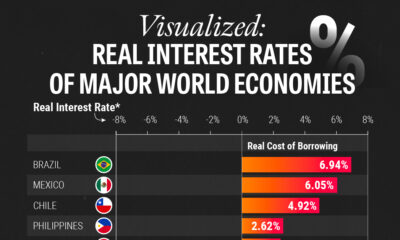

Currently, over half of the major economies have negative real interest rates.

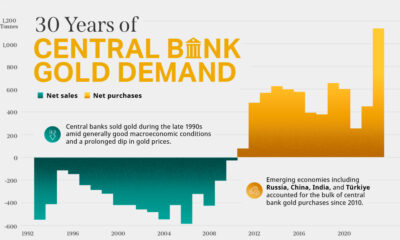

Globally, central banks bought a record 1,136 tonnes of gold in 2022. How has central bank gold demand changed over the last three decades?

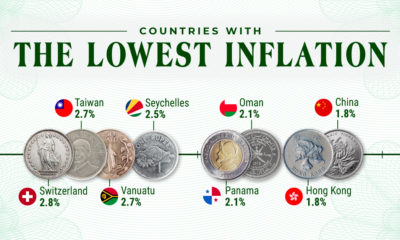

Just four economies around the world had inflation below 2% in 2022.

How much gas have European countries stored ahead of winter, and how does it compare against their annual consumption?

Although inflation may have hit its peak, several countries around the world are still facing double-digit inflation in 2022.

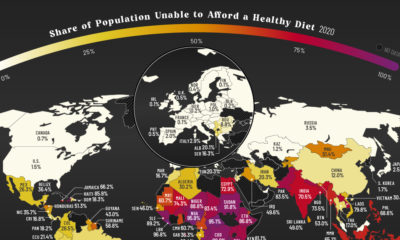

This infographic maps the share of the population unable to afford a healthy diet in 139 countries.

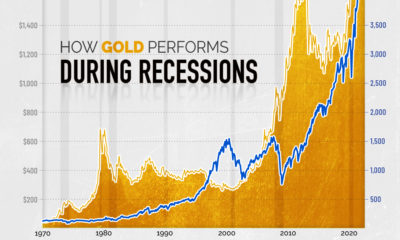

What happens to the price of gold during recessions?

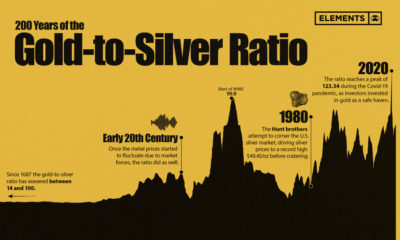

The gold-to-silver ratio used to define the value of currencies and still remains an important metric for metals investors today.

2020 brought about massive changes in U.S. monetary policy, with a 25% increase in M3 money supply and near-zero interest rates.

The interest income needed to beat inflation since 1994 has varied, but in the last 13 years, savings accounts failed to live up to the task.