Energy Shift

The ESG Challenges for Transition Metals

The following content is sponsored by Wood Mackenzie

The ESG Challenges for Transition Metals

An accelerated energy transition is needed to respond to climate change.

According to the Paris Agreement, 196 countries have already committed to limiting global warming to below 2°C, preferably 1.5°C. However, changing the energy system after over a century of burning fossil fuels comes with challenges.

In the above graphic from our sponsor Wood Mackenzie, we discuss the challenges that come with the increasing demand for transition metals.

Building Blocks of a Decarbonized World

Mined commodities like lithium, cobalt, graphite and rare earths are critical to producing electric vehicles (EVs), wind turbines, and other technologies necessary to burn fewer fossil fuels and reduce overall carbon emissions.

EVs, for example, can have up to six times more minerals than a combustion vehicle.

As a result, the extraction and refining of these metals will need to be expedited to limit the rise of global temperatures.

Here’s the outlook for different metals under Wood Mackenzie’s Accelerated Energy Transition (AET) scenario, in which the world is on course to limit the rise in global temperatures since pre-industrial times to 1.5°C by the end of this century.

| Metal | Demand Outlook (%) 2025 | 2030 | 2035 | 2040 |

|---|---|---|---|---|

| Lithium | +260% | +520% | +780% | +940% |

| Cobalt | +170% | +210% | +240% | +270% |

| Graphite | +320% | +660% | +940% | +1100% |

| Neodymium | +170% | +210% | +240% | +260% |

| Dysprosium | +120% | +160% | +180% | +200% |

Graphite demand is expected to soar 1,100% by 2040, as demand for lithium is expected to jump 940% over this time.

A Challenge to Satisfy the Demand for Lithium

Lithium-ion batteries are indispensable for transport electrification and are also commonly used in cell phones, laptop computers, cordless power tools, and other devices.

Lithium demand in an AET scenario is estimated to reach 6.7 million tons by 2050, nine times more than 2022 levels.

In the same scenario, EV sales will double by 2030, making the demand for Li-ion batteries quadruple by 2050.

The ESG Challenge with Cobalt

Another metal in high demand is cobalt, used in rechargeable batteries in smartphones and laptops and also in lithium-ion batteries for vehicles.

Increasing production comes with significant environmental and social risks, as cobalt reserves and mine production are concentrated in regions and countries with substantial ESG problems.

Currently, 70% of mined cobalt comes from the Democratic Republic of Congo, where nearly three-quarters of the population lives in extreme poverty.

| Country | 2021 Production (Tonnes) |

|---|---|

| 🇨🇩 Democratic Republic of the Congo | 120,000 |

| 🇦🇺 Australia | 5,600 |

| 🇵🇭 Philippines | 4,500 |

| 🇨🇦 Canada | 4,300 |

| 🇵🇬 Papua New Guinea | 3,000 |

| 🇲🇬 Madagascar | 2,500 |

| 🇲🇦 Morocco | 2,300 |

| 🇨🇳 China | 2,200 |

| 🇨🇺 Cuba | 2,200 |

| 🇷🇺 Russia | 2,200 |

| 🇮🇩 Indonesia | 2,100 |

| 🇺🇸 U.S. | 700 |

Around one-fifth of cobalt mined in the DRC comes from small-scale artisanal mines, many of which rely on child labor.

Considering other obstacles like rising costs due to reserve depletion and surging resource nationalism, a shortfall in the cobalt market can emerge as early as 2024, according to Wood Mackenzie. Battery recycling, if fully utilised, can ease the upcoming supply shortage, but it cannot fill the entire gap.

Rare Earths: Winners and Losers

Rare earths are used in EVs and wind turbines but also in petroleum refining and gas vehicles. Therefore, an accelerated energy transition presents a mixed bag.

Using permanent magnets in applications like electric motors, sensors, and magnetic recording and storage media is expected to boost demand for materials like neodymium (Nd) and praseodymium (Pr) oxide.

On the contrary, as the world shifts from gas vehicles to EVs, declining demand from catalytic converters in fossil fuel-powered vehicles will impact lanthanum (La) and cerium (Ce).

Taking all into consideration, the demand for rare earths in an accelerated energy transition is forecasted to increase by 233% between 2020 and 2050. In this scenario, existing producers would be impacted by a short- to medium-term supply deficit.

