Electrification

Interactive: EV Charging Stations Across the U.S. Mapped

Electric Vehicle Charging Stations Across America: Mapped

As the electric vehicle market continues to expand, having enough EV charging stations is essential to enable longer driving ranges and lower wait times at chargers.

Currently, the U.S. has about 140,000 public EV chargers distributed across almost 53,000 charging stations, which are still far outnumbered by the 145,000 gas fueling stations in the country.

This graphic maps out EV charging stations across the U.S. using data from the National Renewable Energy Lab. The map has interactive features when viewed on desktop, showing pricing structures and the connector types when hovering over a charging station, along with filtering options.

Which States Lead in EV Charging Infrastructure?

As seen in the map above, most electric vehicle charging stations in the U.S. are located on the west and east coasts of the nation, while the Midwest strip is fairly barren aside from the state of Colorado.

California has the highest number of EV charging stations at 15,182, making up an impressive 29% of all charging stations in America. In fact, the Golden State has nearly double the chargers of the following three states, New York (3,085), Florida (2,858), and Texas (2,419) combined.

| Rank | State | Number of charging stations | Share of U.S. charging stations |

|---|---|---|---|

| 1 | California | 15,182 | 28.7% |

| 2 | New York | 3,085 | 5.8% |

| 3 | Florida | 2,858 | 5.4% |

| 4 | Texas | 2,419 | 4.6% |

| 5 | Massachusetts | 2,328 | 4.4% |

| 6 | Washington | 1,810 | 3.4% |

| 7 | Colorado | 1,718 | 3.2% |

| 8 | Georgia | 1,596 | 3.0% |

| 9 | Maryland | 1,358 | 2.6% |

| 10 | Pennsylvania | 1,260 | 2.4% |

| U.S. Total | 52,889 | 100.0% |

It’s no surprise the four top states by GDP have the highest number of EV chargers, and California’s significant lead is also unsurprising considering its ambition to completely phase out the sale of new gas vehicles by 2035.

The Best States for EV Charging Speeds and Cost

While having many charging stations distributed across a state is important, two other factors determine charging convenience: cost and charger level availability.

EV charger pricing structures and charger level availability across the nation are a Wild West with no set rules and few clear expectations.

Finding Free Electric Vehicle Chargers Across States

Generous electric vehicle charging locations will offer unlimited free charging or a time cap between 30 minutes and 4 hours of free charging before payment is required. Some EV charging stations located in parking structures simply require a parking fee, while others might have a flat charging fee per session, charge by kWh consumed, or have an hourly rate.

While California leads in terms of the raw amount of free chargers available in the state, it’s actually the second worst in the top 10 states when it comes to the share of chargers, at only 11% of them free for 30 minutes or more.

| Rank | State name | Number of free charging stations | Share of free charging stations in the state |

|---|---|---|---|

| 1 | California | 1,717 | 11.3% |

| 2 | Florida | 673 | 23.6% |

| 3 | New York | 662 | 21.5% |

| 4 | Texas | 606 | 25.1% |

| 5 | Maryland | 399 | 29.4% |

| 6 | Georgia | 360 | 22.6% |

| 7 | Washington | 358 | 19.8% |

| 8 | Pennsylvania | 318 | 25.2% |

| 9 | Colorado | 273 | 15.9% |

| 10 | Massachusetts | 150 | 6.4% |

| U.S. Total | 10,295 | 19.5% |

Meanwhile, Maryland leads with almost 30% of the chargers in the state that offer a minimum of 30 minutes of free charging. On the other hand, Massachusetts is the stingiest state of the top 10, with only 6% of charging stations (150 total) in the state offering free charging for electric vehicle drivers.

The States with the Best DC Fast Charger Availability

While free EV chargers are great, having access to fast chargers can matter just as much, depending on how much you value your time. Most EV drivers across the U.S. will have access to level 2 chargers, with more than 86% of charging stations in the country having level 2 chargers available.

Although level 2 charging (4-10 hours from empty to full charge) beats the snail’s pace of level 1 charging (40-50 hours from empty to full charge), between busy schedules and many charging stations that are only free for the first 30 minutes, DC fast charger availability is almost a necessity.

Direct current fast chargers can charge an electric vehicle from empty to 80% in 20-60 minutes but are only available at 12% of America’s EV charging stations today.

| Rank | State | Number of stations with DC fast charger available | Share of DC fast charger available stations in state | Share of free and DC fast charger available stations in state | |

|---|---|---|---|---|---|

| 1 | California | 1,756 | 11.6% | 0.7% | |

| 2 | Florida | 360 | 12.6% | 1.1% | |

| 3 | Texas | 276 | 11.4% | 1.2% | |

| 4 | Colorado | 243 | 14.1% | 1.1% | |

| 5 | New York | 234 | 7.6% | 0.8% | |

| 6 | Washington | 232 | 12.8% | 1.1% | |

| 7 | Georgia | 228 | 14.3% | 1.4% | |

| 8 | Maryland | 223 | 16.4% | 2.7% | |

| 9 | Pennsylvania | 134 | 10.6% | 1.0% | |

| 10 | Massachusetts | 134 | 5.8% | 0.2% | |

| U.S. Total | 6,540 | 12.4% | 0.9% |

Just like free stations, Maryland leads the top 10 states in having the highest share of DC fast chargers at 16%. While Massachusetts was the worst state for DC charger availability at 6%, the state of New York was second-worst at 8% despite its large number of chargers overall. All other states in the top 10 have DC chargers available in at least one in 10 charging stations.

As for the holy grail of charging stations, with free charging and DC fast charger availability, almost 1% of the country’s charging stations are there. So if you’re hoping for free and DC fast charging, the chances in most states are around one in 100.

The Future of America’s EV Charging Infrastructure

As America works towards Biden’s goal of having half of all new vehicles sold in 2030 be zero-emissions vehicles (battery electric, plug-in hybrid electric, or fuel cell electric), charging infrastructure across the nation is essential in improving accessibility and convenience for drivers.

The Biden administration has given early approval to 35 states’ EV infrastructure plans, granting them access to $900 million in funding as part of the $5 billion National Electric Vehicle Infrastructure (NEVI) Formula Program set to be distributed over the next five years.

Along with this program, a $2.5 billion Discretionary Grant Program aims to increase EV charging access in rural, undeserved, and overburdened communities, along with the Inflation Reduction Act’s $3 billion dedicated to supporting access to EV charging for economically disadvantaged communities.

With more than $10 billion being invested into EV charging infrastructure over the next five years and more than half the sum focused on communities with poor current access, charger availability across America is set to continue improving in the coming years.

Electrification

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate (MB-LI-0033)

**Lithium carbonate (MB-LI-0029)

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

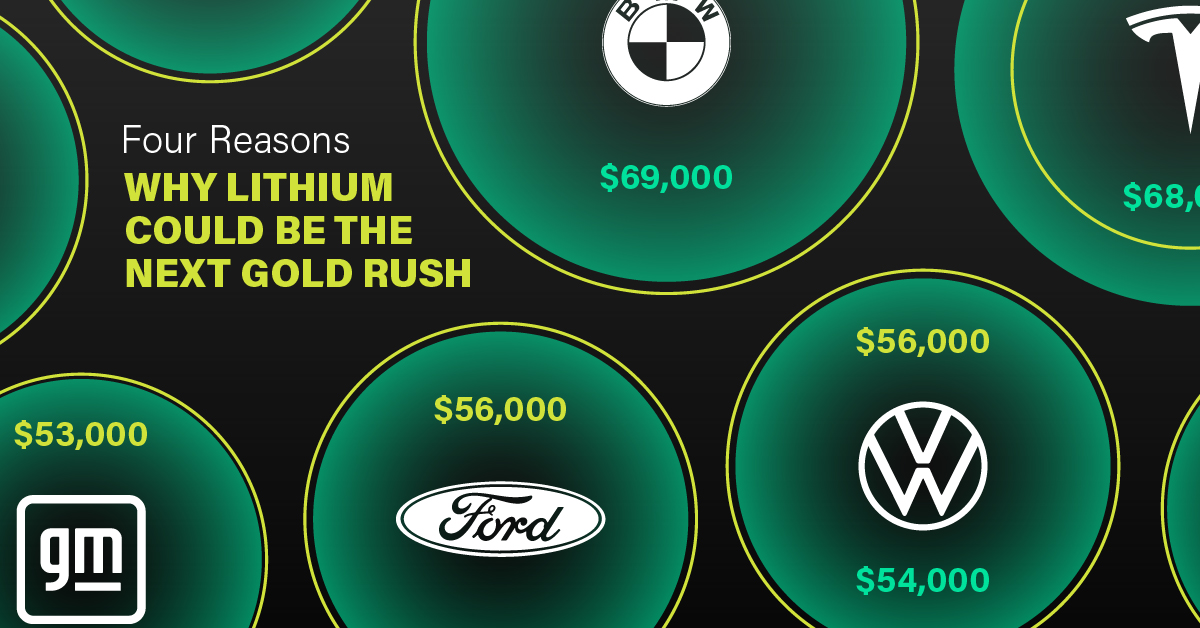

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

Electrification

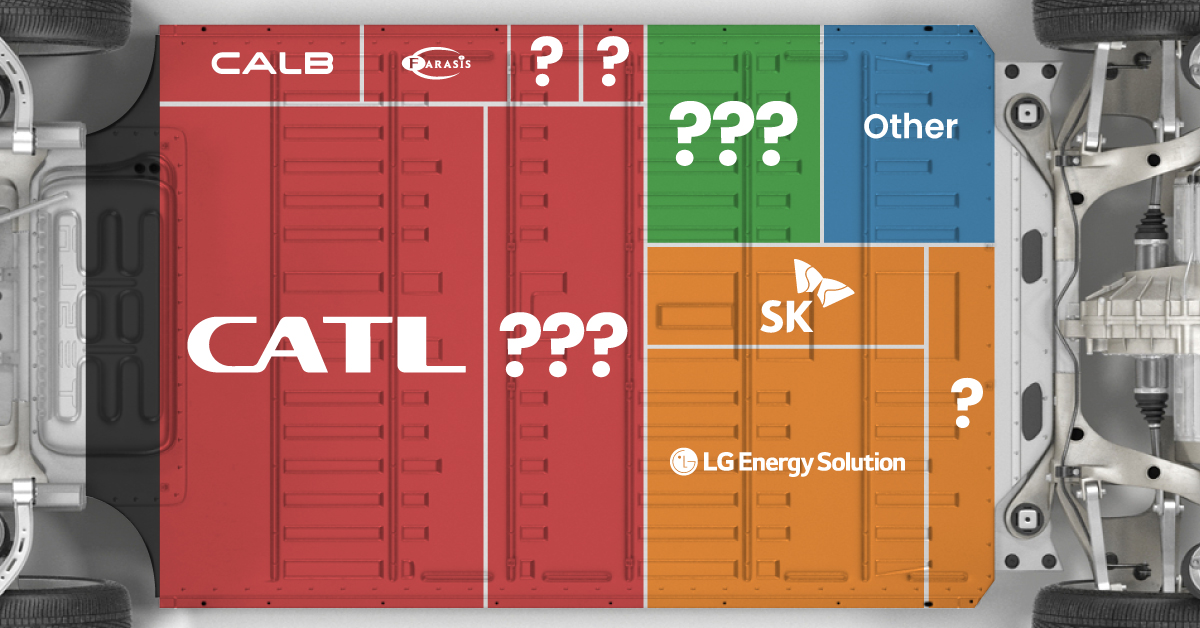

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳China | 242,700 | 34% |

| BYD | 🇨🇳China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷Korea | 108,487 | 15% |

| Panasonic | 🇯🇵Japan | 56,560 | 8% |

| SK On | 🇰🇷Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷Korea | 35,703 | 5% |

| CALB | 🇨🇳China | 23,493 | 3% |

| Farasis Energy | 🇨🇳China | 16,527 | 2% |

| Envision AESC | 🇨🇳China | 8,342 | 1% |

| Sunwoda | 🇨🇳China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now effectively sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Electrification3 years ago

Electrification3 years agoMapped: Solar Power by Country in 2021

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification3 years ago

Electrification3 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity

-

Electrification1 year ago

Electrification1 year agoThe Six Major Types of Lithium-ion Batteries: A Visual Comparison