Electrification

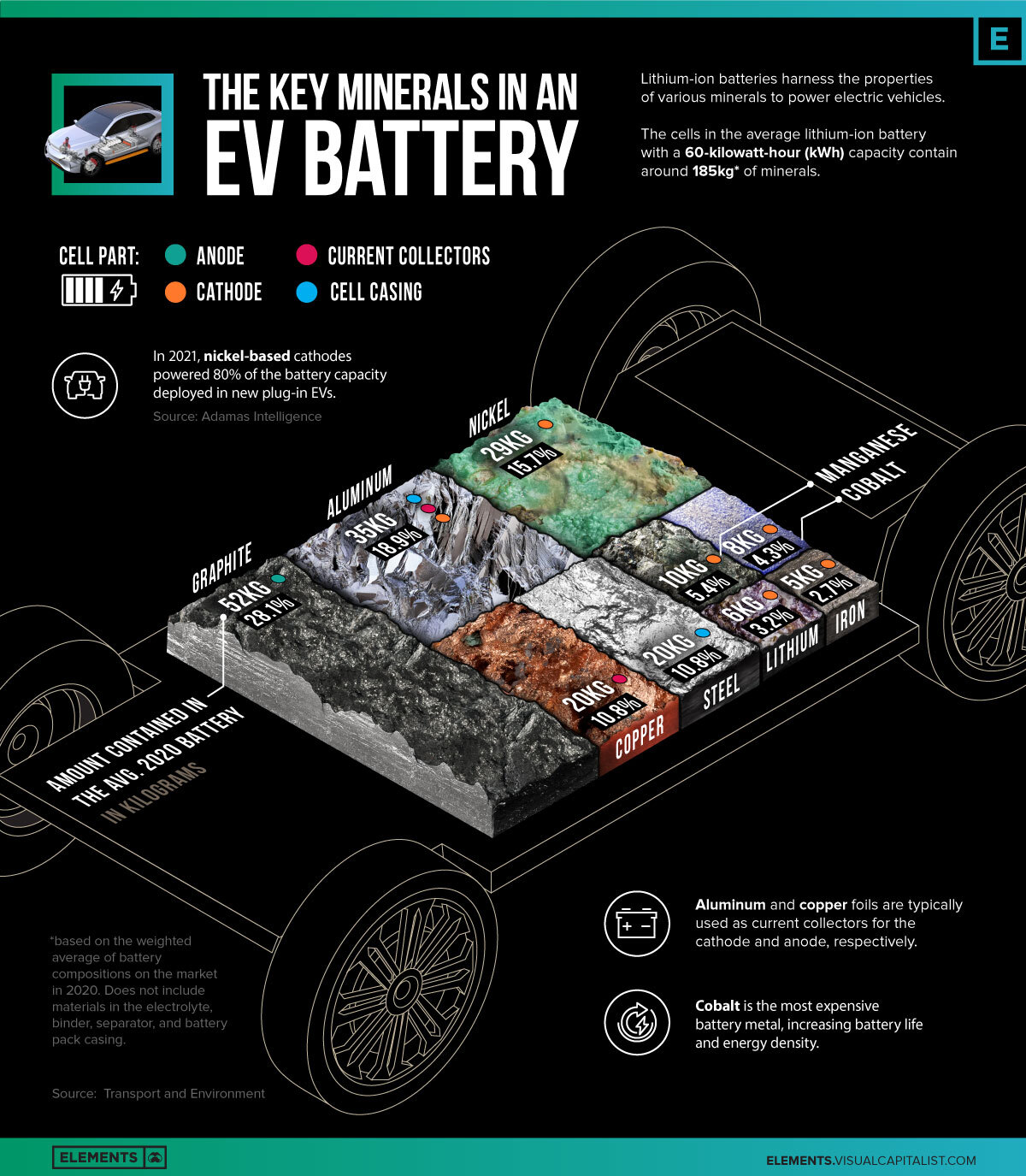

The Key Minerals in an EV Battery

Breaking Down the Key Minerals in an EV Battery

Inside practically every electric vehicle (EV) is a lithium-ion battery that depends on several key minerals that help power it.

Some minerals make up intricate parts within the cell to ensure the flow of electrical current. Others protect it from accidental damage on the outside.

This infographic uses data from the European Federation for Transport and Environment to break down the key minerals in an EV battery. The mineral content is based on the ‘average 2020 battery’, which refers to the weighted average of battery chemistries on the market in 2020.

The Battery Minerals Mix

The cells in the average battery with a 60 kilowatt-hour (kWh) capacity—the same size that’s used in a Chevy Bolt—contained roughly 185 kilograms of minerals. This figure excludes materials in the electrolyte, binder, separator, and battery pack casing.

| Mineral | Cell Part | Amount Contained in the Avg. 2020 Battery (kg) | % of Total |

|---|---|---|---|

| Graphite | Anode | 52kg | 28.1% |

| Aluminum | Cathode, Casing, Current collectors | 35kg | 18.9% |

| Nickel | Cathode | 29kg | 15.7% |

| Copper | Current collectors | 20kg | 10.8% |

| Steel | Casing | 20kg | 10.8% |

| Manganese | Cathode | 10kg | 5.4% |

| Cobalt | Cathode | 8kg | 4.3% |

| Lithium | Cathode | 6kg | 3.2% |

| Iron | Cathode | 5kg | 2.7% |

| Total | N/A | 185kg | 100% |

The cathode contains the widest variety of minerals and is arguably the most important and expensive component of the battery. The composition of the cathode is a major determinant in the performance of the battery, with each mineral offering a unique benefit.

For example, NMC batteries, which accounted for 72% of batteries used in EVs in 2020 (excluding China), have a cathode composed of nickel, manganese, and cobalt along with lithium. The higher nickel content in these batteries tends to increase their energy density or the amount of energy stored per unit of volume, increasing the driving range of the EV. Cobalt and manganese often act as stabilizers in NMC batteries, improving their safety.

Altogether, materials in the cathode account for 31.3% of the mineral weight in the average battery produced in 2020. This figure doesn’t include aluminum, which is used in nickel-cobalt-aluminum (NCA) cathode chemistries, but is also used elsewhere in the battery for casing and current collectors.

Meanwhile, graphite has been the go-to material for anodes due to its relatively low cost, abundance, and long cycle life. Since the entire anode is made up of graphite, it’s the single-largest mineral component of the battery. Other materials include steel in the casing that protects the cell from external damage, along with copper, used as the current collector for the anode.

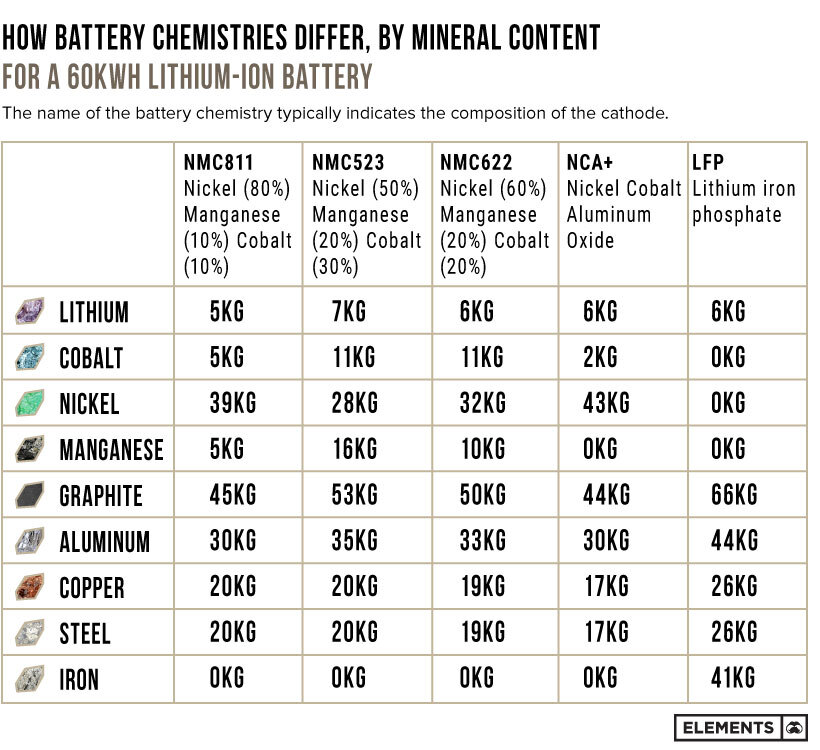

Minerals Bonded by Chemistry

There are several types of lithium-ion batteries with different compositions of cathode minerals. Their names typically allude to their mineral breakdown.

For example:

- NMC811 batteries cathode composition:

80% nickel

10% manganese

10% cobalt - NMC523 batteries cathode composition:

50% nickel

20% manganese

30% cobalt

Here’s how the mineral contents differ for various battery chemistries with a 60kWh capacity:

With consumers looking for higher-range EVs that do not need frequent recharging, nickel-rich cathodes have become commonplace. In fact, nickel-based chemistries accounted for 80% of the battery capacity deployed in new plug-in EVs in 2021.

Lithium iron phosphate (LFP) batteries do not use any nickel and typically offer lower energy densities at better value. Unlike nickel-based batteries that use lithium hydroxide compounds in the cathode, LFP batteries use lithium carbonate, which is a cheaper alternative. Tesla recently joined several Chinese automakers in using LFP cathodes for standard-range cars, driving the price of lithium carbonate to record highs.

The EV battery market is still in its early hours, with plenty of growth on the horizon. Battery chemistries are constantly evolving, and as automakers come up with new models with different characteristics, it’ll be interesting to see which new cathodes come around the block.

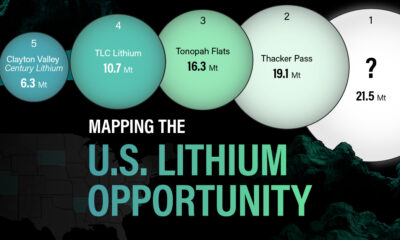

Electrification

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate (MB-LI-0033)

**Lithium carbonate (MB-LI-0029)

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

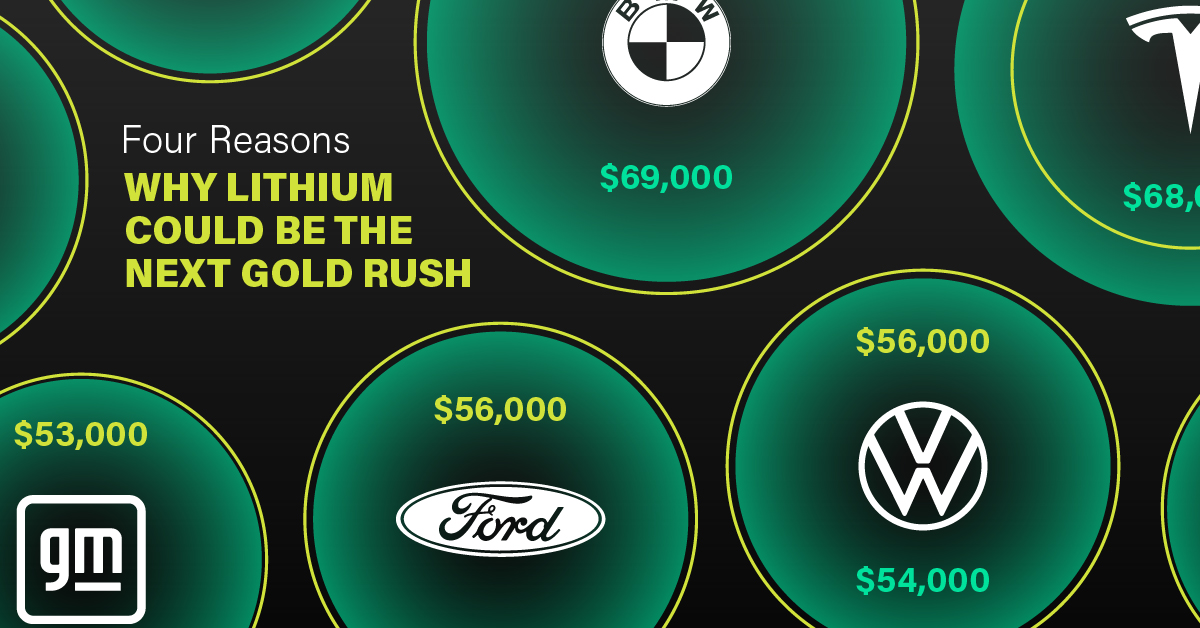

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

Electrification

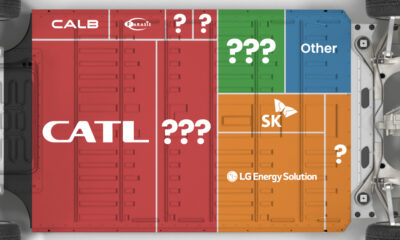

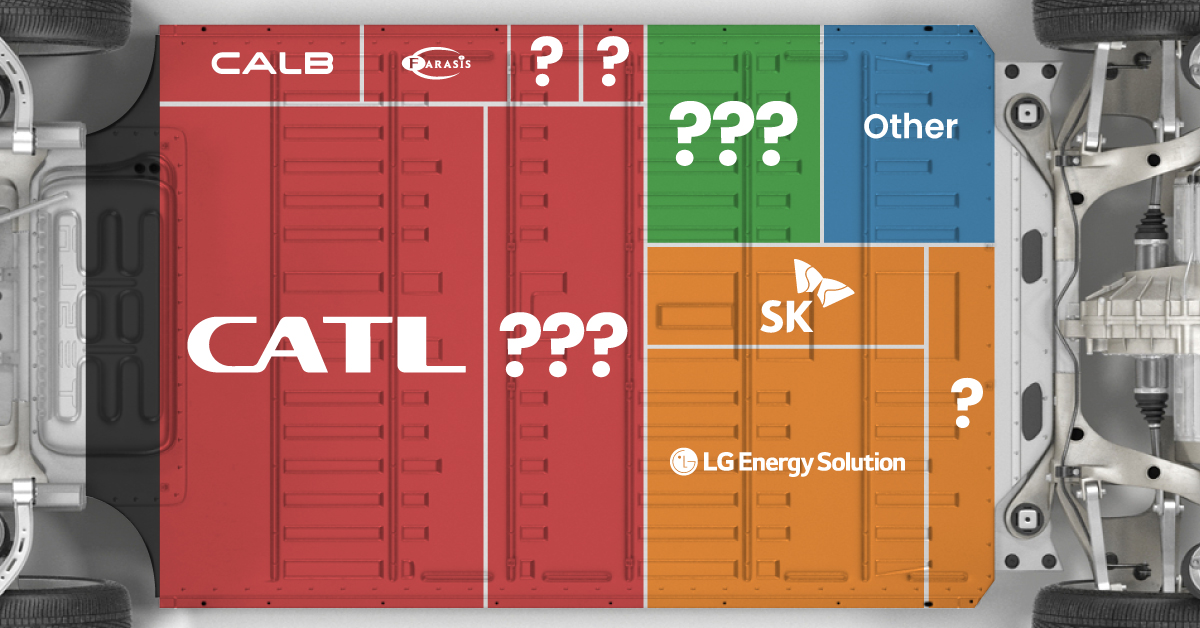

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳China | 242,700 | 34% |

| BYD | 🇨🇳China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷Korea | 108,487 | 15% |

| Panasonic | 🇯🇵Japan | 56,560 | 8% |

| SK On | 🇰🇷Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷Korea | 35,703 | 5% |

| CALB | 🇨🇳China | 23,493 | 3% |

| Farasis Energy | 🇨🇳China | 16,527 | 2% |

| Envision AESC | 🇨🇳China | 8,342 | 1% |

| Sunwoda | 🇨🇳China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now effectively sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity

-

Energy Shift2 years ago

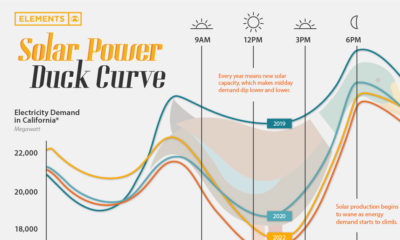

Energy Shift2 years agoThe Solar Power Duck Curve Explained