The ESG dilemma

There is a clear dilemma for energy transition metals in an era of unprecedented demand. Can vital energy transition metals markets ramp up production fast enough to satisfy demand, while also revolutionising supply chains to meet ever-more stringent ESG requirements?

Understanding the challenges and how to capitalise on this investment opportunity has become more important than ever.

Sign up to Wood Mackenzie’s Inside Track to learn more about the impact of an accelerated energy transition on mining and metals.

Energy Shift

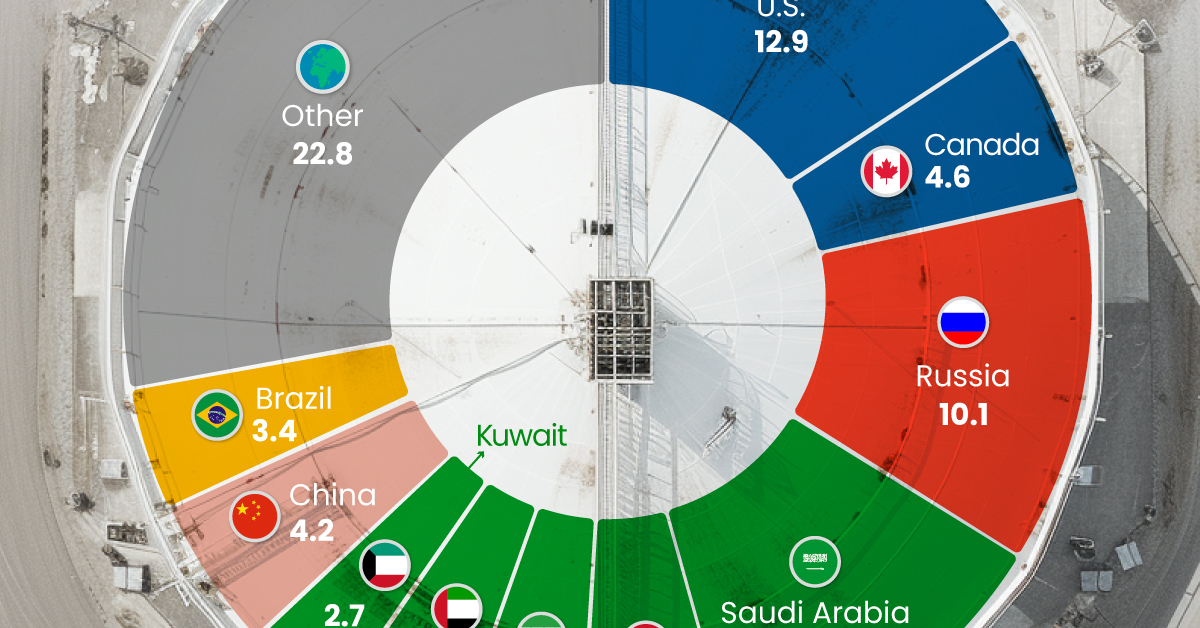

The World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

The World’s Biggest Oil Producers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts to decarbonize the global economy, oil still remains one of the world’s most important resources. It’s also produced by a fairly limited group of countries, which can be a source of economic and political leverage.

This graphic illustrates global crude oil production in 2023, measured in million barrels per day, sourced from the U.S. Energy Information Administration (EIA).

Three Countries Account for 40% of Global Oil Production

In 2023, the United States, Russia, and Saudi Arabia collectively contributed 32.7 million barrels per day to global oil production.

| Oil Production 2023 | Million barrels per day |

|---|---|

| 🇺🇸 U.S. | 12.9 |

| 🇷🇺 Russia | 10.1 |

| 🇸🇦 Saudi Arabia | 9.7 |

| 🇨🇦 Canada | 4.6 |

| 🇮🇶 Iraq | 4.3 |

| 🇨🇳 China | 4.2 |

| 🇮🇷 Iran | 3.6 |

| 🇧🇷 Brazil | 3.4 |

| 🇦🇪 UAE | 3.4 |

| 🇰🇼 Kuwait | 2.7 |

| 🌍 Other | 22.8 |

These three nations have consistently dominated oil production since 1971. The leading position, however, has alternated among them over the past five decades.

In contrast, the combined production of the next three largest producers—Canada, Iraq, and China—reached 13.1 million barrels per day in 2023, just surpassing the production of the United States alone.

