Real Assets

Charted: Commodities vs Equity Valuations (1970–2023)

Charted: Commodities vs Equity Valuations (1970–2023)

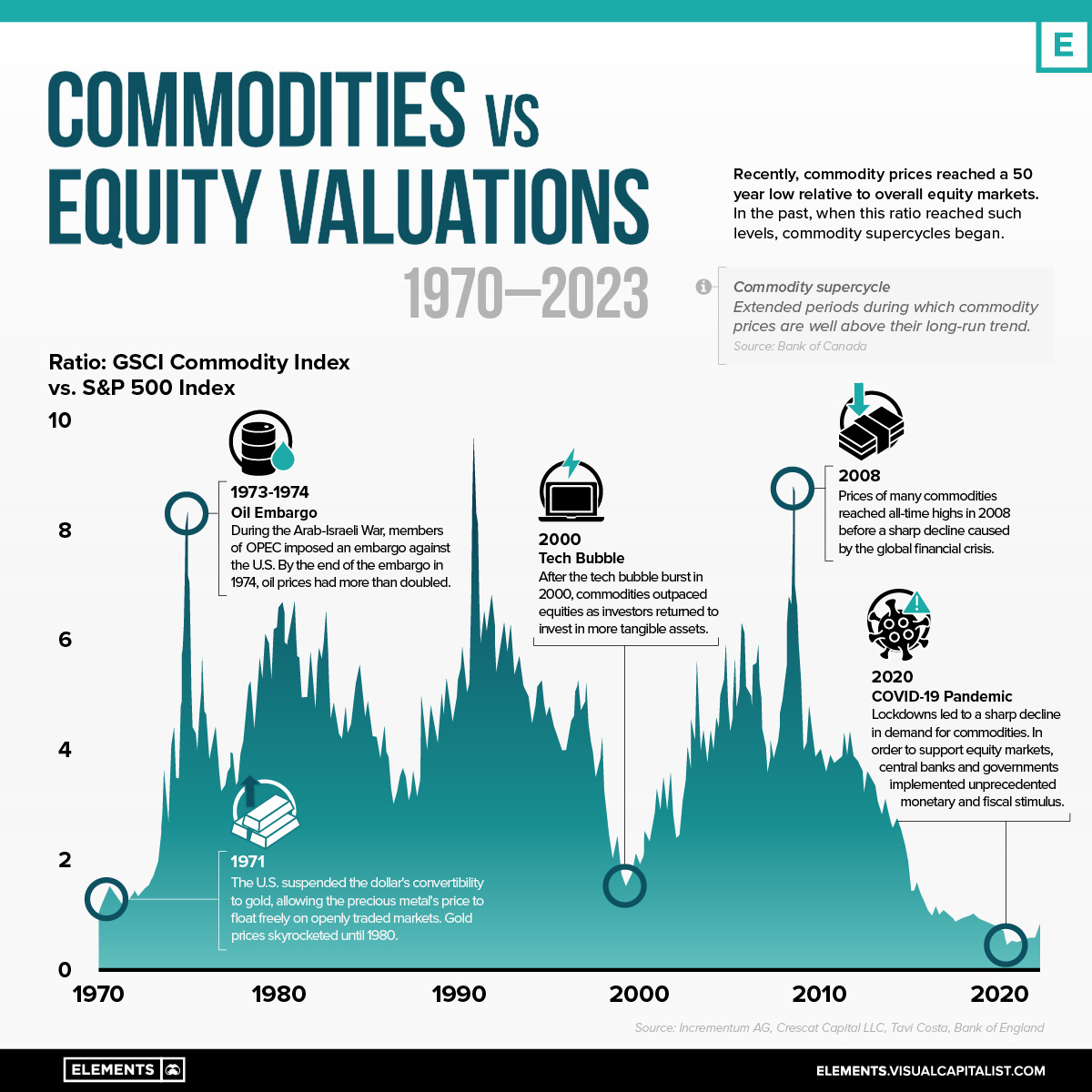

In recent years, commodity prices have reached a 50-year low relative to overall equity markets (S&P 500). Historically, lows in the ratio of commodities to equities have corresponded with the beginning of new commodity supercycles.

The infographic above uses data from Incrementum AG and Crescat Capital LLC to show the relationship between commodities and U.S. equities over the last five decades.

What is a Commodity Supercycle?

A commodity supercycle occurs when prices of commodities rise above their long-term averages for long periods of time, even decades. Once the supply has adequately grown to meet demand, the cycle enters a downswing.

The last commodity supercycle started in 1996 and peaked in 2011, driven by raw material demand from rapid industrialization taking place in Brazil, India, Russia, and China.

| Supercycles in Commodity Prices | 1899-1932 | 1933-1961 | 1962-1995 | 1996-2016 |

|---|---|---|---|---|

| Peak year | 1904 | 1947 | 1978 | 2011 |

| Peak of supercycle from long-term trend (%) | 10.2 | 14.1 | 19.5 | 33.5 |

| Trough of supercycle from long-term trend (%) | -12.9 | -10 | -38.1 | 23.7 |

| Length of cycle from trough-to-trough (years) | 33 | 29 | 34 | 20 |

| Upswing (years) | 5 | 15 | 17 | 16 |

| Downswing (years) | 28 | 14 | 17 | 4 |

Source: Bank of Canada, IHS

While no two supercycles look the same, they all have three indicators in common: a surge in supply, a surge in demand, and a surge in price.

In general, commodity prices and equity valuations tend to have a low to negative correlation, making it rare to see the two moving in tandem in the same direction for any long period of time.

Commodity Prices and Equity Valuations

In line with the above notion, commodity prices and equity valuations have often been at odds with one another in past market cycles.

During the 1970s and early 1980s, for example, rising oil prices led to a significant decline in stock prices as higher energy costs hurt corporate profits. In contrast, during the first half of the 2000s, low oil prices were accompanied by a strong equity bull market that ended with the 2008 stock market crash.

The relationship, however, is not always straightforward and can be affected by various other factors, such as global economic growth, supply and demand, inflation, and other market events.

With the most recent commodity supercycle peaking in 2011, could the next big one be right around the corner?

Real Assets

Visualizing Global Gold Production in 2023

Gold production in 2023 was led by China, Australia, and Russia, with each outputting over 300 tonnes.

Visualizing Global Gold Production in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Over 3,000 tonnes of gold were produced globally in 2023.

In this graphic, we list the world’s leading countries in terms of gold production. These figures come from the latest USGS publication on gold statistics (published January 2024).

China, Australia, and Russia Produced the Most Gold in 2023

China was the top producer in 2023, responsible for over 12% of total global production, followed by Australia and Russia.

| Country | Region | 2023E Production (tonnes) |

|---|---|---|

| 🇨🇳 China | Asia | 370 |

| 🇦🇺 Australia | Oceania | 310 |

| 🇷🇺 Russia | Europe | 310 |

| 🇨🇦 Canada | North America | 200 |

| 🇺🇸 United States | North America | 170 |

| 🇰🇿 Kazakhstan | Asia | 130 |

| 🇲🇽 Mexico | North America | 120 |

| 🇮🇩 Indonesia | Asia | 110 |

| 🇿🇦 South Africa | Africa | 100 |

| 🇺🇿 Uzbekistan | Asia | 100 |

| 🇬🇭 Ghana | Africa | 90 |

| 🇵🇪 Peru | South America | 90 |

| 🇧🇷 Brazil | South America | 60 |

| 🇧🇫 Burkina Faso | Africa | 60 |

| 🇲🇱 Mali | Africa | 60 |

| 🇹🇿 Tanzania | Africa | 60 |

| 🌍 Rest of World | - | 700 |

Gold mines in China are primarily concentrated in eastern provinces such as Shandong, Henan, Fujian, and Liaoning. As of January 2024, China’s gold mine reserves stand at an estimated 3,000 tonnes, representing around 5% of the global total of 59,000 tonnes.

In addition to being the top producer, China emerged as the largest buyer of the yellow metal for the year. In fact, the country’s central bank alone bought 225 tonnes of gold in 2023, according the World Gold Council.

Estimated Global Gold Consumption

Most of the gold produced in 2023 was used in jewelry production, while another significant portion was sold as a store of value, such as in gold bars or coins.

- Jewelry: 46%

- Central Banks and Institutions: 23%

- Physical Bars: 16%

- Official Coins, Medals, and Imitation Coins: 9%

- Electrical and Electronics: 5%

- Other: 1%

According to Fitch Solutions, over the medium term (2023-2032), global gold mine production is expected to grow 15%, as high prices encourage investment and output.

Real Assets

Charted: The Value Gap Between the Gold Price and Gold Miners

While gold prices hit all-time highs, gold mining stocks have lagged far behind.

Gold Price vs. Gold Mining Stocks

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Although the price of gold has reached new record highs in 2024, gold miners are still far from their 2011 peaks.

In this graphic, we illustrate the evolution of gold prices since 2000 compared to the NYSE Arca Gold BUGS Index (HUI), which consists of the largest and most widely held public gold production companies. The data was compiled by Incrementum AG.

Mining Stocks Lag Far Behind

In April 2024, gold reached a new record high as Federal Reserve Chair Jerome Powell signaled policymakers may delay interest rate cuts until clearer signs of declining inflation materialize.

Additionally, with elections occurring in more than 60 countries in 2024 and ongoing conflicts in Ukraine and Gaza, central banks are continuing to buy gold to strengthen their reserves, creating momentum for the metal.

Traditionally known as a hedge against inflation and a safe haven during times of political and economic uncertainty, gold has climbed over 11% so far this year.

According to Business Insider, gold miners experienced their best performance in a year in March 2024. During that month, the gold mining sector outperformed all other U.S. industries, surpassing even the performance of semiconductor stocks.

Still, physical gold has outperformed shares of gold-mining companies over the past three years by one of the largest margins in decades.

| Year | Gold Price | NYSE Arca Gold BUGS Index (HUI) |

|---|---|---|

| 2023 | $2,062.92 | $243.31 |

| 2022 | $1,824.32 | $229.75 |

| 2021 | $1,828.60 | $258.87 |

| 2020 | $1,895.10 | $299.64 |

| 2019 | $1,523.00 | $241.94 |

| 2018 | $1,281.65 | $160.58 |

| 2017 | $1,296.50 | $192.31 |

| 2016 | $1,151.70 | $182.31 |

| 2015 | $1,060.20 | $111.18 |

| 2014 | $1,199.25 | $164.03 |

| 2013 | $1,201.50 | $197.70 |

| 2012 | $1,664.00 | $444.22 |

| 2011 | $1,574.50 | $498.73 |

| 2010 | $1,410.25 | $573.32 |

| 2009 | $1,104.00 | $429.91 |

| 2008 | $865.00 | $302.41 |

| 2007 | $836.50 | $409.37 |

| 2006 | $635.70 | $338.24 |

| 2005 | $513.00 | $276.90 |

| 2004 | $438.00 | $215.33 |

| 2003 | $417.25 | $242.93 |

| 2002 | $342.75 | $145.12 |

| 2001 | $276.50 | $65.20 |

| 2000 | $272.65 | $40.97 |

Among the largest companies on the NYSE Arca Gold BUGS Index, Colorado-based Newmont has experienced a 24% drop in its share price over the past year. Similarly, Canadian Barrick Gold also saw a decline of 6.5% over the past 12 months.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Electrification3 years ago

Electrification3 years agoMapped: Solar Power by Country in 2021

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity