Electrification

The Road to EV Adoption: Fast Lanes and Potholes

The following content is sponsored by Rock Tech Lithium.

The Road to EV Adoption: Fast Lanes and Potholes

Electric vehicles (EVs) are a key piece of the clean energy puzzle.

However, the road to electrification is influenced by various factors. While some are helping speed up the switch to EVs, others are slowing it down.

The above infographic from Rock Tech Lithium outlines the fast lanes accelerating mainstream EV adoption, and the potholes slowing it down.

The Fast Lanes Accelerating EV Adoption

From government policies to falling battery prices, a number of factors are putting EVs in the fast lane to consumer adoption.

Factor #1:

Promoting Policies

The shift to a clean energy future is slowly moving from a goal to a reality.

Governments around the world have made automobile electrification a key part of public policy. More than 20 countries are targeting a complete phase-out of vehicles that emit greenhouse gases over the next two decades. Furthermore, 35 countries have pledged for net-zero economies by 2050, where EVs will play a key role.

As an example, here’s a recent tweet that U.S. President Joe Biden wrote before signing an executive order to make 50% of the U.S. auto fleet electric by 2030:

“The future of the auto industry is electric—and made in America.”

—President Biden on Twitter

Given the increasing importance of EVs, it’s no surprise that governments are not only promoting auto electrification but also incentivizing it.

Factor #2:

Consumer Awareness

The rapid growth of the EV market is partly due to consumers that are choosing to go electric.

Rising awareness around the risks of climate change as well as vehicle improvements from EV manufacturers is spurring EV adoption among consumers. Between 2015 and 2020, consumer spending on EVs increased by 561%, up from $18 billion to $119 billion.

As more consumers switch to EVs, the market will continue to grow.

Factor #3:

More Models

EV manufacturers are recognizing the need for a wider variety of vehicles to meet the needs of different consumers.

The number of available EV models has increased from 86 in 2015 to over 360 in 2020, and thanks to recent announcements from the auto industry, this trend is likely to extend over the next decade.

| Company | # of New EV Models Announced | Year |

|---|---|---|

| Volkswagen | 75 | 2025 |

| Ford | 40 | 2022 |

| GM | 30 | 2025 |

| Hyundai-Kia1 | 29 | 2025 |

| BMW | 25 | 2023 |

| Renault-Nissan2 | 20 | 2022 |

| Toyota | 15 | 2025 |

| Total | 234 | N/A |

1Hyundai is the parent company of Kia Motors.

2Refers to the Renault-Nissan-Mitsubishi Alliance.

Source: IEA

With more models available, consumers have a wider variety of cars to choose from, reducing the barriers to EV adoption.

Factor #4:

Falling Battery Prices

Batteries are the most expensive and important components of EVs.

Improvements in battery technology, in addition to expanding production, have driven down the cost of EV batteries. As battery costs fall, so do EV prices, bringing EVs closer to price-parity with gas-powered cars.

| Year | Battery Pack Price ($/kWh) | % Price Drop Since 2010 |

|---|---|---|

| 2010 | $1,191 | 0% |

| 2011 | $924 | 22% |

| 2012 | $726 | 39% |

| 2013 | $668 | 44% |

| 2014 | $592 | 50% |

| 2015 | $384 | 68% |

| 2016 | $295 | 75% |

| 2017 | $221 | 81% |

| 2018 | $181 | 85% |

| 2019 | $157 | 87% |

| 2020 | $137 | 89% |

Source: BloombergNEF

According to BloombergNEF, at the battery pack price point of $100/kWh, EV prices will become competitive with gas-powered cars, providing a boost to electrification.

All of the above factors are playing a major role in accelerating the EV transition. So what’s slowing it down?

The Potholes Slowing Down EV Adoption

Although the EV market is growing exponentially, it’s still in its early days, with various obstacles to overcome on the way to mainstream penetration.

Pothole #1:

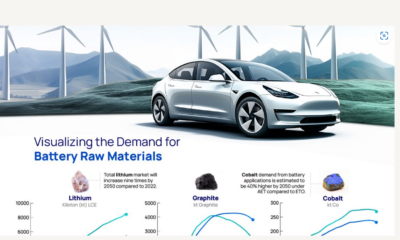

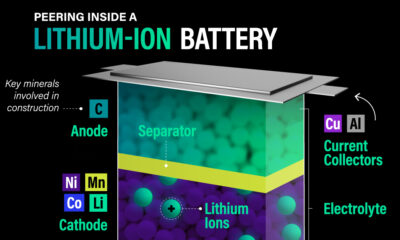

The Supply of Battery Metals

EV batteries rely on the properties of various battery metals to power EVs. In fact, a single EV contains around 207 kg of metals.

As EV adoption grows, the demand for these critical minerals is expected to reach unprecedented highs. In turn, this could result in supply shortages for metals like lithium, cobalt, and graphite, potentially slowing down the growth of the EV market.

To avoid potential shortages, EV manufacturers like Tesla and Volkswagen are vertically integrating to mine their own metals, while governments work to build domestic and independent metal supply chains.

Pothole #2:

Charging Infrastructure

With more EVs on the roads, drivers need more places to plug in and recharge.

However, most countries are lagging behind in the installation of public chargers. The global average ratio of public chargers to EV stock is less than 0.15. This means that on average, there are less than 3 chargers for every 20 EVs.

But there are signs of optimism. Global charging infrastructure has doubled since 2017, and governments are incentivizing charger installations with subsidies and tax rebates.

