Technology Metals

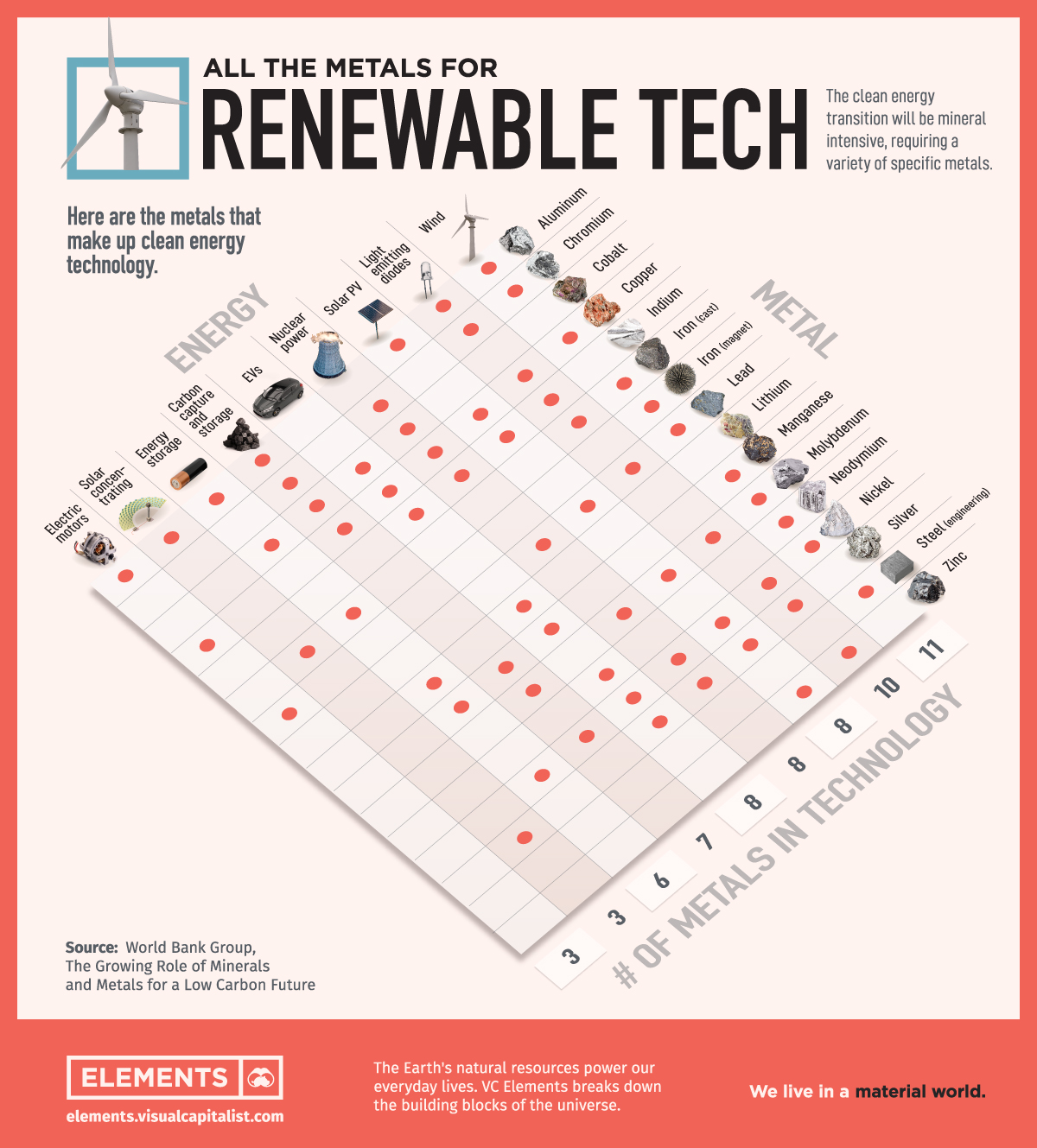

Visualizing All the Metals for Renewable Tech

This graphic takes the data from the World Bank’s Climate Smart Report and outlines what metals each renewable technology will require and their overlapping uses.

Visualizing the Metals for Renewable Tech

The energy transition will be mineral intensive and create massive demand for all the metals in renewable tech. Electricity from renewable technology grew at the fastest rate in two decades in 2020, according to a report from the International Energy Agency (IEA).

Consequently, as the pace of the energy transition gains further momentum, the demand for metals will increase. But which ones?

As shown above, the graphic takes data from the World Bank’s Climate Smart Report outlines what metals each renewable technology will require and their overlapping uses.

All the Metals for Renewable Tech

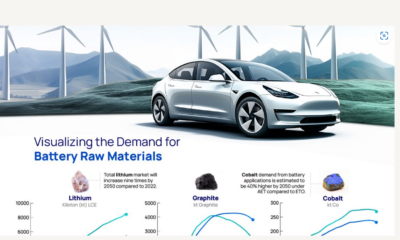

According to the IEA, the number and amount metals used vary by technology. Lithium, nickel, cobalt, manganese and graphite are important for battery performance, durability, and energy density. Rare earth elements are in the permanent magnets that help spin wind turbines and EV motors.

| kg/vehicle | Copper | Lithium | Nickel | Manganese | Cobalt | Graphite | Zinc | Rare earths | Others |

|---|---|---|---|---|---|---|---|---|---|

| Electric car | 53.2 | 8.9 | 39.9 | 24.5 | 13.3 | 66.3 | 0.1 | 0.5 | 0.31 |

| Conventional car | 22.3 | 0 | 0 | 11.2 | 0 | 0 | 0.1 | 0 | 0.3 |

In particular, a typical electric car requires six times the minerals of a conventional car, and an onshore wind farm requires nine times more minerals than a gas-fired power plant with a similar output. Electricity grids need massive amounts of copper and aluminum, with copper being a keystone for all electricity-related technologies.

| kg/MW | Copper | Nickel | Manganese | Cobalt | Chromium | Molybdenum | Zinc | Rare earths |

|---|---|---|---|---|---|---|---|---|

| Offshore wind | 8,000 | 240 | 790 | 0 | 525 | 109 | 5,500 | 239 |

| Onshore wind | 2,900 | 404 | 780 | 0 | 470 | 99 | 5,500 | 14 |

| Solar PV | 2,822 | 1.3 | 0 | 0 | 0 | 0 | 30 | 0 |

| Nuclear | 1,473 | 1297 | 148 | 0 | 2,190 | 70 | 0 | 0.5 |

| Coal | 1,150 | 721 | 4.63 | 201 | 308 | 66 | 0 | 0 |

| Natural gas | 1,100 | 16 | 0 | 1.8 | 48.34 | 0 | 0 | 0 |

Inevitably, more mining must happen to provide the minerals for a renewable energy transition. According to the IEA, reaching the goals of the Paris Agreement would quadruple mineral demand by 2040.

Limited Resources, High Prices

Eventually, a rapid increase in demand for minerals will create opportunities and challenges in meeting sustainability goals. There is a lack of investment in new mine supply which could substantially raise the costs of clean energy technologies.

In fact, the mining industry needs to invest $1.7 trillion over the next 15 years to supply enough metals for renewable tech, according to consultancy Wood Mackenzie.

However, the mining industry is not ready to support an accelerated energy transition. While there are a host of projects at varying stages of development, there are many risks that could increase supply constraints and price volatility:

- High geographical concentration of production

- Long project development lead times

- Declining resource quality

- Growing scrutiny of environmental and social performance

- Higher exposure to climate risks

In addition, some nations are in a better position than others to secure the metals they need for renewable technologies. Attaining these new sources will be vital and valuable for a clean energy future.

Energy Shift

China Dominates the Supply of U.S. Critical Minerals List

China was the world’s leading producer of 30 out of 50 entries on the U.S. critical minerals list, according to the U.S. Geological Survey.

China Dominates the Supply of U.S. Critical Minerals List

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Most countries have, for many decades, kept a record of their own critical minerals list.

For example, the U.S., drew up a list of “war minerals” during World War I, containing important minerals which could not be found and produced in abundance domestically. They included: tin, nickel, platinum, nitrates and potash.

Since then, as the economy has grown and innovated, critical mineral lists have expanded considerably. The Energy Act of 2020 defines a critical mineral as:

“A non-fuel mineral or mineral material essential to the economic or national security of the U.S., whose supply chains are vulnerable to disruption.” — Energy Act, 2020.

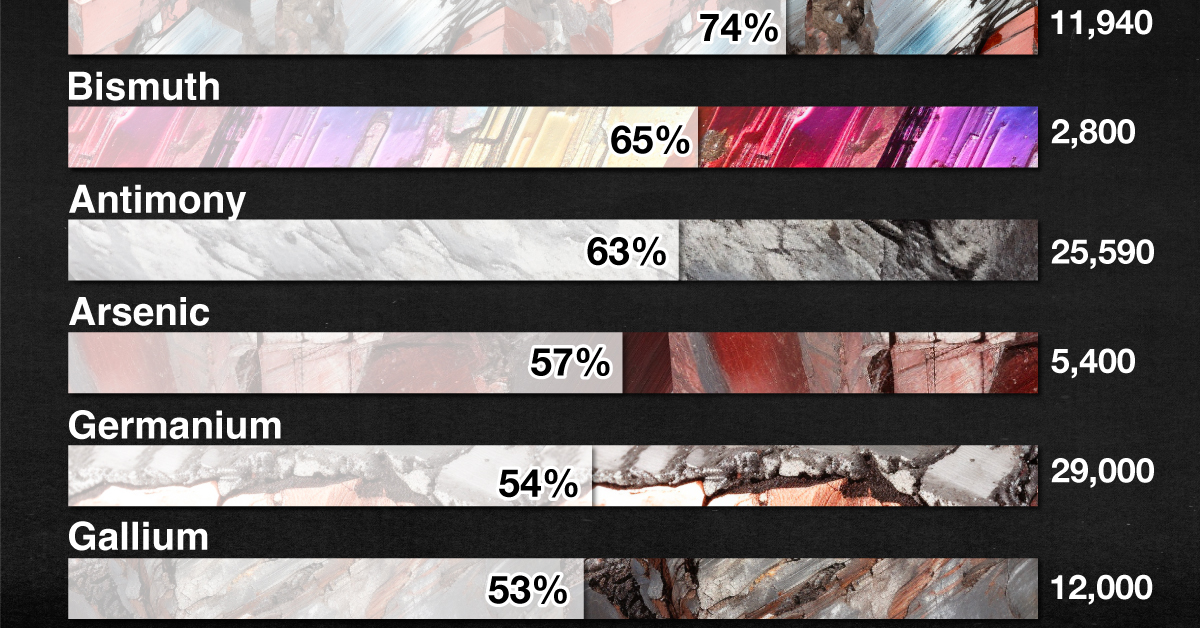

Currently there are 50 entries on this list and the U.S. Geological Survey (USGS) estimates that China is the leading producer for 30 of them. From USGS data, we visualize China’s share of U.S. imports for 10 critical minerals.

What Key Critical Minerals Does the U.S. Import From China?

The U.S. is 100% import-reliant for its supply of yttrium, with China responsible for 94% of U.S. imports of the metal from 2018 to 2021.

A soft silvery metal, yttrium is used as an additive for alloys, making microwave filters for radars, and as a catalyst in ethylene polymerization—a key process in making certain kinds of plastic.

China is a major supplier of the following listed critical minerals to the U.S.

| Critical Mineral | China's Share of U.S. Imports | U.S. Imports (Tonnes) | Uses |

|---|---|---|---|

| Yttrium | 94% | 1,000 | Catalyst, Microwave filters |

| Rare Earths | 74% | 11,940 | Smartphones, Cameras |

| Bismuth | 65% | 2,800 | Metallurgy |

| Antimony | 63% | 25,590 | Batteries |

| Arsenic | 57% | 5,400 | Semiconductors |

| Germanium | 54% | 29,000 | Chips, Fiber optics |

| Gallium | 53% | 12,000 | Chips, Fiber optics |

| Barite | 38% | 2,300 | Hydrocarbon production |

| Graphite (natural) | 33% | 82,000 | Batteries, Lubricants |

| Tungsten | 29% | 14,000 | Metallurgy |

Note: China’s share of U.S. critical minerals imports is based on average imports from 2018 to 2021.

Meanwhile, the U.S. also imports nearly three-quarters of its rare earth compounds and metals demand from China. Rare earth elements—so called since they are not found in easily-mined, concentrated clusters—are a collection of 15 elements on the periodic table, known as the lanthanide series.

Rare earths are used in smartphones, cameras, hard disks, and LEDs but also, crucially, in the clean energy and defense industries.

Does China’s Dominance of U.S. Critical Minerals Supply Matter?

The USGS estimates that China could potentially disrupt the global rare earth oxide supply by cutting off 40–50% production, impacting suppliers of advanced components used in U.S. defense systems.

A version of this sort of trade warfare is already playing out. Earlier this year, China implemented export controls on germanium and gallium. The U.S. relies on China for around 54% of its demand for both minerals, used for producing chips, solar panels, and fiber optics.

China’s controls were seen as a retaliation against the U.S. which has restricted the supply of chips, chip design software, and lithography machines to Chinese companies.

Technology Metals

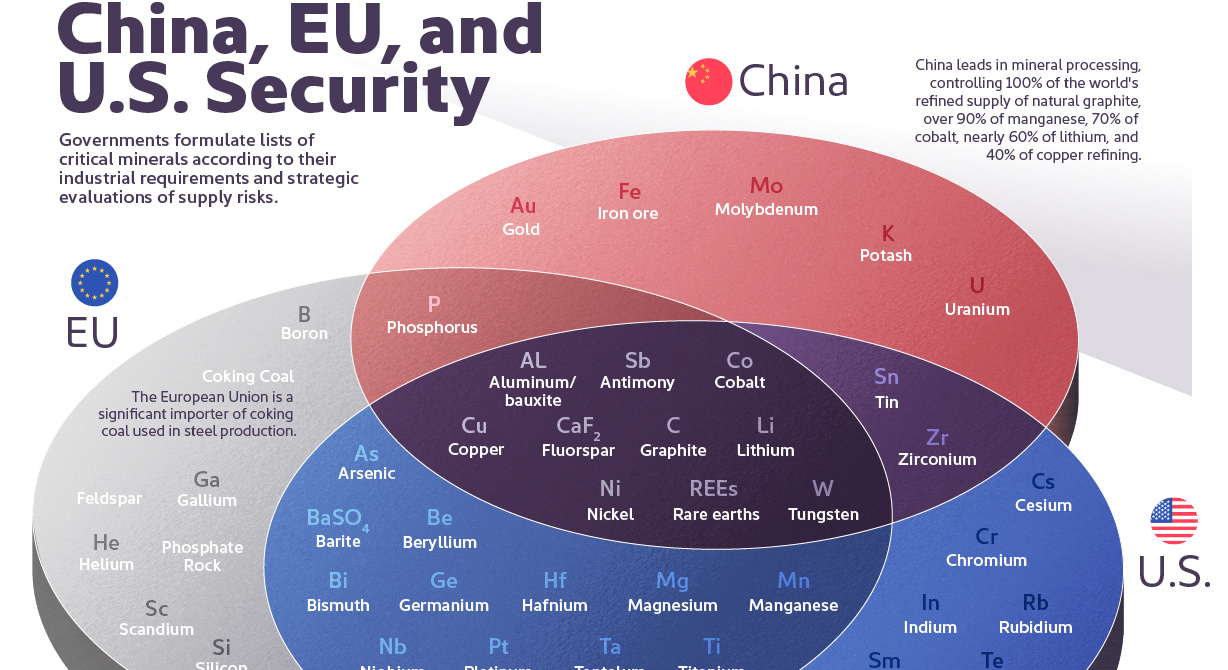

The Critical Minerals to China, EU, and U.S. National Security

Ten materials, including cobalt, lithium, graphite, and rare earths, are deemed critical by all three.

The Critical Minerals to China, EU, and U.S. Security

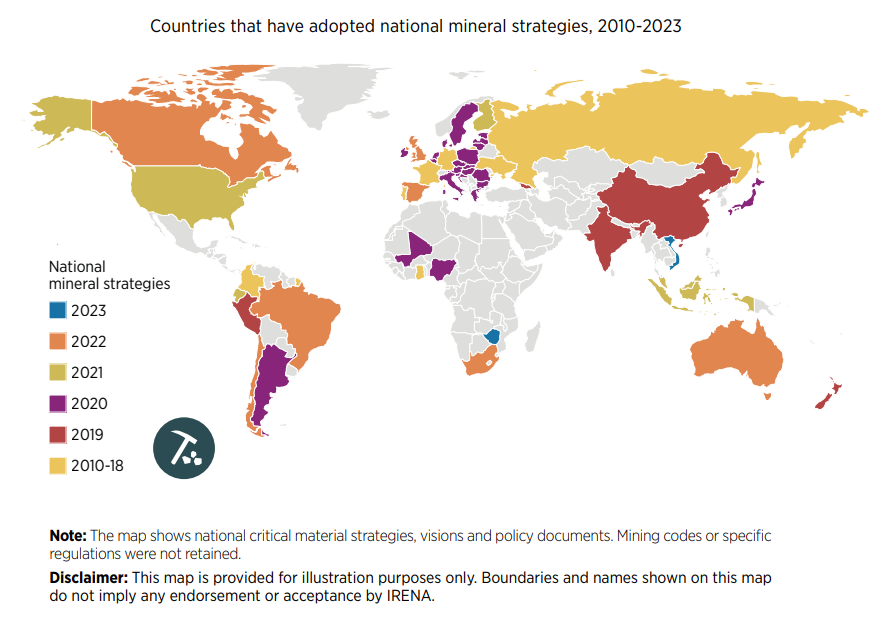

Governments formulate lists of critical minerals according to their industrial requirements and strategic evaluations of supply risks.

Over the last decade, minerals like nickel, copper, and lithium have been on these lists and deemed essential for clean technologies like EV batteries and solar and wind power.

This graphic uses IRENA and the U.S. Department of Energy data to identify which minerals are essential to China, the United States, and the European Union.

What are Critical Minerals?

There is no universally accepted definition of critical minerals. Countries and regions maintain lists that mirror current technology requirements and supply and demand dynamics, among other factors.

These lists are also constantly changing. For example, the EU’s first critical minerals list in 2011 featured only 14 raw materials. In contrast, the 2023 version identified 34 raw materials as critical.

One thing countries share, however, is the concern that a lack of minerals could slow down the energy transition.

With most countries committed to reducing greenhouse gas emissions, the total mineral demand from clean energy technologies is expected to double by 2040.

U.S. and EU Seek to Reduce Import Reliance on Critical Minerals

Ten materials feature on critical material lists of both the U.S., the EU, and China, including cobalt, lithium, graphite, and rare earths.

| Mineral / Considered Critical | 🇺🇸 U.S. | 🇪🇺 EU | 🇨🇳 China |

|---|---|---|---|

| Aluminum/ bauxite | Yes | Yes | Yes |

| Antimony | Yes | Yes | Yes |

| Cobalt | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes |

| Fluorspar | Yes | Yes | Yes |

| Graphite | Yes | Yes | Yes |

| Lithium | Yes | Yes | Yes |

| Nickel | Yes | Yes | Yes |

| Rare earths | Yes | Yes | Yes |

| Tungsten | Yes | Yes | Yes |

| Arsenic | Yes | Yes | No |

| Barite | Yes | Yes | No |

| Beryllium | Yes | Yes | No |

| Bismuth | Yes | Yes | No |

| Germanium | Yes | Yes | No |

| Hafnium | Yes | Yes | No |

| Magnesium | Yes | Yes | No |

| Manganese | Yes | Yes | No |

| Niobium | Yes | Yes | No |

| Platinum | Yes | Yes | No |

| Tantalum | Yes | Yes | No |

| Titanium | Yes | Yes | No |

| Vanadium | Yes | Yes | No |

| Tin | Yes | No | Yes |

| Zirconium | Yes | No | Yes |

| Phosphorus | No | Yes | Yes |

| Cesium | Yes | No | No |

| Chromium | Yes | No | No |

| Indium | Yes | No | No |

| Rubidium | Yes | No | No |

| Samarium | Yes | No | No |

| Tellurium | Yes | No | No |

| Zinc | Yes | No | No |

| Boron | No | Yes | No |

| Coking Coal | No | Yes | No |

| Feldspar | No | Yes | No |

| Gallium | No | Yes | No |

| Helium | No | Yes | No |

| Phosphate Rock | No | Yes | No |

| Scandium | No | Yes | No |

| Silicon | No | Yes | No |

| Strontium | No | Yes | No |

| Gold | No | No | Yes |

| Iron ore | No | No | Yes |

| Molybdenum | No | No | Yes |

| Potash | No | No | Yes |

| Uranium | No | No | Yes |

Despite having most of the same materials found in the U.S. or China’s list, the European list is the only one to include phosphate rock. The region has limited phosphate resources (only produced in Finland) and largely depends on imports of the material essential for manufacturing fertilizers.

Coking coal is also only on the EU list. The material is used in the manufacture of pig iron and steel. Production is currently dominated by China (58%), followed by Australia (17%), Russia (7%), and the U.S. (7%).

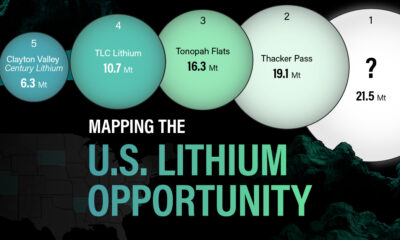

The U.S. has also sought to reduce its reliance on imports. Today, the country is 100% import-dependent on manganese and graphite and 76% on cobalt.

After decades of sourcing materials from other countries, the U.S. local production of raw materials has become extremely limited. For instance, there is only one operating nickel mine (primary) in the country, the Eagle Mine in Michigan. Likewise, the country only hosts one lithium source in Nevada, the Silver Peak Mine.

China’s Dominance

Despite being the world’s biggest carbon polluter, China is the largest producer of most of the world’s critical minerals for the green revolution.

China produces 60% of all rare earth elements used as components in high-technology devices, including smartphones and computers. The country also has a 13% share of the lithium production market. In addition, it refines around 35% of the world’s nickel, 58% of lithium, and 70% of cobalt.

Among some of the unique materials on China’s list is gold. Although gold is used on a smaller scale in technology, China has sought gold for economic and geopolitical factors, mainly to diversify its foreign exchange reserves, which rely heavily on the U.S. dollar.

Analysts estimate China has bought a record 400 tonnes of gold in recent years.

China has also slated uranium as a critical mineral. The Chinese government has stated it intends to become self-sufficient in nuclear power plant capacity and fuel production for those plants.

According to the World Nuclear Association, China aims to produce one-third of its uranium domestically.

-

Electrification3 years ago

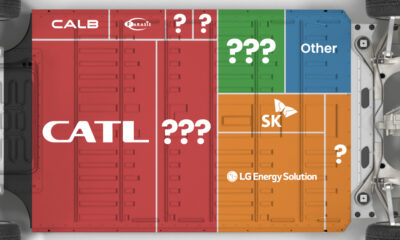

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies