Energy Shift

Visualized: The Growth of Clean Energy Stocks

The following content is sponsored by the EnergyX

The Growth of Clean Energy Stocks

Over the last few years, energy investment trends have shifted from fossil fuels to renewable and sustainable energy sources. Long-term energy investors now see significant returns from clean energy stocks, especially compared to those invested in fossil fuels alone.

For this graphic, Visual Capitalist has collaborated with EnergyX to examine the rise of clean energy stocks and gain a deeper understanding of the factors driving this growth.

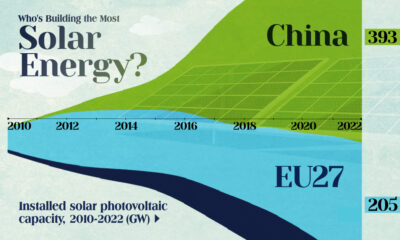

Sustainable Energy Stock Performance

In 2023, the IEA reported that 62% of all energy investment went toward sustainable sources. As the world embraces sustainable energy and technologies like EVs, it’s no surprise that clean energy companies provide solid returns for their investors over long periods.

Taking the top-five clean energy stocks by market cap (as of April 2024) and charting their five-year cumulative returns, it is clear that investments in clean energy are growing:

| Company | Price: 01/04/2019 | Price: 12/29/2024 | 5-Year-Return % |

|---|---|---|---|

| First Solar, Inc. | $46.32 | $172.28 | 272% |

| Enphase Energy, Inc. | $5.08 | $132.14 | 2,501% |

| Consolidated Edison, Inc. | $76.55 | $90.97 | 19% |

| NextEra Energy, Inc. | $43.13 | $60.74 | 41% |

| Brookfield Renewable Partners | $14.78 | $26.28 | 78% |

But how does this compare to the performance of fossil fuel stocks?

When comparing the performance of the S&P Global Oil Index and the S&P Clean Energy Index between 2019 and 2023, we see that the former returned 15%, whereas the latter returned an impressive 41%. This trend demonstrates the potential for clean energy stocks to yield significant returns on an industry level, sparking optimism and excitement for potential investors.

A Shift In Returns

With global investment trends moving away from traditional, non-sustainable sources, the companies that could shape the energy transition provide investors with alternative opportunities and avenues for growth.

One such company is EnergyX. The lithium technology company has patented a groundbreaking technology that can improve lithium extraction rates by an incredible 300%, and its stock price has grown tenfold since its first offering in 2021.

Energy Shift

Visualized: A Decade of Clean Energy Investment

In this graphic, Visual Capitalist has partnered with EnergyX to explore the growth of global clean energy investment.

Visualized: A Decade of Clean Energy Investment

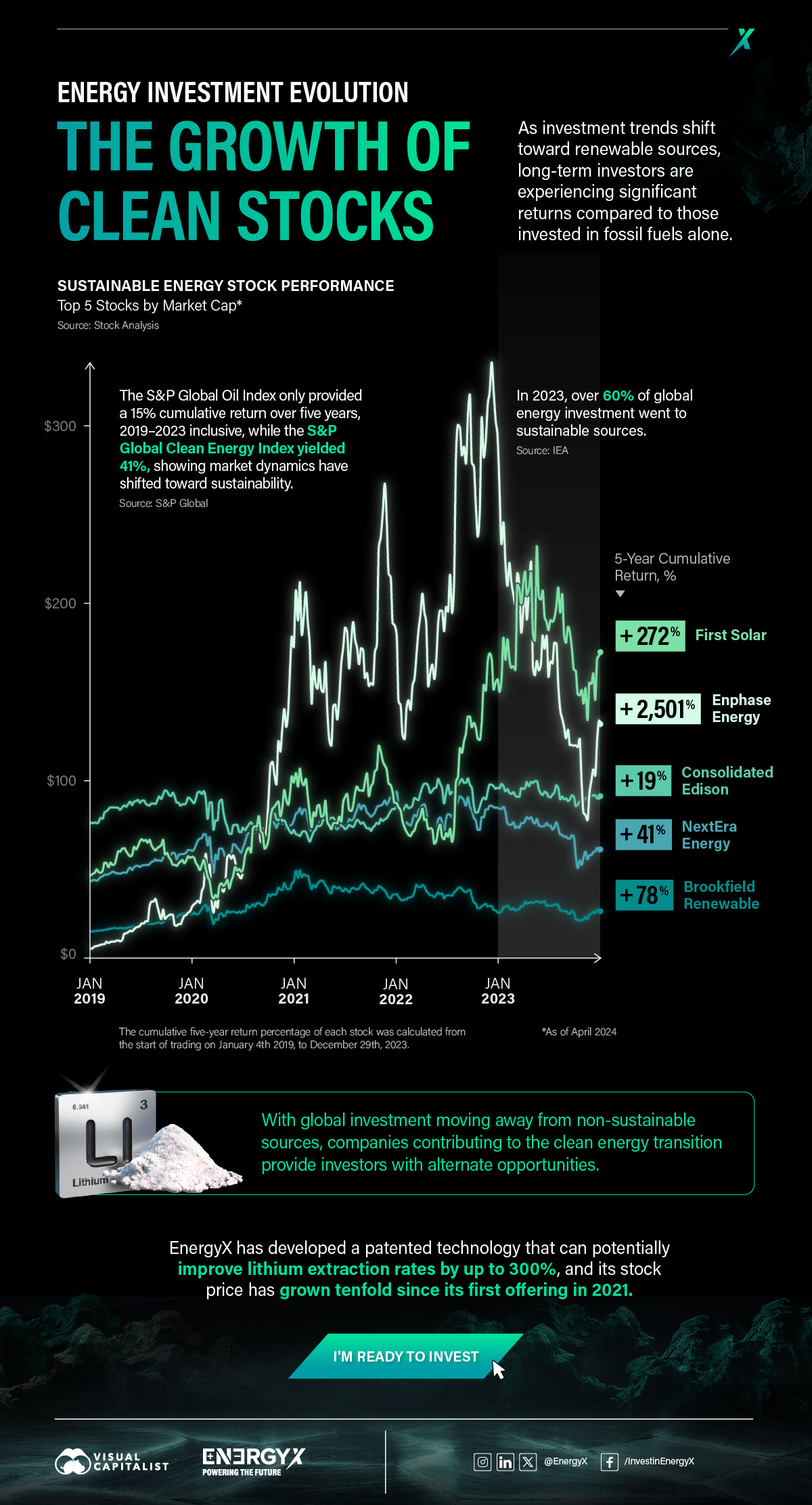

Global energy investment is growing every year. But recently, investments in clean energy have been significantly outpacing investments in fossil fuels.

For this graphic, we partnered with EnergyX to explore how global energy investment has changed and learn how investments in clean energy are starting to pay off for their investors.

The Rise of Sustainable Energy Investment

Propelled by various climate initiatives such as the Paris Agreement and the widespread adoption of EVs, global investment in sustainable energy surged to over $1.7 trillion in 2023, the highest ever, and the IEA projects that this growth could continue:

| Energy Product | 2020 | 2021 | 2022 | 2023 | 2030F |

|---|---|---|---|---|---|

| Clean Electrification | $0.97T | $1.05 | $1.21T | $1.34T | $1.65T |

| Low-Emission Fuels | $0.01T | $0.01 | $0.01T | $0.02T | $0.05T |

| Energy Efficiency | $0.28T | $0.35 | $0.39T | $0.38T | $0.49T |

| Clean Energy Total | $1.26T | $1.41T | $1.61T | $1.74T | $2.19T |

| Natural Gas | $0.26T | $0.27T | $0.31T | $0.32T | $0.35T |

| Oil | $0.42T | $0.48T | $0.52T | $0.55T | $0.60T |

| Coal | $0.16T | $0.16T | $0.18T | $0.18T | $0.11T |

| Fossil Fuel Total | $0.84T | $0.91T | $1.01T | $1.05T | $1.06T |

| Total Energy Investment | $2.10T | $2.32T | $2.62T | $2.79T | $3.25T |

Between 2020 and 2030, global investment in sustainable energy could increase by 74% to nearly $2.2 trillion, compared to just 26% additional investment in fossil fuels, with a forecast total of $1.06 trillion. This shows that sustainability is the future of energy investment.

Sustainable Investor Success Stories

While the growing investments in clean energy show that the world embraces sustainability, energy investors will still look for decent returns. Now, in 2024, clean energy investments are beginning to bear fruit. Here are just a few examples:

- Between 2019 and 2023, Tesla had a cumulative return of 1,073%

- NextEra Energy’s quarterly dividend increased by over 10% as of February 2024

- Investors in EnergyX have 10x’ed their investments since the company’s first offering in 2021

Lithium plays a critical role in powering electric vehicles (EVs) and facilitating the transition to sustainable energy. EnergyX has patented technology that enhances lithium extraction rates by up to 300%, contributing to meeting the growing demand for lithium and fueling the EVs of the future.

Energy Shift

Ranked: The World’s Largest Lithium Producers in 2023

Three countries account for almost 90% of the lithium produced in the world.

The World’s Largest Lithium Producers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Three countries—Australia, Chile, and China—accounted for 88% of lithium production in 2023.

In this graphic, we list the world’s leading countries in terms of lithium production. These figures come from the latest USGS publication on lithium statistics (published Jan 2024).

Australia Leads, China Approaches Chile

Australia, the world’s leading producer, extracts lithium directly from hard-rock mines, specifically the mineral spodumene.

The country saw a big jump in output over the last decade. In 2013, Australia produced 13,000 metric tons of lithium, compared to 86,000 metric tons in 2023.

| Country | Lithium production 2023E (metric tons) |

|---|---|

| 🇦🇺 Australia | 86,000 |

| 🇨🇱 Chile | 44,000 |

| 🇨🇳 China | 33,000 |

| 🇦🇷 Argentina | 9,600 |

| 🇧🇷 Brazil | 4,900 |

| 🇨🇦 Canada | 3,400 |

| 🇿🇼 Zimbabwe | 3,400 |

| 🇵🇹 Portugal | 380 |

| 🌍 World Total | 184,680 |

Chile is second in rank but with more modest growth. Chilean production rose from 13,500 metric tons in 2013 to 44,000 metric tons in 2023. Contrary to Australia, the South American country extracts lithium from brine.

China, which also produces lithium from brine, has been approaching Chile over the years. The country increased its domestic production from 4,000 metric tons in 2013 to 33,000 last year.

Chinese companies have also increased their ownership shares in lithium producers around the globe; three Chinese companies are also among the top lithium mining companies. The biggest, Tianqi Lithium, has a significant stake in Greenbushes, the world’s biggest hard-rock lithium mine in Australia.

Argentina, the fourth country on our list, more than tripled its production over the last decade and has received investments from other countries to increase its output.

With all the top producers increasing output to cover the demand from the clean energy industry, especially for electric vehicle (EV) batteries, the lithium market has seen a surplus recently, which caused prices to collapse by more than 80% from a late-2022 record high.

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Electrification3 years ago

Electrification3 years agoMapped: Solar Power by Country in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification3 years ago

Electrification3 years agoThe World’s Largest Nickel Mining Companies

-

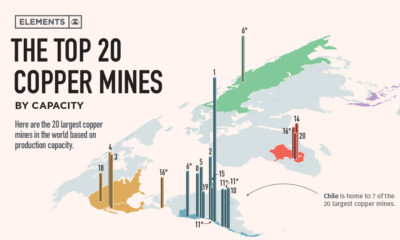

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity

-

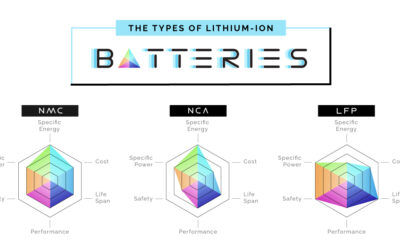

Electrification1 year ago

Electrification1 year agoThe Six Major Types of Lithium-ion Batteries: A Visual Comparison

-

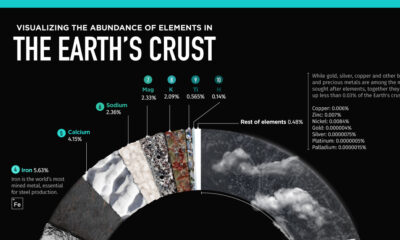

Misc3 years ago

Misc3 years agoVisualizing the Abundance of Elements in the Earth’s Crust