Pothole #3:

Charging Times

While filling up gas tanks takes less than five minutes, it can take up to eight hours to fully charge an EV battery.

Fast chargers that use direct current can fully charge EVs in a couple of hours, but they’re more expensive to install. However, the majority of publicly available chargers are slow, making it inconvenient for drivers to charge on the go.

As charging technology improves, faster chargers are being developed to boost charge times. According to Bloomberg, new ultra-fast chargers can fully charge EVs in less than 30 minutes. Furthermore, the market share of fast chargers is expected to grow from 15% today to 27% by 2030.

Pothole #4:

Range Anxiety

Compared to gas-powered vehicles, EVs do not go the distance yet.

Limited driving ranges are known to cause “range anxiety”—the fear of running out of power—among EV drivers, presenting a hurdle for mainstream EV adoption. Additionally, the lack of charging infrastructure reinforces the problem of limited ranges.

However, consistent improvements in battery technology are resulting in longer driving ranges. Between 2015 and 2020, the average range for battery EVs increased by 60%. With further technological improvements, extended ranges will allow EVs be compete more aggressively with their gas-guzzling counterparts.

The Decade of the Electric Vehicle

The EV market is growing at a remarkable rate. EV makers sold around three million vehicles in 2020, up 155% from just over one million vehicles sold in 2017.

With several factors driving EV adoption and stakeholders working to overcome the industry’s obstacles, mainstream adoption of EVs is on the horizon.

Electrification

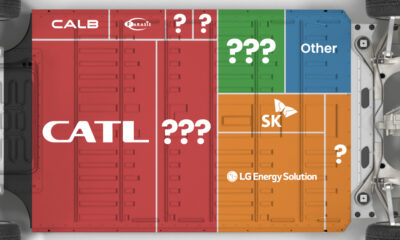

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳China | 242,700 | 34% |

| BYD | 🇨🇳China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷Korea | 108,487 | 15% |

| Panasonic | 🇯🇵Japan | 56,560 | 8% |

| SK On | 🇰🇷Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷Korea | 35,703 | 5% |

| CALB | 🇨🇳China | 23,493 | 3% |

| Farasis Energy | 🇨🇳China | 16,527 | 2% |

| Envision AESC | 🇨🇳China | 8,342 | 1% |

| Sunwoda | 🇨🇳China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now effectively sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

Electrification

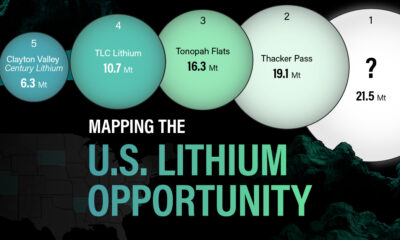

White Gold: Mapping U.S. Lithium Mines

In this graphic, Visual Capitalist partnerered with EnergyX to explore the size and location of U.S. lithium mines.

White Gold: Mapping U.S. Lithium Mines

The U.S. doubled imports of lithium-ion batteries for the third consecutive year in 2022, and with EV demand growing yearly, U.S. lithium mines must ramp up production or rely on other nations for their supply of refined lithium.

To determine if the domestic U.S. lithium opportunity can meet demand, we partnered with EnergyX to determine how much lithium sits within U.S. borders.

U.S. Lithium Projects

The most crucial measure of a lithium mine’s potential is the quantity that can be extracted from the source.

For each lithium resource, the potential volume of lithium carbonate equivalent (LCE) was calculated with a ratio of one metric ton of lithium producing 5.32 metric tons of LCE. Cumulatively, existing U.S. lithium projects contain 94.8 million metric tons of LCE.

| Rank | Project Name | LCE, million metric tons (est.) |

|---|---|---|

| 1 | McDermitt Caldera | 21.5 |

| 2 | Thacker Pass | 19.1 |

| 3 | Tonopah Flats | 18.0 |

| 4 | TLC Lithium | 10.7 |

| 5 | Clayton Valley (Century Lithium) | 6.3 |

| 6 | Zeus Lithium | 6.3 |

| 7 | Rhyolite Ridge | 3.4 |

| 8 | Arkansas Smackover (Phase 1A) | 2.8 |

| 9 | Basin Project | 2.2 |

| 10 | McGee Deposit | 2.1 |

| 11 | Arkansas Smackover (South West) | 1.8 |

| 12 | Clayton Valley (Lithium-X, Pure Energy) | 0.8 |

| 13 | Big Sandy | 0.3 |

| 14 | Imperial Valley/Salton Sea | 0.3 |

U.S. Lithium Opportunities, By State

U.S. lithium projects mainly exist in western states, with comparatively minor opportunities in central or eastern states.

| State | LCE, million metric tons (est.) |

|---|---|

| Nevada | 88.2 |

| Arkansas | 4.6 |

| Arizona | 2.5 |

| California | 0.3 |

Currently, the U.S. is sitting on a wealth of lithium that it is underutilizing. For context, in 2022, the U.S. only produced about 5,000 metric tons of LCE and imported a projected 19,000 metric tons of LCE, showing that the demand for the mineral is healthy.

The Next Gold Rush?

U.S. lithium companies have the opportunity to become global leaders in lithium production and accelerate the transition to sustainable energy sources. This is particularly important as the demand for lithium is increasing every year.

EnergyX is on a mission to meet U.S. lithium demands using groundbreaking technology that can extract 300% more lithium from a source than traditional methods.

You can take advantage of this opportunity by investing in EnergyX and joining other significant players like GM in becoming a shareholder.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies