Real Assets

Which Countries Have the Lowest Inflation?

Which Countries Have the Lowest Inflation?

Investors are bracing for longer inflation.

The Federal Reserve indicated that more restrictive monetary policy is in the cards amid strong employment gains. In Europe, while inflation has fallen, it is still far above the 2% target. Across the Euro area inflation is estimated to have reached 8.5% in January.

At the same time, some countries have managed to tamp down inflation. Slower growth, cheaper import costs, and foreign exchange policy are some of the factors keeping inflation subdued.

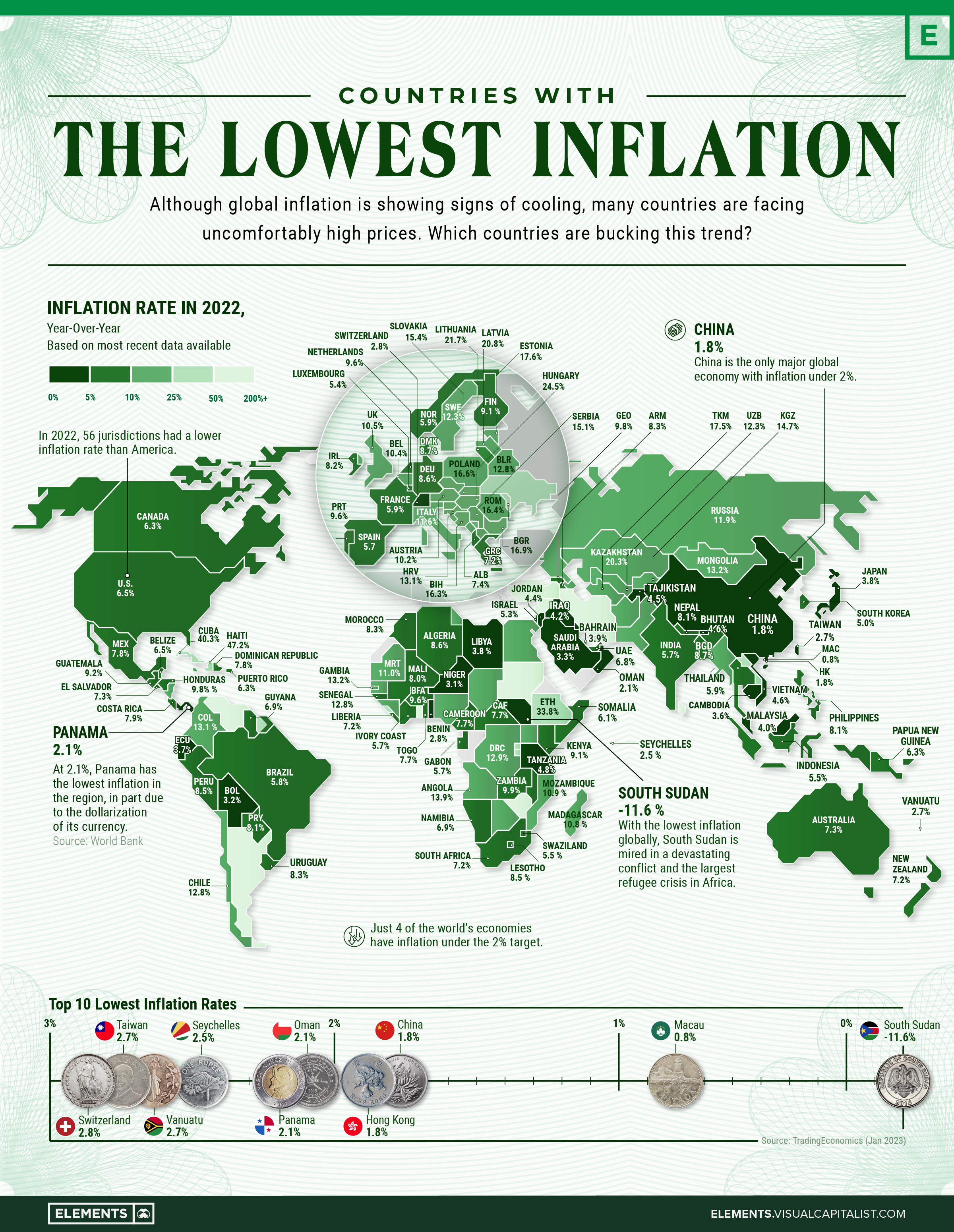

As price pressures rattle global markets, the above infographic maps inflation rates globally using data from Trading Economics, focusing in on the countries with the lowest inflation levels.

World’s Lowest Inflation Rates

Many of the lowest inflation rates around the world are located in Asia, including Macau, China, Hong Kong, and Taiwan. In this region, widespread lockdowns strained growth and consumer spending, lessening inflationary pressures. Last year, Chinese consumers saved $2.2 trillion in bank deposits during these restrictions which were lifted earlier this year.

Inflation in the region was impacted by several other factors. Earlier on in the pandemic, Asian countries including China were less impacted by rising food costs, services inflation, and supply-chain disruptions, unlike what was seen in North America and Europe.

But now as China has reopened, some signs of inflation are beginning to appear. Food prices are up 4.8% annually in December, and hotel rates are rising.

| Rank | Country / Region | Inflation Rate, Year-Over-Year | Date |

|---|---|---|---|

| 1 | 🇸🇸 South Sudan | -11.6% | Dec 2022 |

| 2 | 🇲🇴 Macau | 0.8% | Nov 2022 |

| 3 | 🇨🇳 China | 1.8% | Dec 2022 |

| 4 | 🇭🇰 Hong Kong SAR | 1.8% | Nov 2022 |

| 5 | 🇴🇲 Oman | 2.1% | Nov 2022 |

| 6 | 🇵🇦 Panama | 2.1% | Dec 2022 |

| 7 | 🇸🇨 Seychelles | 2.5% | Dec 2022 |

| 8 | 🇻🇺 Vanuatu | 2.7% | Mar 2022 |

| 9 | 🇹🇼 Taiwan | 2.7% | Dec 2022 |

| 10 | 🇨🇭 Switzerland | 2.8% | Dec 2022 |

| 11 | 🇱🇮 Liechtenstein | 2.8% | Dec 2022 |

| 12 | 🇧🇯 Benin | 2.8% | Dec 2022 |

| 13 | 🇲🇻 Maldives | 2.8% | Nov 2022 |

| 14 | 🇳🇪 Niger | 3.1% | Dec 2022 |

| 15 | 🇧🇳 Brunei | 3.1% | Nov 2022 |

| 16 | 🇧🇴 Bolivia | 3.2% | Nov 2022 |

| 17 | 🇰🇼 Kuwait | 3.2% | Nov 2022 |

| 18 | 🇸🇦 Saudi Arabia | 3.3% | Dec 2022 |

| 19 | 🇰🇭 Cambodia | 3.6% | Oct 2022 |

| 20 | 🇫🇯 Fiji | 3.6% | Dec 2022 |

| 21 | 🇪🇨 Ecuador | 3.7% | Dec 2022 |

| 22 | 🇯🇵 Japan | 3.8% | Nov 2022 |

| 23 | 🇱🇾 Libya | 3.8% | Nov 2022 |

| 24 | 🇧🇲 Bermuda | 3.8% | Oct 2022 |

| 25 | 🇧🇭 Bahrain | 3.9% | Nov 2022 |

| 26 | 🇲🇾 Malaysia | 4.0% | Nov 2022 |

| 27 | 🇵🇸 Palestine | 4.1% | Dec 2022 |

| 28 | 🇮🇶 Iraq | 4.2% | Nov 2022 |

| 29 | 🇯🇴 Jordan | 4.4% | Dec 2022 |

| 30 | 🇹🇯 Tajikistan | 4.5% | Nov 2022 |

| 31 | 🇻🇳 Vietnam | 4.6% | Dec 2022 |

| 32 | 🇧🇹 Bhutan | 4.6% | Nov 2022 |

| 33 | 🇹🇿 Tanzania | 4.8% | Dec 2022 |

| 34 | 🇳🇨 New Caledonia | 4.9% | Dec 2022 |

| 35 | 🇰🇷 South Korea | 5.0% | Dec 2022 |

| 36 | 🇮🇱 Israel | 5.3% | Dec 2022 |

| 37 | 🇱🇺 Luxembourg | 5.4% | Dec 2022 |

| 38 | 🇸🇿 Swaziland | 5.5% | Oct 2022 |

| 39 | 🇮🇩 Indonesia | 5.5% | Dec 2022 |

| 40 | 🇬🇦 Gabon | 5.7% | Oct 2022 |

| 41 | 🇨🇮 Ivory Coast | 5.7% | Nov 2022 |

| 42 | 🇪🇸 Spain | 5.7% | Dec 2022 |

| 43 | 🇮🇳 India | 5.7% | Dec 2022 |

| 44 | 🇧🇷 Brazil | 5.8% | Dec 2022 |

| 45 | 🇹🇭 Thailand | 5.9% | Dec 2022 |

| 46 | 🇫🇷 France | 5.9% | Dec 2022 |

| 47 | 🇳🇴 Norway | 5.9% | Dec 2022 |

| 48 | 🇶🇦 Qatar | 5.9% | Dec 2022 |

| 49 | 🇩🇯 Djibouti | 6.1% | Sep 2022 |

| 50 | 🇸🇴 Somalia | 6.1% | Dec 2022 |

| 51 | 🇹🇹 Trinidad and Tobago | 6.2% | Sep 2022 |

| 52 | 🇵🇬 Papua New Guinea | 6.3% | Sep 2022 |

| 53 | 🇵🇷 Puerto Rico | 6.3% | Nov 2022 |

| 54 | 🇨🇦 Canada | 6.3% | Dec 2022 |

| 55 | 🇧🇸 Bahamas | 6.5% | Sep/22 |

| 56 | 🇧🇿 Belize | 6.5% | Nov 2022 |

| 57 | 🇺🇸 U.S. | 6.5% | Dec 2022 |

| 58 | 🇦🇼 Aruba | 6.6% | Nov 2022 |

| 59 | 🇸🇬 Singapore | 6.7% | Nov 2022 |

| 60 | 🇹🇱 East Timor | 6.7% | Nov 2022 |

| 61 | 🇦🇪 UAE | 6.8% | Jun 2022 |

| 62 | 🇳🇦 Namibia | 6.9% | Dec 2022 |

| 63 | 🇬🇾 Guyana | 6.9% | Nov 2022 |

| 64 | 🇳🇿 New Zealand | 7.2% | Sep 2022 |

| 65 | 🇿🇦 South Africa | 7.2% | Dec 2022 |

| 66 | 🇬🇷 Greece | 7.2% | Dec 2022 |

| 67 | 🇱🇷 Liberia | 7.2% | Sep 2022 |

| 68 | 🇦🇺 Australia | 7.3% | Sep 2022 |

| 69 | 🇲🇹 Malta | 7.3% | Dec 2022 |

| 70 | 🇸🇻 El Salvador | 7.3% | Dec 2022 |

| 71 | 🇦🇱 Albania | 7.4% | Dec 2022 |

| 72 | 🇨🇻 Cape Verde | 7.6% | Dec 2022 |

| 73 | 🇨🇲 Cameroon | 7.7% | Sep 2022 |

| 74 | 🇨🇫 Central African Republic | 7.7% | Nov 2022 |

| 75 | 🇹🇬 Togo | 7.7% | Dec 2022 |

| 76 | 🇲🇽 Mexico | 7.8% | Dec 2022 |

| 77 | 🇩🇴 Dominican Republic | 7.8% | Dec 2022 |

| 78 | 🇨🇷 Costa Rica | 7.9% | Dec 2022 |

| 79 | 🇨🇾 Cyprus | 7.9% | Dec 2022 |

| 80 | 🇲🇱 Mali | 8.0% | Nov 2022 |

| 81 | 🇳🇵 Nepal | 8.1% | Nov 2022 |

| 82 | 🇵🇭 Philippines | 8.1% | Dec 2022 |

| 83 | 🇵🇾 Paraguay | 8.1% | Dec 2022 |

| 84 | 🇧🇧 Barbados | 8.2% | Oct 2022 |

| 85 | 🇮🇪 Ireland | 8.2% | Dec 2022 |

| 86 | 🇺🇾 Uruguay | 8.3% | Dec 2022 |

| 87 | 🇲🇦 Morocco | 8.3% | Nov 2022 |

| 88 | 🇦🇲 Armenia | 8.3% | Dec 2022 |

| 89 | 🇵🇪 Peru | 8.5% | Dec 2022 |

| 90 | 🇱🇸 Lesotho | 8.5% | Oct 2022 |

| 91 | 🇩🇿 Algeria | 8.6% | Nov 2022 |

| 92 | 🇩🇪 Germany | 8.6% | Dec 2022 |

| 93 | 🇩🇰 Denmark | 8.7% | Dec 2022 |

| 94 | 🇧🇩 Bangladesh | 8.7% | Dec 2022 |

| 95 | 🇫🇴 Faroe Islands | 8.8% | Sep 2022 |

| 96 | 🇫🇮 Finland | 9.1% | Dec 2022 |

| 97 | 🇰🇪 Kenya | 9.1% | Dec 2022 |

| 98 | 🇰🇾 Cayman Islands | 9.2% | Sep 2022 |

| 99 | 🇬🇹 Guatemala | 9.2% | Dec 2022 |

| 100 | 🇬🇼 Guinea Bissau | 9.4% | Nov 2022 |

*Inflation rates based on latest available data.

Globally, one outlier is South Sudan. Political instability and violence have depressed growth and inflation, which stood at -11.6% in December. As it faces a severe humanitarian crisis, the country has the lowest inflation rate worldwide.

Oil-producing nation Oman has also seen low inflation, at 2.1%. One reason for this is that the Omani rial is pegged to the U.S. dollar, keeping the currency anchored. Inflation has remained moderate over the last decade in the country.

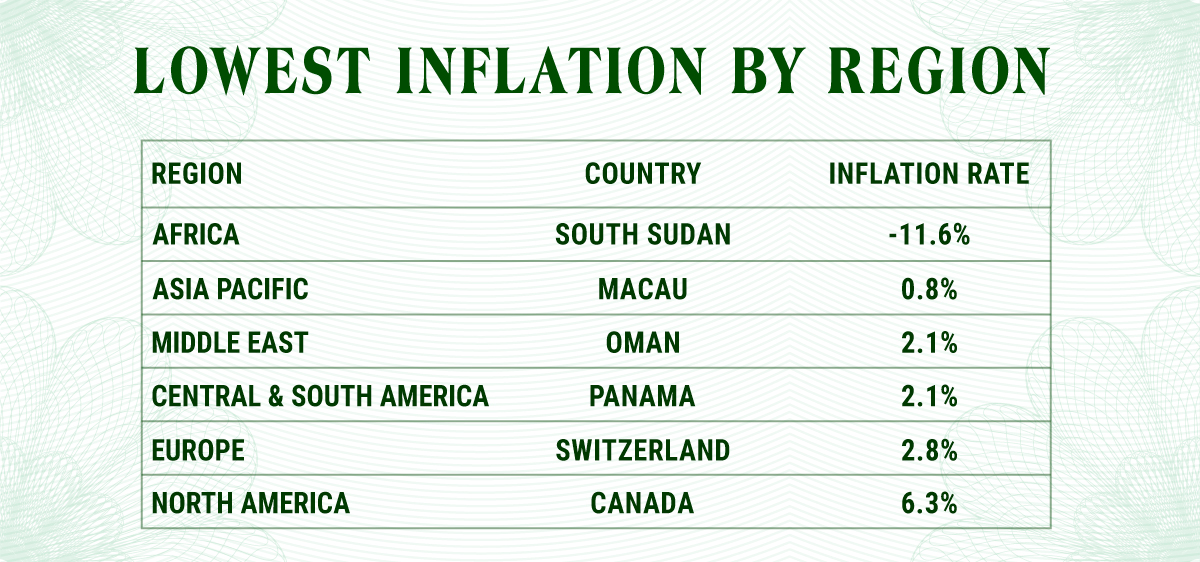

The Country With the Lowest Inflation, by Region

In Europe, Switzerland has the lowest inflation rate, at 2.8%, or roughly one-third of the Euro area’s. It is also the lowest rate in the OECD. The country’s strong currency has shielded it from inflationary pressures and high import prices.

Meanwhile, Swiss production prices have risen marginally above inflation, to 4.1% annually in mid-2022. Last year, the Swiss central bank raised interest rates for the first time since 2007 from -0.75% to -0.25% following 20 years of deflation.

Panama has the lowest rate in Latin America. The dollarization of the Panamanian balboa has helped quash price pressures. In July, the government regulated the price of 72 items to keep the cost of living from rising after three weeks of protests as inflation climbed as high as 5.2% during the course of 2022.

With the lowest inflation in Asia, Macau witnessed the tourism industry fall off a cliff given lockdown measures, and the economy saw both its GDP and inflation collapse in 2022. Its real GDP is projected to have fallen close to 30% for the year.

Future Gazing

The IMF estimates that 84% of countries around the world will have lower inflation than last year. By 2024, both headline and core inflation are projected to remain above pre-pandemic levels at 4.1%.

Opposing forces of China’s reopening and weaker global growth could offset inflationary pressures, yet this interplay—among a host of other factors—remains to be seen.

Real Assets

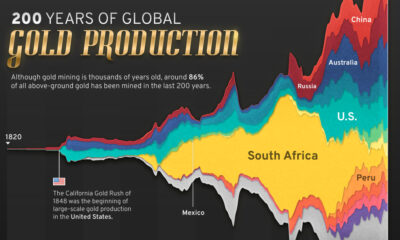

Visualizing Global Gold Production in 2023

Gold production in 2023 was led by China, Australia, and Russia, with each outputting over 300 tonnes.

Visualizing Global Gold Production in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Over 3,000 tonnes of gold were produced globally in 2023.

In this graphic, we list the world’s leading countries in terms of gold production. These figures come from the latest USGS publication on gold statistics (published January 2024).

China, Australia, and Russia Produced the Most Gold in 2023

China was the top producer in 2023, responsible for over 12% of total global production, followed by Australia and Russia.

| Country | Region | 2023E Production (tonnes) |

|---|---|---|

| 🇨🇳 China | Asia | 370 |

| 🇦🇺 Australia | Oceania | 310 |

| 🇷🇺 Russia | Europe | 310 |

| 🇨🇦 Canada | North America | 200 |

| 🇺🇸 United States | North America | 170 |

| 🇰🇿 Kazakhstan | Asia | 130 |

| 🇲🇽 Mexico | North America | 120 |

| 🇮🇩 Indonesia | Asia | 110 |

| 🇿🇦 South Africa | Africa | 100 |

| 🇺🇿 Uzbekistan | Asia | 100 |

| 🇬🇭 Ghana | Africa | 90 |

| 🇵🇪 Peru | South America | 90 |

| 🇧🇷 Brazil | South America | 60 |

| 🇧🇫 Burkina Faso | Africa | 60 |

| 🇲🇱 Mali | Africa | 60 |

| 🇹🇿 Tanzania | Africa | 60 |

| 🌍 Rest of World | - | 700 |

Gold mines in China are primarily concentrated in eastern provinces such as Shandong, Henan, Fujian, and Liaoning. As of January 2024, China’s gold mine reserves stand at an estimated 3,000 tonnes, representing around 5% of the global total of 59,000 tonnes.

In addition to being the top producer, China emerged as the largest buyer of the yellow metal for the year. In fact, the country’s central bank alone bought 225 tonnes of gold in 2023, according the World Gold Council.

Estimated Global Gold Consumption

Most of the gold produced in 2023 was used in jewelry production, while another significant portion was sold as a store of value, such as in gold bars or coins.

- Jewelry: 46%

- Central Banks and Institutions: 23%

- Physical Bars: 16%

- Official Coins, Medals, and Imitation Coins: 9%

- Electrical and Electronics: 5%

- Other: 1%

According to Fitch Solutions, over the medium term (2023-2032), global gold mine production is expected to grow 15%, as high prices encourage investment and output.

Real Assets

Charted: The Value Gap Between the Gold Price and Gold Miners

While gold prices hit all-time highs, gold mining stocks have lagged far behind.

Gold Price vs. Gold Mining Stocks

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Although the price of gold has reached new record highs in 2024, gold miners are still far from their 2011 peaks.

In this graphic, we illustrate the evolution of gold prices since 2000 compared to the NYSE Arca Gold BUGS Index (HUI), which consists of the largest and most widely held public gold production companies. The data was compiled by Incrementum AG.

Mining Stocks Lag Far Behind

In April 2024, gold reached a new record high as Federal Reserve Chair Jerome Powell signaled policymakers may delay interest rate cuts until clearer signs of declining inflation materialize.

Additionally, with elections occurring in more than 60 countries in 2024 and ongoing conflicts in Ukraine and Gaza, central banks are continuing to buy gold to strengthen their reserves, creating momentum for the metal.

Traditionally known as a hedge against inflation and a safe haven during times of political and economic uncertainty, gold has climbed over 11% so far this year.

According to Business Insider, gold miners experienced their best performance in a year in March 2024. During that month, the gold mining sector outperformed all other U.S. industries, surpassing even the performance of semiconductor stocks.

Still, physical gold has outperformed shares of gold-mining companies over the past three years by one of the largest margins in decades.

| Year | Gold Price | NYSE Arca Gold BUGS Index (HUI) |

|---|---|---|

| 2023 | $2,062.92 | $243.31 |

| 2022 | $1,824.32 | $229.75 |

| 2021 | $1,828.60 | $258.87 |

| 2020 | $1,895.10 | $299.64 |

| 2019 | $1,523.00 | $241.94 |

| 2018 | $1,281.65 | $160.58 |

| 2017 | $1,296.50 | $192.31 |

| 2016 | $1,151.70 | $182.31 |

| 2015 | $1,060.20 | $111.18 |

| 2014 | $1,199.25 | $164.03 |

| 2013 | $1,201.50 | $197.70 |

| 2012 | $1,664.00 | $444.22 |

| 2011 | $1,574.50 | $498.73 |

| 2010 | $1,410.25 | $573.32 |

| 2009 | $1,104.00 | $429.91 |

| 2008 | $865.00 | $302.41 |

| 2007 | $836.50 | $409.37 |

| 2006 | $635.70 | $338.24 |

| 2005 | $513.00 | $276.90 |

| 2004 | $438.00 | $215.33 |

| 2003 | $417.25 | $242.93 |

| 2002 | $342.75 | $145.12 |

| 2001 | $276.50 | $65.20 |

| 2000 | $272.65 | $40.97 |

Among the largest companies on the NYSE Arca Gold BUGS Index, Colorado-based Newmont has experienced a 24% drop in its share price over the past year. Similarly, Canadian Barrick Gold also saw a decline of 6.5% over the past 12 months.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Electrification3 years ago

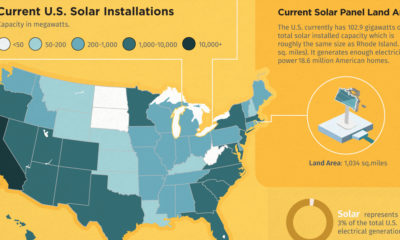

Electrification3 years agoHow Much Land is Needed to Power the U.S. with Solar?