Urbanization

Visualizing the Material Impact of Global Urbanization

Visualizing the Material Impact of Global Urbanization

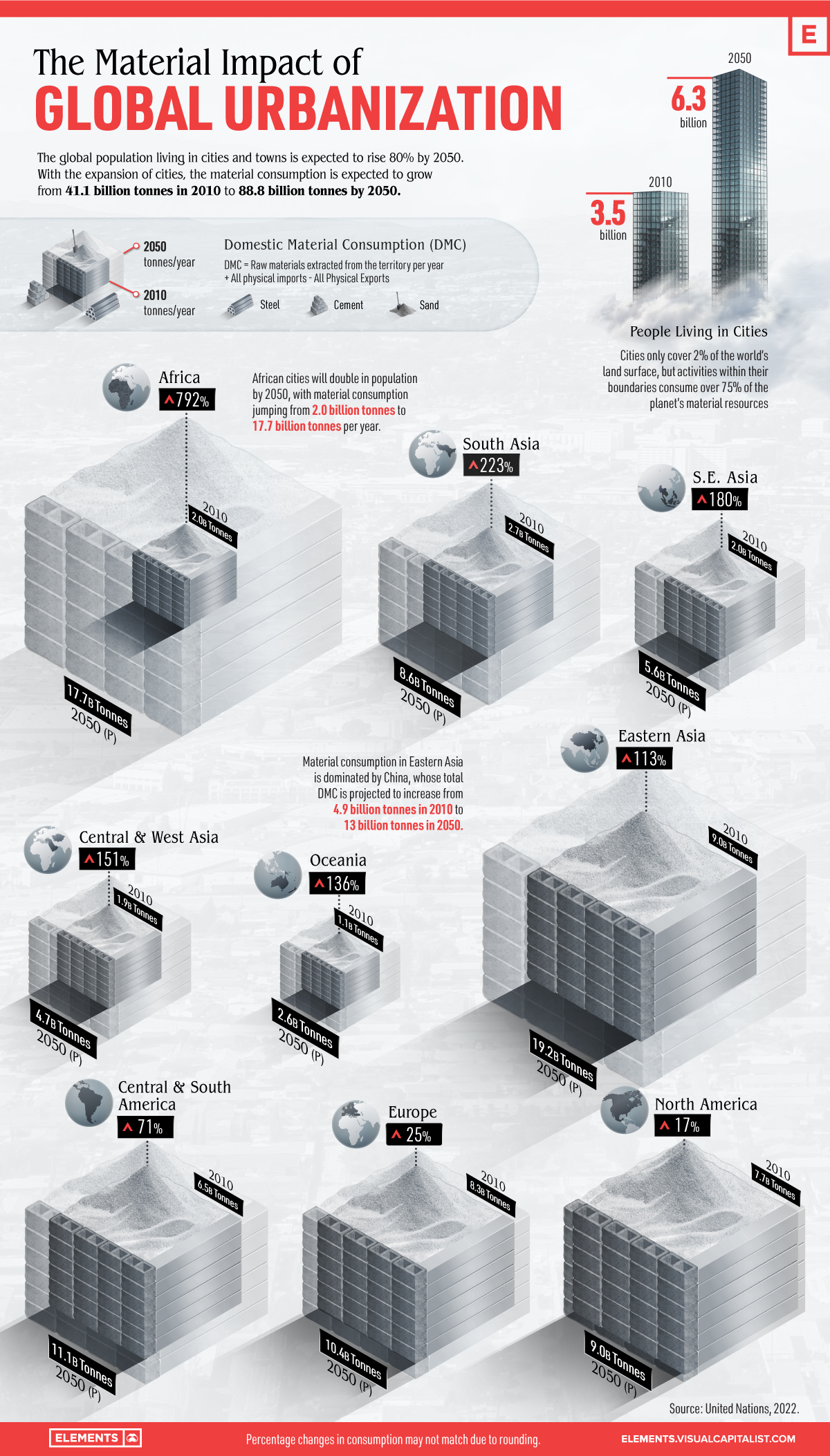

Cities only cover 2% of the world’s land surface, but activities within their boundaries consume over 75% of the planet’s material resources.

With the expansion of urban areas, the world’s material consumption is expected to grow from 41.1 billion tonnes in 2010 to about 89 billion tonnes by 2050.

In today’s graphic, we use data from the UN International Resource Panel to visualize the material impact of global urbanization.

How Material Consumption is Calculated

Today, more than 4.3 billion people or 55% of the world’s population live in urban settings, and the number is expected to rise to 80% by 2050.

Every year, the world produces an immense amount of materials in order to supply the continuous construction of human-built environments.

To calculate how much we use to build our cities, the UN uses the Domestic Material Consumption (DMC), a measure of all raw materials extracted from the domestic territory per year, plus all physical imports, minus all physical exports.

Generally, the material consumption is highly uneven across the different world regions. In terms of material footprint, the world’s wealthiest countries consume 10 times as much as the poorest and twice the global average.

Based on the total urban DMC, Eastern Asia leads the world in material consumption, with China consuming more than half of the world’s aluminum and concrete.

| Major Global Regions | 2010 Material Consumption (billion tonnes) | 2050P Material Consumption (billion tonnes) | % total urban DMC change (2010-2050P) |

|---|---|---|---|

| Africa | 2.0 | 17.7 | 792% |

| Southern Asia | 2.7 | 8.6 | 223% |

| South-Eastern Asia | 2.0 | 5.6 | 180% |

| Central and Western Asia | 1.9 | 4.7 | 151% |

| Oceania | 1.1 | 2.6 | 136% |

| Eastern Asia | 9.0 | 19.2 | 113% |

| South and Central America | 6.5 | 11.1 | 71% |

| Europe | 8.3 | 10.4 | 25% |

| North America | 7.7 | 9.0 | 17% |

| World | 41.1 | 88.8 | 116% |

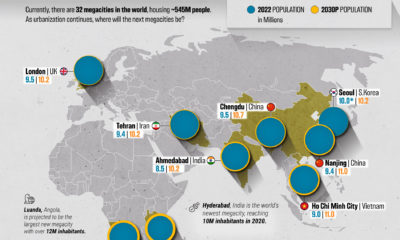

According to the UN, the bulk of urban growth will happen in the cities of the Global South, particularly in China, India, and Nigeria.

Consumption in Asia is set to increase as the continent hosts the majority of the world’s megacities—cities housing more than 10 million people.

However, the biggest jump in the next decades will happen in Africa. The continent is expected to double in population by 2050, with material consumption jumping from 2 billion tonnes to 17.7 billion tonnes per year.

A Resource-Efficient Future

Global urban DMC is already at a rate of 8–17 tonnes per capita per year.

With the world population expected to swell by almost two and a half billion people by 2050, new and existing cities must accommodate many of them.

This could exacerbate existing problems like pollution and carbon emissions, but it could equally be an opportunity to develop the low-carbon and resource-efficient cities of the future.

Urbanization

Ranked: The 20 Most Air-Polluted Cities on Earth

Using 2022 average PM2.5 concentrations, we rank the most polluted cities in the world.

Ranked: The 20 Most Air-Polluted Cities on Earth

According to the World Health Organization (WHO), almost the entire global population (99%) breathes air that exceeds WHO air quality limits.

In the above map, we use 2022 average PM2.5 concentrations from IQAir’s World Air Quality Report to visualize the most air-polluted major cities in the world.

World’s Air Pollution Hot Spots

As one of the standard air quality indicators used by the WHO, the PM2.5 concentration refers to the quantity of fine particulate matter with a diameter of 2.5 micrometers or less in a given volume of air.

Fine particulate matter that is this small can penetrate the lungs when inhaled and enter the bloodstream, affecting all major organs.

Based on annual average PM2.5 concentrations (μg/m³) in 2022, here are the most polluted cities in the world.

| Rank | City | 2022 average PM2.5 concentration (μg/m³) |

|---|---|---|

| 1 | 🇵🇰 Lahore, Pakistan | 97.4 |

| 2 | 🇨🇳 Hotan, China | 94.3 |

| 3 | 🇮🇳 Bhiwadi, India | 92.7 |

| 4 | 🇮🇳 Delhi, India | 92.6 |

| 5 | 🇵🇰 Peshawar, Pakistan | 91.8 |

| 6 | 🇮🇳 Darbhanga, India | 90.3 |

| 7 | 🇮🇳 Asopur, India | 90.2 |

| 8 | 🇹🇩 N'Djamena, Chad | 89.7 |

| 9 | 🇮🇳 New Delhi, India | 89.1 |

| 10 | 🇮🇳 Patna, India | 88.9 |

| 11 | 🇮🇳 Ghaziabad, India | 88.6 |

| 12 | 🇮🇳 Dharuhera, India | 87.8 |

| 13 | 🇮🇶 Baghdad, Iraq | 86.7 |

| 14 | 🇮🇳 Chapra, India | 85.9 |

| 15 | 🇮🇳 Muzaffarnagar, India | 85.5 |

| 16 | 🇵🇰 Faisalabad, Pakistan | 84.5 |

| 17 | 🇮🇳 Greater Noida, India | 83.2 |

| 18 | 🇮🇳 Bahadurgarh, India | 82.2 |

| 19 | 🇮🇳 Faridabad, India | 79.7 |

| 20 | 🇮🇳 Muzaffarpur, India | 79.2 |

With numbers these high, the concentration of some or all of the following pollutants are at dangerous levels in these cities:

- Ground-level ozone

- Particulate matter

- Carbon monoxide

- Sulfur dioxide

- Nitrogen dioxide

At the top of the list, Lahore in Pakistan has a combination of high vehicle and industrial emissions, as well as smoke from brick kilns, crop residue, general waste burning, and dust from construction sites.

Air pollution levels can also be impacted by practices such as large-scale tree removal in order to build new roads and buildings.

As a result of its growing population and rapidly expanding industrial sector, India has 14 cities on the list, outpacing China, formerly considered the world’s number one air pollution source.

The only African country on the list, Chad, experienced severe dust storms in 2022 that resulted in an 18% increase in PM2.5 concentration in 2022 compared to the previous year.

The Cost of Poor Air Quality

Poor air quality is one of the leading causes of early deaths worldwide, just behind high blood pressure, tobacco use, and poor diet.

According to a 2020 study by the Health Effects Institute, 6.67 million people died as a result of air pollution in 2019.

In addition to the millions of premature deaths each year, the global cost of health damages associated with air pollution currently sits at $8.1 trillion.

Urbanization

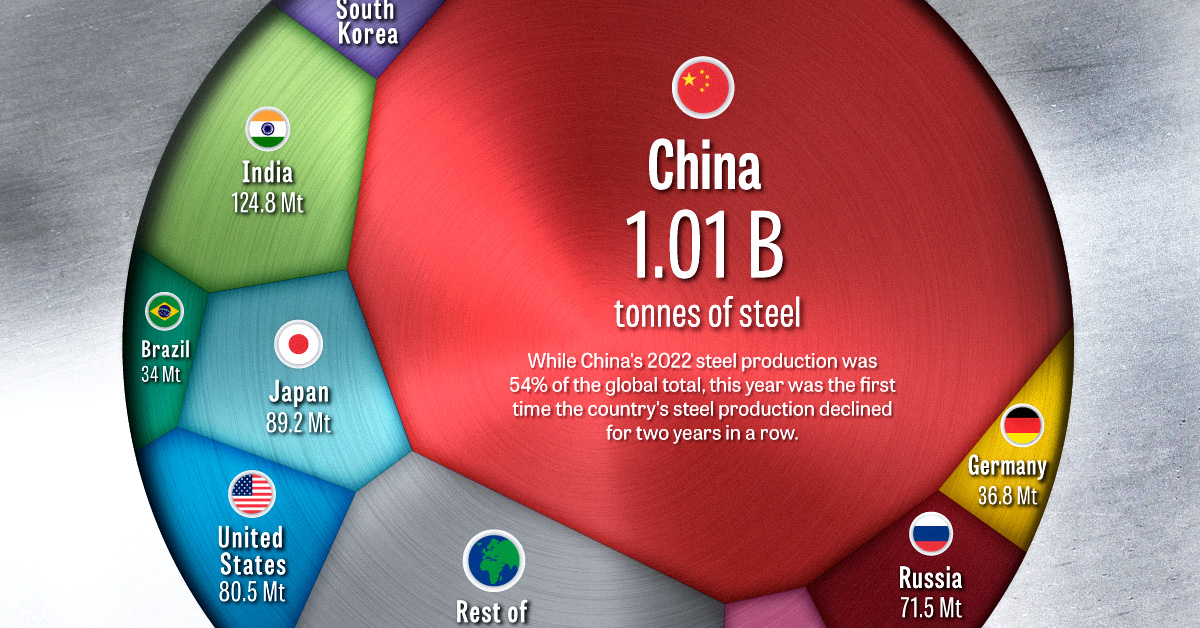

Visualizing the World’s Largest Steel-Producing Countries

China has dominated global steel production the past few decades, but how did the country get here, and is its production growth over?

The Largest Steel-Producing Countries: Visualized

Steel is a critical component of modern industry and economy, essential for the construction of buildings, automobiles, and many other appliances and infrastructure used in our daily lives.

This graphic uses data from the World Steel Association to visualize the world’s top steel-producing countries, and highlights China’s ascent to the top, as it now makes up more than half of the world’s steel production.

The State of Global Steel Production

Global steel production in 2022 reached 1,878 million tonnes, barely surpassing the pre-pandemic production of 1,875 million tonnes in 2019.

| Country | 2022 Production (in million tonnes) | Annual Production Change | Global Share |

|---|---|---|---|

| 🇨🇳 China | 1013.0 | -2.0% | 53.9% |

| 🇮🇳 India | 124.8 | 5.3% | 6.6% |

| 🇯🇵 Japan | 89.2 | -7.9% | 4.8% |

| 🇺🇸 United States | 80.5 | -6.5% | 4.3% |

| 🇷🇺 Russia | 71.5 | -5.8% | 3.8% |

| 🇰🇷 South Korea | 65.9 | -6.9% | 3.5% |

| 🇩🇪 Germany | 36.8 | -8.8% | 2.0% |

| 🇹🇷 Türkiye | 35.1 | -15.0% | 1.9% |

| 🇧🇷 Brazil | 34.0 | -6.5% | 1.8% |

| 🇮🇷 Iran | 30.6 | 6.8% | 1.6% |

| 🇮🇹 Italy | 21.6 | -13.0% | 1.1% |

| 🇹🇼 Taiwan | 20.7 | -12.1% | 1.1% |

| 🇻🇳 Vietnam | 20.0 | -15.0% | 1.1% |

| 🇲🇽 Mexico | 18.2 | -1.9% | 1.0% |

| 🇮🇩 Indonesia | 15.6 | 8.3% | 0.8% |

| Rest of World | 201.0 | -11.2% | 10.7% |

| World Total | 1878.5 | -3.9% | 100.0% |

2022’s steel production marked a significant reduction compared to the post-pandemic rebound of 1,960 million tonnes in 2021, with a year-over-year decline of 4.2%–the largest drop since 2009, and prior to that, 1991.

This decline was spread across many of the world’s top steel producers, with only three of the top fifteen countries, India, Iran, and Indonesia, increasing their yearly production. Most of the other top steel-producing countries saw annual production declines of more than 5%, with Turkey, Italy, Taiwan, and Vietnam’s production all declining by double digits.

Even the world’s top steel-producing nation, China, experienced a modest 2% decline, which due to the country’s large production amounted to a decline of 19.8 million tonnes, more than many other nations produce in a year.

Despite India, the world’s second-largest steel producer, increasing its production by 5.3%, the country’s output still amounts to just over one-tenth of the steel produced by China.

China’s Meteoric Rise in Steel Production

Although China dominates the world’s steel production with more than a 54% share today, this hasn’t always been the case.

In 1967, the World Steel Association’s first recorded year of steel production figures, China only produced an estimated 14 million tonnes, making up barely 3% of global output. At that time, the U.S. and the USSR were competing as the world’s top steel producers at 115 and 102 million tonnes respectively, followed by Japan at 62 million tonnes.

Almost three decades later in 1996, China had successively overtaken Russia, the U.S., and Japan to become the top steel-producing nation with 101 million tonnes of steel produced that year.

The early 2000s marked a period of rapid growth for China, with consistent double-digit percentage increases in steel production each year.

The Recent Decline in China’s Steel Production

Since the early 2000s, China’s average annual growth in steel production has slowed to 3.4% over the last decade (2013-2022), a considerable decline compared to the previous decade’s (2003-2012) 15.2% average annual growth rate.

The past couple of years have seen China’s steel production decline, with 2021 and 2022 marking the first time the country’s production fell for two consecutive years in a row.

While it’s unlikely China will relinquish its position as the top steel-producing nation anytime soon, it remains to be seen whether this recent decline marks the beginning of a new trend or just a brief deviation from the country’s consistent production growth.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021