Energy Shift

Visualizing All the Nuclear Waste in the World

Subscribe to the Decarbonization Channel’s free mailing list for more like this.

Visualizing All the Nuclear Waste in the World

Originally posted on the Decarbonization Channel. Subscribe to the free mailing list to be the first to receive decarbonization-related visualizations, with a focus on the U.S. power sector.

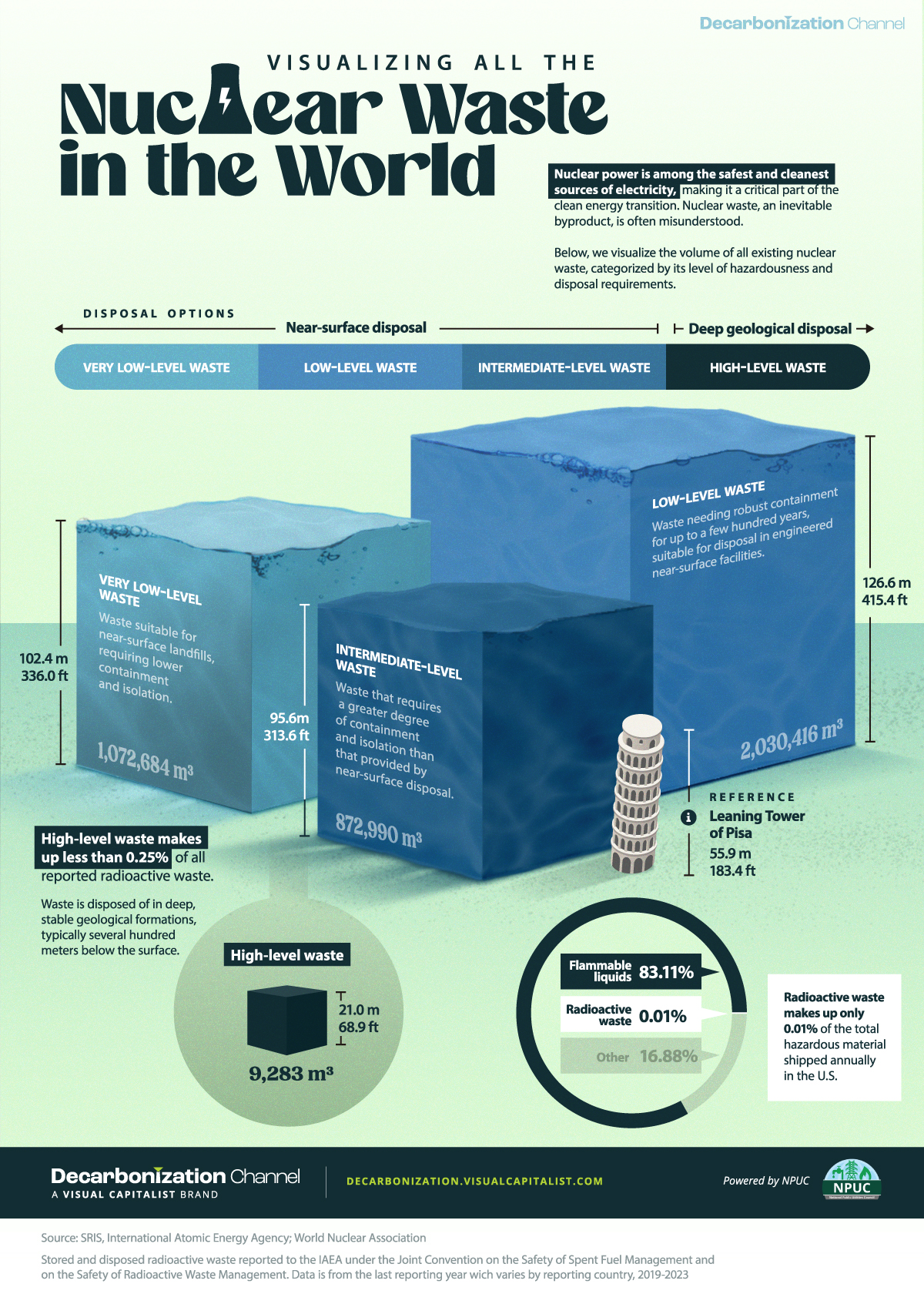

Nuclear power is among the safest and cleanest sources of electricity, making it a critical part of the clean energy transition.

However, nuclear waste, an inevitable byproduct, is often misunderstood.

In collaboration with the National Public Utilities Council, this graphic shows the volume of all existing nuclear waste, categorized by its level of hazardousness and disposal requirements, based on data from the International Atomic Energy Agency (IAEA).

Storage and Disposal

Nuclear provides about 10% of global electricity generation.

Nuclear waste, produced as a result of this, can be divided into four different types:

- Very low-level waste: Waste suitable for near-surface landfills, requiring lower containment and isolation.

- Low-level waste: Waste needing robust containment for up to a few hundred years, suitable for disposal in engineered near-surface facilities.

- Intermediate-level waste: Waste that requires a greater degree of containment and isolation than that provided by near-surface disposal.

- High-level waste: Waste is disposed of in deep, stable geological formations, typically several hundred meters below the surface.

Despite safety concerns, high-level radioactive waste constitutes less than 0.25% of total radioactive waste reported to the IAEA.

| Waste Class | Disposed (cubic meters) | Stored (cubic meters) | Total (cubic meters) |

|---|---|---|---|

| Very low-level waste | 758,802 | 313,882 | 1,072,684 |

| Low-level waste | 1,825,558 | 204,858 | 2,030,416 |

| Intermediate level waste | 671,097 | 201,893 | 872,990 |

| High-level waste | 3,960 | 5,323 | 9,283 |

Stored and disposed radioactive waste reported to the IAEA under the Joint Convention on the Safety of Spent Fuel Management and on the Safety of Radioactive Waste Management. Data is from the last reporting year which varies by reporting country, 2019-2023.

The amount of waste produced by the nuclear power industry is small compared to other industrial activities.

While flammable liquids comprise 82% of the hazardous materials shipped annually in the U.S., radioactive waste accounts for only 0.01%.

Energy Shift

Visualizing Copper Production by Country in 2023

Chile and Peru account for one-third of the world’s copper output.

Visualizing Copper Production by Country in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Copper is considered an essential metal for the clean energy transition because it is a great conductor of electricity.

As a result, governments around the world have been encouraging the construction of new mines, and mining companies have been seeking new projects and acquiring existing mines to meet the growing demand.

In this graphic, we illustrate global copper production in 2023, based on data from the U.S. Geological Survey, Mineral Commodity Summaries, as of January 2024.

Most Copper Comes from South America

Chile and Peru account for one-third of the world’s copper output.

| Country | Region | 2023E Production (Million tonnes) |

|---|---|---|

| 🇨🇱 Chile | South America | 5.0 |

| 🇵🇪 Peru | South America | 2.6 |

| 🇨🇩 Congo (Kinshasa) | Africa | 2.5 |

| 🇨🇳 China | Asia | 1.7 |

| 🇺🇸 United States | North America | 1.1 |

| 🇷🇺 Russia | Europe/Asia | 0.9 |

| 🇦🇺 Australia | Oceania | 0.8 |

| 🇮🇩 Indonesia | Asia | 0.8 |

| 🇿🇲 Zambia | Africa | 0.8 |

| 🇲🇽 Mexico | North America | 0.7 |

| 🇰🇿 Kazakhstan | Asia | 0.6 |

| 🇨🇦 Canada | North America | 0.5 |

| 🇵🇱 Poland | Europe | 0.4 |

| 🌍 Rest of World | -- | 3.1 |

| World total (rounded) | -- | 21.5 |

Chile is also home to the two largest mines in the world, Escondida and Collahuasi.

Meanwhile, African countries have rapidly increased their production. The Democratic Republic of Congo, for example, transitioned from being a secondary copper producer in the late 1990s to becoming the third-largest producer by 2023.

Part of the growth in copper mining in Africa is attributed to high investment from China. Chinese mining companies represent 8% of Africa’s total output in the mining sector.

Within its territory, China has also seen a 277% growth in copper production over the last three decades.

In the U.S., Arizona is the leading copper-producing state, accounting for approximately 70% of domestic output. Copper is also mined in Michigan, Missouri, Montana, Nevada, New Mexico, and Utah.

Energy Shift

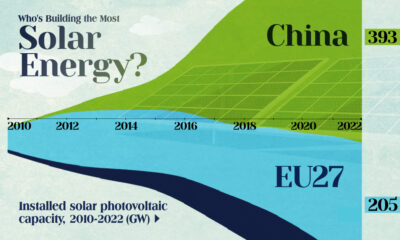

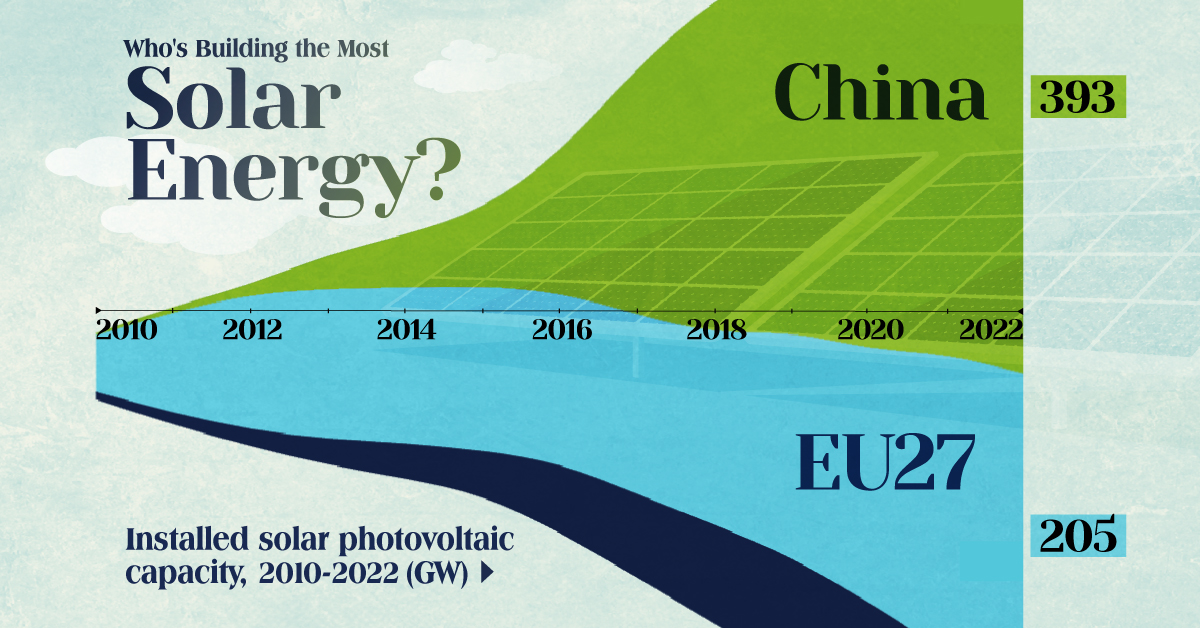

Who’s Building the Most Solar Energy?

China’s solar capacity triples USA, nearly doubles EU.

Who’s Building the Most Solar Energy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2023, solar energy accounted for three-quarters of renewable capacity additions worldwide. Most of this growth occurred in Asia, the EU, and the U.S., continuing a trend observed over the past decade.

In this graphic, we illustrate the rise in installed solar photovoltaic (PV) capacity in China, the EU, and the U.S. between 2010 and 2022, measured in gigawatts (GW). Bruegel compiled the data..

Chinese Dominance

As of 2022, China’s total installed capacity stands at 393 GW, nearly double that of the EU’s 205 GW and surpassing the USA’s total of 113 GW by more than threefold in absolute terms.

| Installed solar capacity (GW) | China | EU27 | U.S. |

|---|---|---|---|

| 2022 | 393.0 | 205.5 | 113.0 |

| 2021 | 307.0 | 162.7 | 95.4 |

| 2020 | 254.0 | 136.9 | 76.4 |

| 2019 | 205.0 | 120.1 | 61.6 |

| 2018 | 175.3 | 104.0 | 52.0 |

| 2017 | 130.8 | 96.2 | 43.8 |

| 2016 | 77.8 | 91.5 | 35.4 |

| 2015 | 43.6 | 87.7 | 24.2 |

| 2014 | 28.4 | 83.6 | 18.1 |

| 2013 | 17.8 | 79.7 | 13.3 |

| 2012 | 6.7 | 71.1 | 8.6 |

| 2011 | 3.1 | 53.3 | 5.6 |

| 2010 | 1.0 | 30.6 | 3.4 |

Since 2017, China has shown a compound annual growth rate (CAGR) of approximately 25% in installed PV capacity, while the USA has seen a CAGR of 21%, and the EU of 16%.

Additionally, China dominates the production of solar power components, currently controlling around 80% of the world’s solar panel supply chain.

In 2022, China’s solar industry employed 2.76 million individuals, with manufacturing roles representing approximately 1.8 million and the remaining 918,000 jobs in construction, installation, and operations and maintenance.

The EU industry employed 648,000 individuals, while the U.S. reached 264,000 jobs.

According to the IEA, China accounts for almost 60% of new renewable capacity expected to become operational globally by 2028.

Despite the phasing out of national subsidies in 2020 and 2021, deployment of solar PV in China is accelerating. The country is expected to reach its national 2030 target for wind and solar PV installations in 2024, six years ahead of schedule.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity