Misc

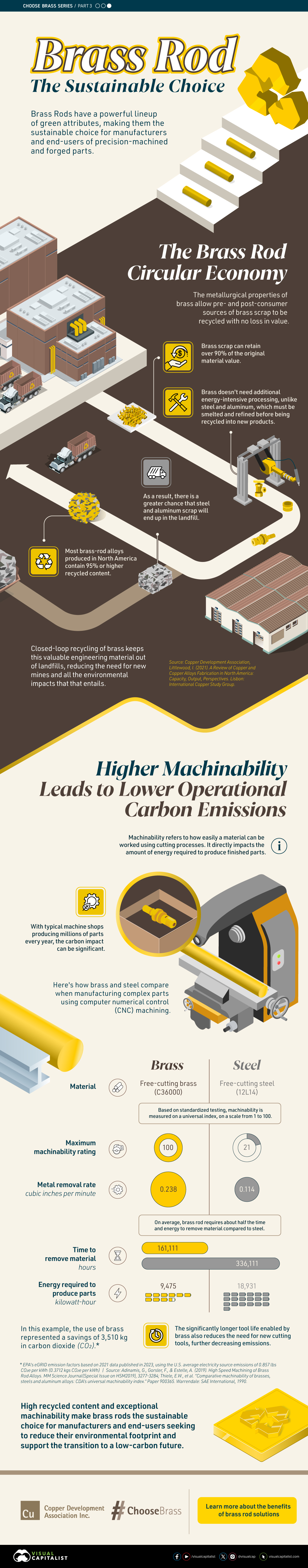

Brass Rods: The Sustainable Choice

The following content is sponsored by the Copper Development Association

Brass Rods: The Sustainable Choice

Brass rods have a powerful lineup of green attributes, making them the sustainable choice for manufacturers and end-users of precision machined and forged parts.

This infographic, from the Copper Development Association, shows how brass rods can reduce emissions in machine shops, be recycled without losing properties, and contribute to a cleaner environment.

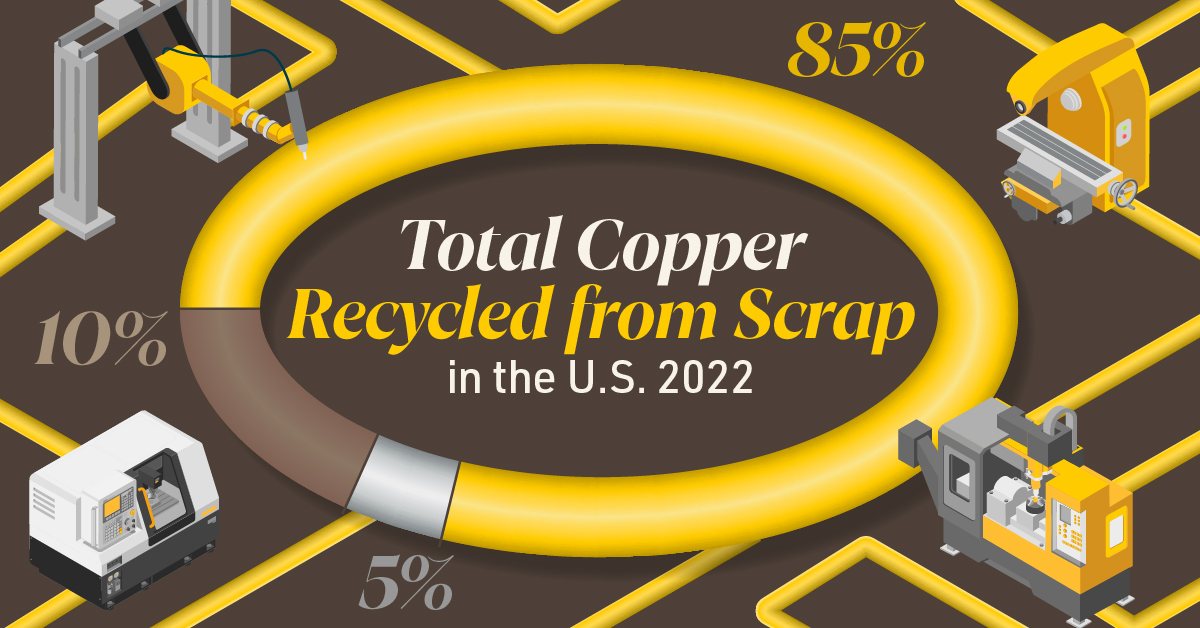

The Brass Rod Circular Economy

The metallurgical properties of brass allow pre- and post-consumer sources of brass scrap to be recycled with no loss in properties.

Brass scrap can retain over 90% of the original material value. In addition, brass doesn’t need energy-intensive processing, unlike steel and aluminum, which must be smelted and refined before being recycled into new products.

As a result, there is a greater chance that steel and aluminum scrap will end up in landfills.

Most brass-rod alloys produced in North America contain 95% or higher recycled content.

Closed-loop recycling of brass keeps this valuable engineering material out of landfills, reducing the need for new mines and all the environmental impacts that entails.

Higher Machinability Leads to Lower Operational Carbon Emissions

Machinability is how easily a material can be worked using cutting processes. It directly impacts the amount of energy required to produce finished parts.

With typical machine shops producing millions of parts each year, the carbon impact can be significant.

Here’s how brass and steel compare when manufacturing complex parts using computer numerical control (CNC) machining.

| Material | Brass | Steel |

|---|---|---|

| Type | Free-cutting brass (C36000) | Free-cutting steel (12L14) |

| Maximum machinability rating (0-100) | 100 | 21 |

| Metal Removal Rate (cubic inches per minute) | 0.238 | 0.114 |

| Time to remove material (hours) | 161,111 | 336,111 |

| Energy required to produce parts (kilowatt-hour) | 9,475 | 18,931 |

In this example, using brass represented a savings of 3,510 kg in carbon dioxide (CO2).

The significantly longer tool life enabled by brass also reduces the need for new cutting tools, further decreasing emissions.

High recycled content and exceptional machinability make brass rods the sustainable choice for manufacturers and end-users seeking to reduce their environmental footprint and support the transition to a low-carbon future.

Explore the advantages of brass rod solutions.

Misc

Visualizing Global Aluminum Production

China dominates global production with nearly 60% share.

Visualizing Global Aluminum Production

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows estimated aluminum smelter production by country in 2023, based on data from the most recent U.S. Geological Survey (USGS) Mineral Commodity Summaries, published in January 2024 .

From this data, we can see that China leads as the top producer, accounting for nearly 60% of the world’s smelter capacity. Its neighbor India is the second-largest producer, making only a tenth of China’s output.

| Country | 2023 Aluminum Smelter Production (tonnes) | % of total |

|---|---|---|

| 🇨🇳 China | 41,000,000 | 59% |

| 🇮🇳 India | 4,100,000 | 6% |

| 🇷🇺 Russia | 3,800,000 | 5% |

| 🇨🇦 Canada | 3,000,000 | 4% |

| 🇦🇪 United Arab Emirates | 2,700,000 | 4% |

| 🇧🇭 Bahrain | 1,600,000 | 2% |

| 🇦🇺 Australia | 1,500,000 | 2% |

| 🇳🇴 Norway | 1,300,000 | 2% |

| 🇧🇷 Brazil | 1,100,000 | 2% |

| 🌍 Rest of the World | 9,460,000 | 14% |

| Total | 69,560,000 | 100% |

Responsible for 5% of global aluminum output, Russia has been targeted by recent sanctions from the U.S. and the UK.

The sanctions include prohibiting metal-trading exchanges from accepting new aluminum produced by Russia and barring the import of the Russian metal into the U.S. and Britain. The actions are aimed at disrupting Russian export revenue amid Moscow’s ongoing invasion of Ukraine.

The World’s Most Common Metal

Aluminum is the primary material used for making cans, foil, and many other products. It originates from bauxites, rocks composed of aluminum oxides, and various minerals.

Approximately 25% of annually produced aluminum is utilized by the construction industry, while another 23% is allocated to vehicle frames, wires, wheels, and other components within the transportation sector. Aluminum foil, cans, and packaging constitute another significant end-use category, accounting for 17% of consumption.

Despite its extensive use, aluminum is still plentiful. Aluminum is the world’s most common metal by crustal abundance, making up 8.2% of the Earth’s crust.

According to the USGS, global resources of bauxite are estimated to be between 55 billion and 75 billion tonnes and are sufficient to meet world demand for metal well into the future.

Misc

Brass Rods: The Secure Choice

This graphic shows why brass rods are the secure choice for precision-machined and forged parts.

Brass Rods: The Secure Choice

The unique combination of machinability and recyclability makes brass rods the secure choice for manufacturers seeking future-proof raw material solutions.

This infographic, from the Copper Development Association, shows three ways brass rods give manufacturers greater control and a license to grow in the competitive market for precision-machined and forged products.

Future-Proof Investments in New Machine Tools

A material’s machinability directly impacts machine throughput, which typically has the largest impact on machine shop profitability.

The high-speed machining capabilities of brass rods maximize machine tool performance, allowing manufacturers to run the material faster and longer without sacrificing tool life, chip formation, or surface quality.

The high machining efficiency of brass leads to reduced per-part costs, quicker return on investment (ROI) for new machine tools, and expanded production capacity for new projects.

Supply Security Through Closed Loop Recycling

Brass, like its parent element copper, can be infinitely recycled.

In 2022, brass- and wire-rod mills accounted for the majority of the 830,000 tonnes of copper recycled from scrap in the U.S.

Given that scrap ratios for machined parts typically range from 60-70% by weight, producing mills benefit from a secure and steady supply of clean scrap returned directly from customers, which is recycled to create new brass rods.

The high residual value of brass scrap creates a strong recycling incentive. Scrap buy back programs give manufacturers greater control over raw material net costs as scrap value is often factored into supplier purchase agreements.

Next Generation Alloys for a Lead-Free Future

Increasingly stringent global regulations continue to pressure manufacturers to minimize the use of materials containing trace amounts of lead and other harmful impurities.

The latest generation of brass-rod alloys is engineered to meet the most demanding criteria for lead leaching in drinking water and other sensitive applications.

Seven brass-rod alloys passed rigorous testing to become the only ‘Acceptable Materials’ against lower lead leaching criteria recently adopted in the national U.S. drinking water quality standard, NSF 61.

Learn more about the advantages of brass rods solutions.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Electrification3 years ago

Electrification3 years agoMapped: Solar Power by Country in 2021

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity