Energy Shift

Visualized: How the Oil and Gas Industry Spends Its Profits

How the Oil and Gas Industry Spends Its Profits

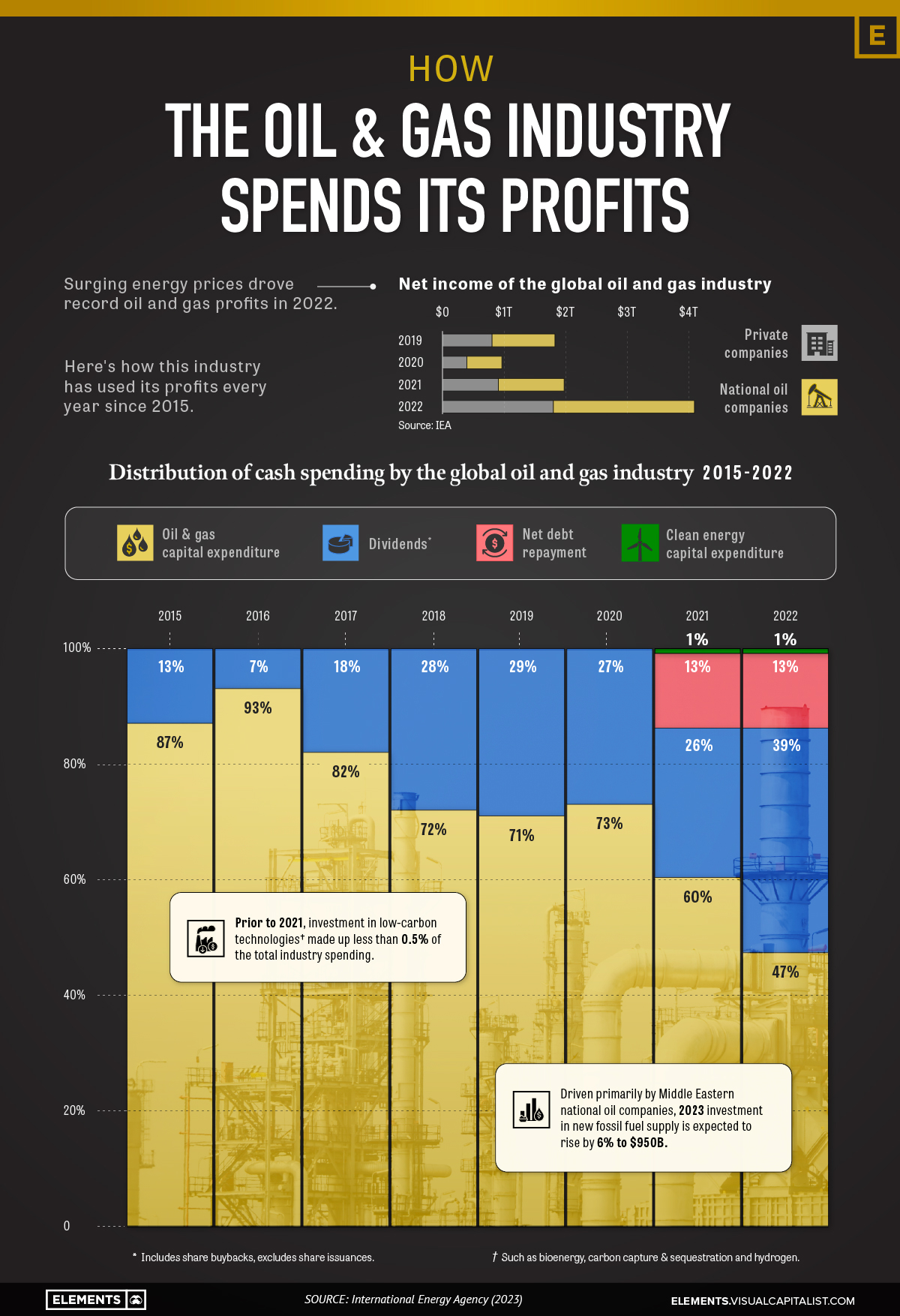

2022 was a highly profitable year for the oil and gas industry. Due to Russia’s invasion of Ukraine, energy prices skyrocketed, and the industry amassed an astounding $4 trillion in profits.

So, how were these 2022 profits spent? And how does this spending compare to previous years?

To find out, we’ve visualized the distribution of cash spending by the global oil and gas industry between 2015 and 2022, according to the International Energy Agency’s 2023 World Energy Investment report.

Distribution of Cash Spending: 2015-2022

Unlike previous years, a majority of the oil and gas industry’s 2022 profits were channeled towards enhancing shareholder dividends and reducing debt burdens.

This means that capital expenditure for oil and gas production dropped below 50% of total spending for the first time in more than 15 years.

| Distribution of Spending | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|

| Oil and gas capital expenditure | 87% | 93% | 82% | 72% | 71% | 73% | 60% | 47% |

| Clean energy capital expenditure | 0% | 0% | 0% | 0% | 0% | 0% | 1% | 1% |

| Dividends* | 13% | 7% | 18% | 28% | 29% | 27% | 26% | 39% |

| Net debt repayment | 0% | 0% | 0% | 0% | 0% | 0% | 13% | 13% |

| TOTAL | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

*Dividends include share buybacks, exclude share issuances.

Shareholder pressures for greater returns, as well as long-term demand and cost concerns, were primary reasons for the reshaping of this spending.

Conversely, even with the continued demands for the sector to contribute more to addressing climate change, cash flow allocated to clean energy remained around 1% of spending.

Subnational Spending Trends

The International Energy Agency (IEA) predicts that expenditure on new fossil fuel supply will experience a 6% increase in 2023, reaching a total of $950 billion.

While this refers to global numbers, noteworthy disparities do exist based on geographical location and different types of oil and gas companies, including:

- Most of the growth in new supply expenditure is expected to come from Middle Eastern national oil companies. Based on their announced spending, they are the only subset in the industry that is planning to spend significantly more in 2023 than in 2022.

- Real spending on oil and gas supply continues to fall short of 2019 levels for a majority of North American and European companies.

- While only making up 1% of total spending in 2022, investment in carbon capture, utilization, and storage (CCUS), hydrogen, and bioenergy are growing in the industry. Most of these projects are led by major private players, along with national oil companies from Europe and North America.

What About the Energy Transition?

While there are shifts in the oil and gas industry’s spending, it’s important to note that current capital expenditures in fossil fuels are more than double what is required to achieve the IEA’s 2050 Net Zero Emissions Scenario.

Therefore, more meaningful and substantial shifts in spending are necessary to bring down the emissions of the sector.

Energy Shift

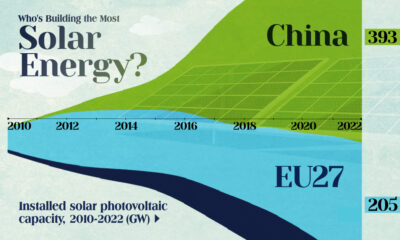

Who’s Building the Most Solar Energy?

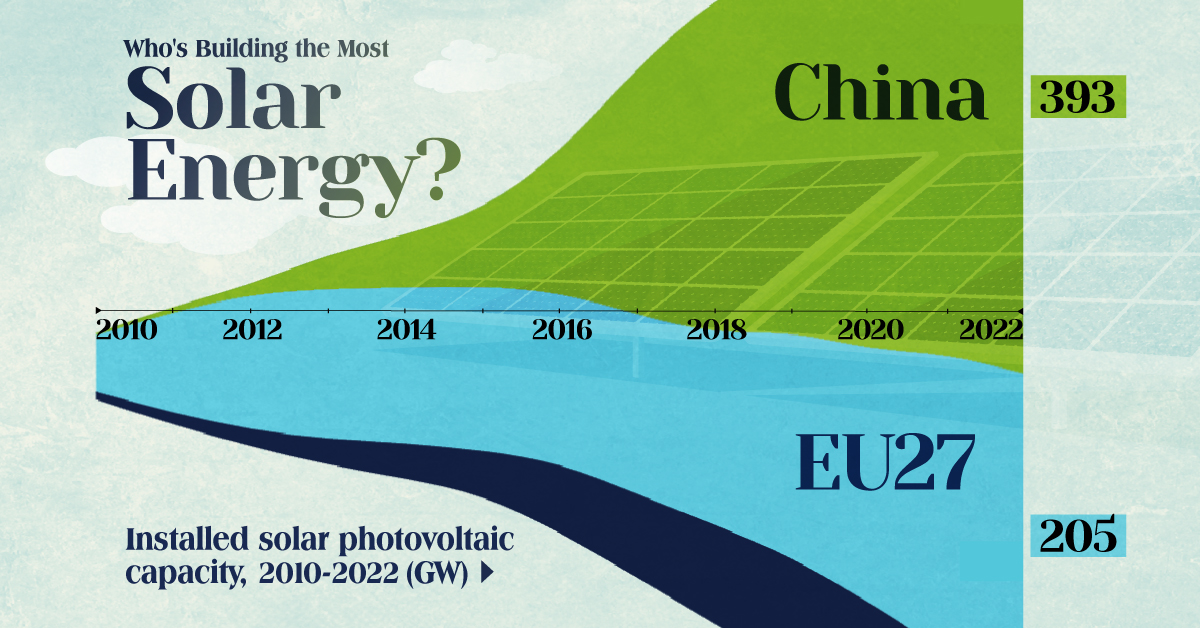

China’s solar capacity triples USA, nearly doubles EU.

Who’s Building the Most Solar Energy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2023, solar energy accounted for three-quarters of renewable capacity additions worldwide. Most of this growth occurred in Asia, the EU, and the U.S., continuing a trend observed over the past decade.

In this graphic, we illustrate the rise in installed solar photovoltaic (PV) capacity in China, the EU, and the U.S. between 2010 and 2022, measured in gigawatts (GW). Bruegel compiled the data..

Chinese Dominance

As of 2022, China’s total installed capacity stands at 393 GW, nearly double that of the EU’s 205 GW and surpassing the USA’s total of 113 GW by more than threefold in absolute terms.

| Installed solar capacity (GW) | China | EU27 | U.S. |

|---|---|---|---|

| 2022 | 393.0 | 205.5 | 113.0 |

| 2021 | 307.0 | 162.7 | 95.4 |

| 2020 | 254.0 | 136.9 | 76.4 |

| 2019 | 205.0 | 120.1 | 61.6 |

| 2018 | 175.3 | 104.0 | 52.0 |

| 2017 | 130.8 | 96.2 | 43.8 |

| 2016 | 77.8 | 91.5 | 35.4 |

| 2015 | 43.6 | 87.7 | 24.2 |

| 2014 | 28.4 | 83.6 | 18.1 |

| 2013 | 17.8 | 79.7 | 13.3 |

| 2012 | 6.7 | 71.1 | 8.6 |

| 2011 | 3.1 | 53.3 | 5.6 |

| 2010 | 1.0 | 30.6 | 3.4 |

Since 2017, China has shown a compound annual growth rate (CAGR) of approximately 25% in installed PV capacity, while the USA has seen a CAGR of 21%, and the EU of 16%.

Additionally, China dominates the production of solar power components, currently controlling around 80% of the world’s solar panel supply chain.

In 2022, China’s solar industry employed 2.76 million individuals, with manufacturing roles representing approximately 1.8 million and the remaining 918,000 jobs in construction, installation, and operations and maintenance.

The EU industry employed 648,000 individuals, while the U.S. reached 264,000 jobs.

According to the IEA, China accounts for almost 60% of new renewable capacity expected to become operational globally by 2028.

Despite the phasing out of national subsidies in 2020 and 2021, deployment of solar PV in China is accelerating. The country is expected to reach its national 2030 target for wind and solar PV installations in 2024, six years ahead of schedule.

Energy Shift

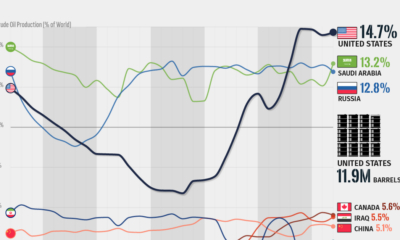

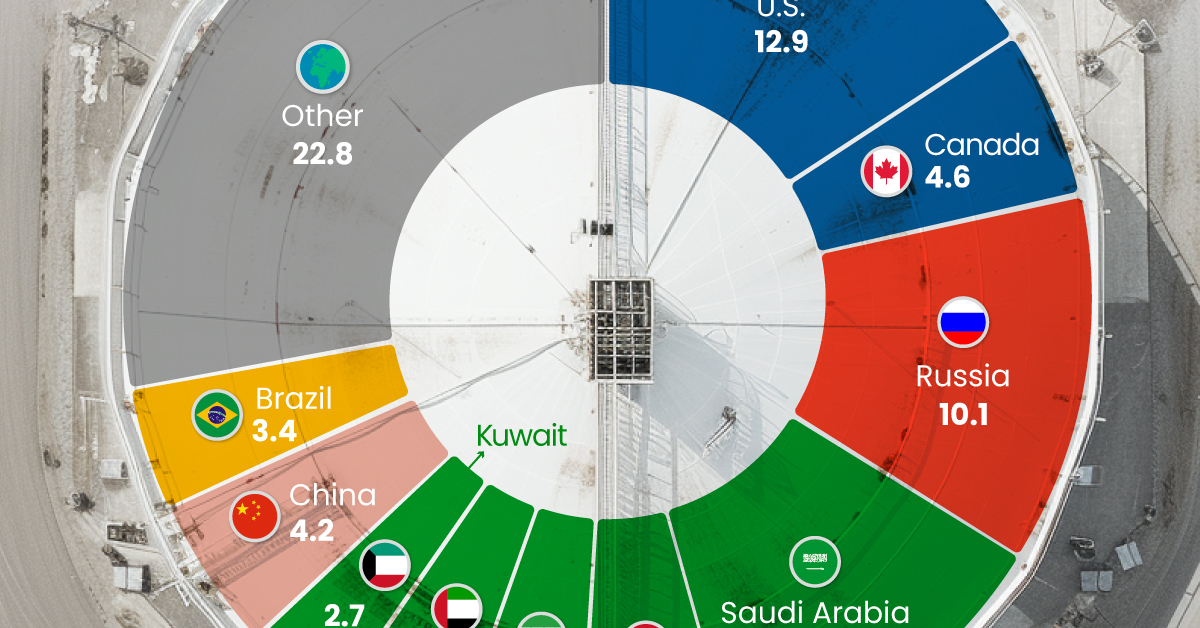

The World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

The World’s Biggest Oil Producers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts to decarbonize the global economy, oil still remains one of the world’s most important resources. It’s also produced by a fairly limited group of countries, which can be a source of economic and political leverage.

This graphic illustrates global crude oil production in 2023, measured in million barrels per day, sourced from the U.S. Energy Information Administration (EIA).

Three Countries Account for 40% of Global Oil Production

In 2023, the United States, Russia, and Saudi Arabia collectively contributed 32.7 million barrels per day to global oil production.

| Oil Production 2023 | Million barrels per day |

|---|---|

| 🇺🇸 U.S. | 12.9 |

| 🇷🇺 Russia | 10.1 |

| 🇸🇦 Saudi Arabia | 9.7 |

| 🇨🇦 Canada | 4.6 |

| 🇮🇶 Iraq | 4.3 |

| 🇨🇳 China | 4.2 |

| 🇮🇷 Iran | 3.6 |

| 🇧🇷 Brazil | 3.4 |

| 🇦🇪 UAE | 3.4 |

| 🇰🇼 Kuwait | 2.7 |

| 🌍 Other | 22.8 |

These three nations have consistently dominated oil production since 1971. The leading position, however, has alternated among them over the past five decades.

In contrast, the combined production of the next three largest producers—Canada, Iraq, and China—reached 13.1 million barrels per day in 2023, just surpassing the production of the United States alone.

In the near term, no country is likely to surpass the record production achieved by the U.S. in 2023, as no other producer has ever reached a daily capacity of 13.0 million barrels. Recently, Saudi Arabia’s state-owned Saudi Aramco scrapped plans to increase production capacity to 13.0 million barrels per day by 2027.

In 2024, analysts forecast that the U.S. will maintain its position as the top oil producer. In fact, according to Macquarie Group, U.S. oil production is expected to achieve a record pace of about 14 million barrels per day by the end of the year.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity