Energy Shift

How Old Are the World’s Nuclear Reactors?

How Old Are the World’s Nuclear Reactors?

Since the advent of nuclear electricity in the 1950s, nuclear reactors have played an essential role in meeting our rising energy needs.

Nuclear reactors are designed to operate for decades and are typically licensed for 20 to 40 years, and they can last even longer with license renewals.

So, just how old is the world’s current nuclear reactor fleet?

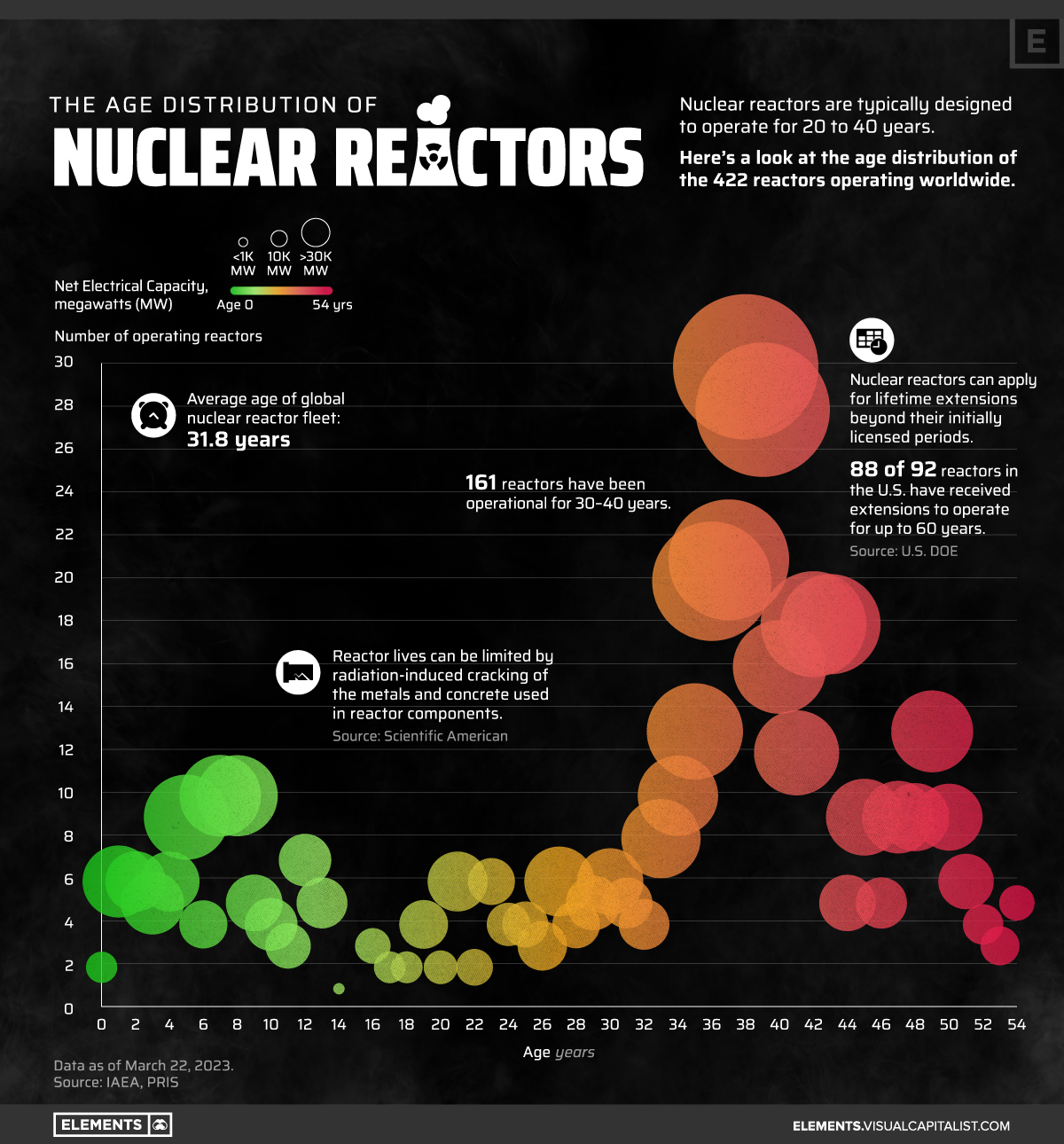

The bubble chart above looks at the age distribution of the 422 reactors operating worldwide as of March 2023, based on data from the Power Reactor Information System (PRIS).

The Age Distribution of the Global Reactor Fleet

Nuclear power saw a building boom in the 1970s, 80s, and 90s as countries expanded their energy portfolios and sought to capitalize on the advancements in nuclear technology. As a result, the majority of the world’s nuclear reactors began operating during this period.

| Age Group (years) | Number of Reactors | Net Electrical Capacity (megawatts) |

|---|---|---|

| 0–10 | 67 | 66,937 |

| 11–20 | 29 | 20,964 |

| 21–30 | 46 | 40,905 |

| 31–40 | 155 | 149,638 |

| 41–50 | 107 | 88,526 |

| >50 | 18 | 10,921 |

| Total | 422 | 377,891 |

Data as of March 22, 2023.

Of the total of 422 reactors, 262 reactors have been in operation for 31 to 50 years. In other words, about 62% of all current nuclear reactors were connected to the grid between 1973 and 1992.

Nuclear power’s growth slowed down at the turn of the 21st century, with decreasing public support and increasing concern over nuclear safety. As a result, only a small number of reactors fall into the 11-to-20-year-old age group.

But over the last decade, some countries have renewed their interest in nuclear energy, while others like China have continued to expand their reactor fleets. Some 67 reactors are between zero and 10 years old, accounting for 18% of global nuclear electrical capacity.

The oldest operating reactors (five of them) are 54 years old and entered commercial service in 1969. Two of these are located in the United States, two in India, and one in Switzerland.

How Long Can Nuclear Reactors Last?

Although specific lifespans can vary, nuclear reactors are typically designed to last for 20 to 40 years.

However, reactors can operate beyond their initially licensed periods with lifetime extensions. Extending reactor lives requires rigorous assessments, safety evaluations, and refurbishments.

Some countries have granted license renewals for aging reactors. Notably, 88 of the 92 reactors in the U.S. have received approvals to operate for up to 60 years, and some have applied for additional 20-year extensions to operate for up to 80 years.

With safety concerns addressed, reactors with lifetime extensions can offer various advantages. Without the high capital investments needed to build new reactors, they can produce carbon-free electricity at low and competitive costs, which is especially important as the global power sector looks to decarbonize.

Energy Shift

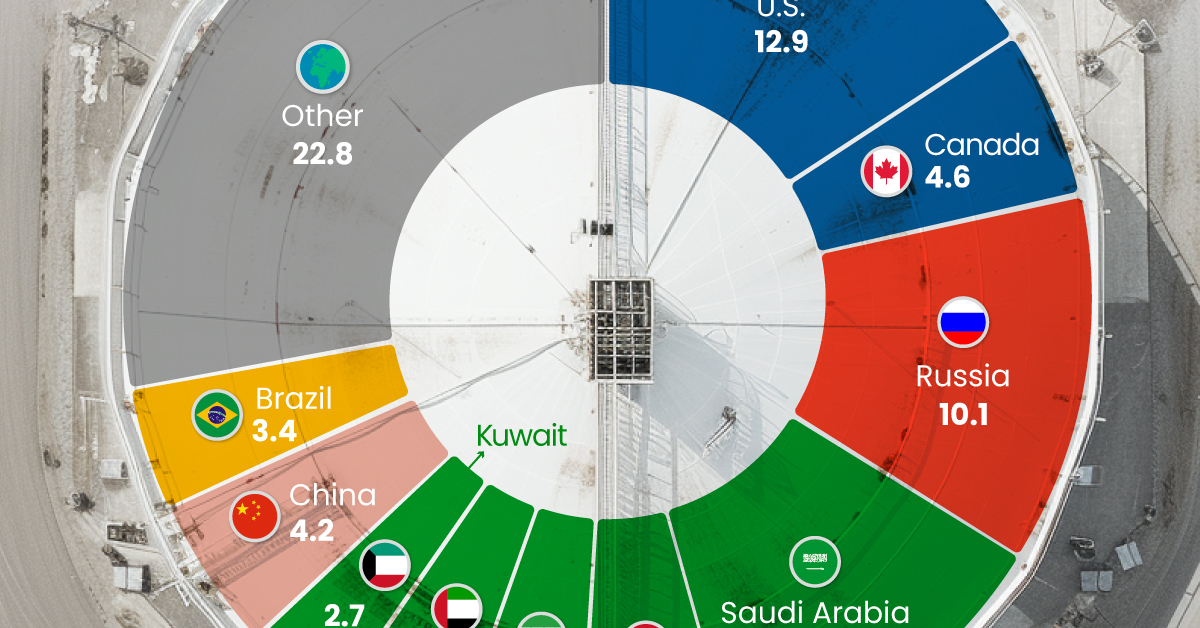

The World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

The World’s Biggest Oil Producers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts to decarbonize the global economy, oil still remains one of the world’s most important resources. It’s also produced by a fairly limited group of countries, which can be a source of economic and political leverage.

This graphic illustrates global crude oil production in 2023, measured in million barrels per day, sourced from the U.S. Energy Information Administration (EIA).

Three Countries Account for 40% of Global Oil Production

In 2023, the United States, Russia, and Saudi Arabia collectively contributed 32.7 million barrels per day to global oil production.

| Oil Production 2023 | Million barrels per day |

|---|---|

| 🇺🇸 U.S. | 12.9 |

| 🇷🇺 Russia | 10.1 |

| 🇸🇦 Saudi Arabia | 9.7 |

| 🇨🇦 Canada | 4.6 |

| 🇮🇶 Iraq | 4.3 |

| 🇨🇳 China | 4.2 |

| 🇮🇷 Iran | 3.6 |

| 🇧🇷 Brazil | 3.4 |

| 🇦🇪 UAE | 3.4 |

| 🇰🇼 Kuwait | 2.7 |

| 🌍 Other | 22.8 |

These three nations have consistently dominated oil production since 1971. The leading position, however, has alternated among them over the past five decades.

In contrast, the combined production of the next three largest producers—Canada, Iraq, and China—reached 13.1 million barrels per day in 2023, just surpassing the production of the United States alone.

In the near term, no country is likely to surpass the record production achieved by the U.S. in 2023, as no other producer has ever reached a daily capacity of 13.0 million barrels. Recently, Saudi Arabia’s state-owned Saudi Aramco scrapped plans to increase production capacity to 13.0 million barrels per day by 2027.

In 2024, analysts forecast that the U.S. will maintain its position as the top oil producer. In fact, according to Macquarie Group, U.S. oil production is expected to achieve a record pace of about 14 million barrels per day by the end of the year.

Energy Shift

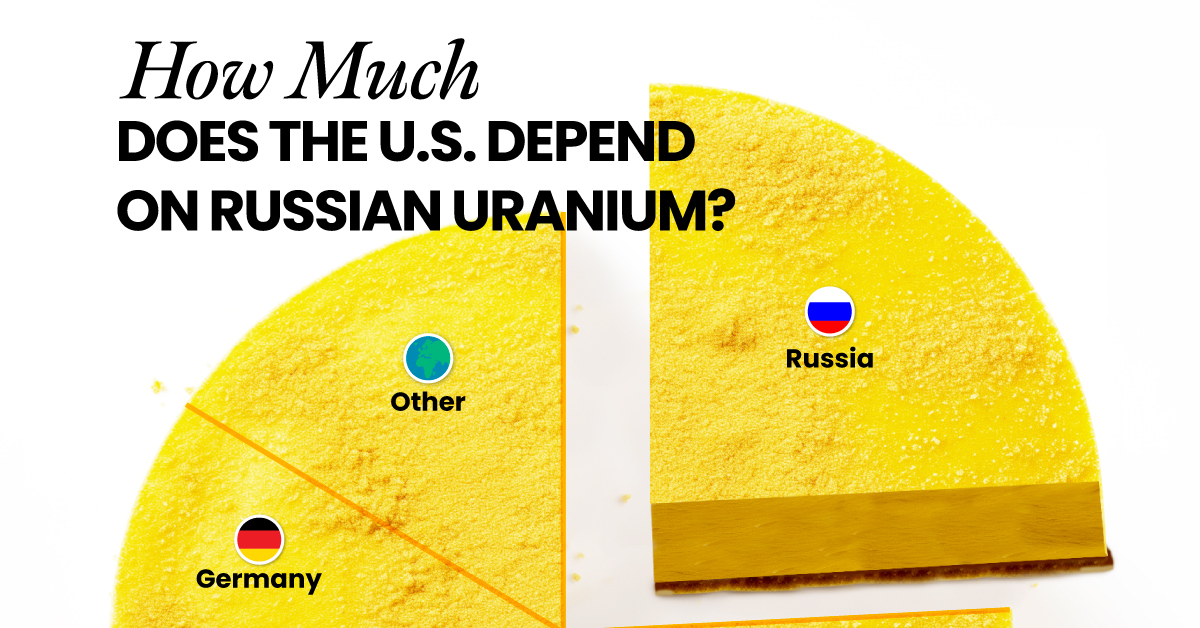

How Much Does the U.S. Depend on Russian Uranium?

Despite a new uranium ban being discussed in Congress, the U.S. is still heavily dependent on Russian uranium.

How Much Does the U.S. Depend on Russian Uranium?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

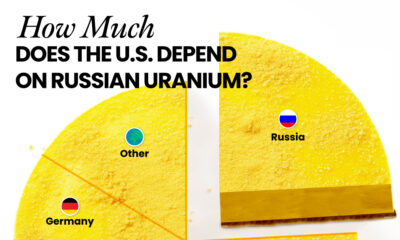

The U.S. House of Representatives recently passed a ban on imports of Russian uranium. The bill must pass the Senate before becoming law.

In this graphic, we visualize how much the U.S. relies on Russian uranium, based on data from the United States Energy Information Administration (EIA).

U.S. Suppliers of Enriched Uranium

After Russia invaded Ukraine, the U.S. imposed sanctions on Russian-produced oil and gas—yet Russian-enriched uranium is still being imported.

Currently, Russia is the largest foreign supplier of nuclear power fuel to the United States. In 2022, Russia supplied almost a quarter of the enriched uranium used to fuel America’s fleet of more than 90 commercial reactors.

| Country of enrichment service | SWU* | % |

|---|---|---|

| 🇺🇸 United States | 3,876 | 27.34% |

| 🇷🇺 Russia | 3,409 | 24.04% |

| 🇩🇪 Germany | 1,763 | 12.40% |

| 🇬🇧 United Kingdom | 1,593 | 11.23% |

| 🇳🇱 Netherlands | 1,303 | 9.20% |

| Other | 2,232 | 15.79% |

| Total | 14,176 | 100% |

SWU stands for “Separative Work Unit” in the uranium industry. It is a measure of the amount of work required to separate isotopes of uranium during the enrichment process. Source: U.S. Energy Information Administration

Most of the remaining uranium is imported from European countries, while another portion is produced by a British-Dutch-German consortium operating in the United States called Urenco.

Similarly, nearly a dozen countries around the world depend on Russia for more than half of their enriched uranium—and many of them are NATO-allied members and allies of Ukraine.

In 2023 alone, the U.S. nuclear industry paid over $800 million to Russia’s state-owned nuclear energy corporation, Rosatom, and its fuel subsidiaries.

It is important to note that 19% of electricity in the U.S. is powered by nuclear plants.

The dependency on Russian fuels dates back to the 1990s when the United States turned away from its own enrichment capabilities in favor of using down-blended stocks of Soviet-era weapons-grade uranium.

As part of the new uranium-ban bill, the Biden administration plans to allocate $2.2 billion for the expansion of uranium enrichment facilities in the United States.

-

Electrification3 years ago

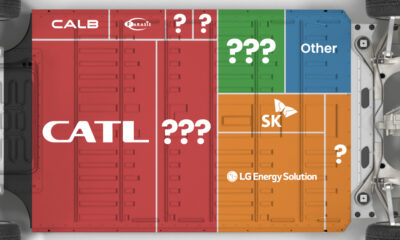

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies