 11 | Arkansas Smackover (South West) | 1.8 |

| 12 | Clayton Valley (Lithium-X, Pure Energy) | 0.8 |

| 13 | Big Sandy | 0.3 |

| 14 | Imperial Valley/Salton Sea | 0.3 |

U.S. Lithium Opportunities, By State

U.S. lithium projects mainly exist in western states, with comparatively minor opportunities in central or eastern states.

| State | LCE, million metric tons (est.) |

|---|---|

| Nevada | 88.2 |

| Arkansas | 4.6 |

| Arizona | 2.5 |

| California | 0.3 |

Currently, the U.S. is sitting on a wealth of lithium that it is underutilizing. For context, in 2022, the U.S. only produced about 5,000 metric tons of LCE and imported a projected 19,000 metric tons of LCE, showing that the demand for the mineral is healthy.

The Next Gold Rush?

U.S. lithium companies have the opportunity to become global leaders in lithium production and accelerate the transition to sustainable energy sources. This is particularly important as the demand for lithium is increasing every year.

EnergyX is on a mission to meet U.S. lithium demands using groundbreaking technology that can extract 300% more lithium from a source than traditional methods.

You can take advantage of this opportunity by investing in EnergyX and joining other significant players like GM in becoming a shareholder.

Electrification

Will Direct Lithium Extraction Disrupt the $90B Lithium Market?

Visual Capitalist and EnergyX explore how direct lithium extraction could disrupt the $90B lithium industry.

Will Direct Lithium Extraction Disrupt the $90B Lithium Market?

Current lithium extraction and refinement methods are outdated, often harmful to the environment, and ultimately inefficient. So much so that by 2030, lithium demand will outstrip supply by a projected 1.42 million metric tons. But there is a solution: Direct lithium extraction (DLE).

For this graphic, we partnered with EnergyX to try to understand how DLE could help meet global lithium demands and change an industry that is critical to the clean energy transition.

The Lithium Problem

Lithium is crucial to many renewable energy technologies because it is this element that allows EV batteries to react. In fact, it’s so important that projections show the lithium industry growing from $22.2B in 2023 to nearly $90B by 2030.

But even with this incredible growth, as you can see from the table, refined lithium production will need to increase 86.5% over and above current projections.

| 2022 (million metric tons) | 2030P (million metric tons) | |

|---|---|---|

| Lithium Carbonate Demand | 0.46 | 1.21 |

| Lithium Hydroxide Demand | 0.18 | 1.54 |

| Lithium Metal Demand | 0 | 0.22 |

| Lithium Mineral Demand | 0.07 | 0.09 |

| Total Demand | 0.71 | 3.06 |

| Total Supply | 0.75 | 1.64 |

The Solution: Direct Lithium Extraction

DLE is a process that uses a combination of solvent extraction, membranes, or adsorbents to extract and then refine lithium directly from its source. LiTASTM, the proprietary DLE technology developed by EnergyX, can recover an incredible 300% more lithium per ton than existing processes, making it the perfect tool to help meet lithium demands.

Additionally, LiTASTM can refine lithium at the lowest cost per unit volume directly from brine, an essential step in meeting tomorrow’s lithium demand and manufacturing next-generation batteries, while significantly reducing the footprint left by lithium mining.

| Hard Rock Mining | Underground Reservoirs | Direct Lithium Extraction | |

|---|---|---|---|

| Direct CO2 Emissions | 15,000 kg | 5,000 kg | 3.5 kg |

| Water Use | 170 m3 | 469 m3 | 34-94 m3 |

| Lithium Recovery Rate | 58% | 30-40% | 90% |

| Land Use | 464 m2 | 3124 m2 | 0.14 m2 |

| Process Time | Variable | 18 months | 1-2 days |

Providing the World with Lithium

DLE promises to disrupt the outdated lithium industry by improving lithium recovery rates and slashing emissions, helping the world meet the energy demands of tomorrow’s electric vehicles.

EnergyX is on a mission to become a worldwide leader in the sustainable energy transition using groundbreaking direct lithium extraction technology. Don’t miss your chance to join companies like GM and invest in EnergyX to transform the future of renewable energy.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Electrification3 years ago

Electrification3 years agoHow Much Land is Needed to Power the U.S. with Solar?