In the near term, no country is likely to surpass the record production achieved by the U.S. in 2023, as no other producer has ever reached a daily capacity of 13.0 million barrels. Recently, Saudi Arabia’s state-owned Saudi Aramco scrapped plans to increase production capacity to 13.0 million barrels per day by 2027.

In 2024, analysts forecast that the U.S. will maintain its position as the top oil producer. In fact, according to Macquarie Group, U.S. oil production is expected to achieve a record pace of about 14 million barrels per day by the end of the year.

Energy Shift

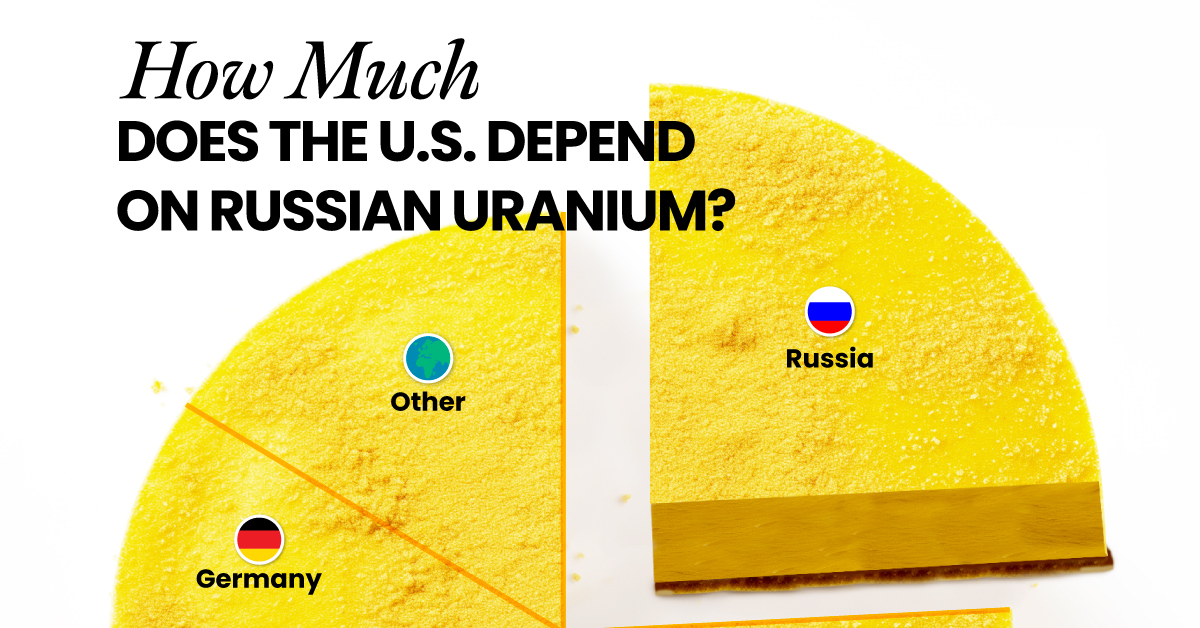

How Much Does the U.S. Depend on Russian Uranium?

Despite a new uranium ban being discussed in Congress, the U.S. is still heavily dependent on Russian uranium.

How Much Does the U.S. Depend on Russian Uranium?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The U.S. House of Representatives recently passed a ban on imports of Russian uranium. The bill must pass the Senate before becoming law.

In this graphic, we visualize how much the U.S. relies on Russian uranium, based on data from the United States Energy Information Administration (EIA).

U.S. Suppliers of Enriched Uranium

After Russia invaded Ukraine, the U.S. imposed sanctions on Russian-produced oil and gas—yet Russian-enriched uranium is still being imported.

Currently, Russia is the largest foreign supplier of nuclear power fuel to the United States. In 2022, Russia supplied almost a quarter of the enriched uranium used to fuel America’s fleet of more than 90 commercial reactors.

| Country of enrichment service | SWU* | % |

|---|---|---|

| 🇺🇸 United States | 3,876 | 27.34% |

| 🇷🇺 Russia | 3,409 | 24.04% |

| 🇩🇪 Germany | 1,763 | 12.40% |

| 🇬🇧 United Kingdom | 1,593 | 11.23% |

| 🇳🇱 Netherlands | 1,303 | 9.20% |

| Other | 2,232 | 15.79% |

| Total | 14,176 | 100% |

SWU stands for “Separative Work Unit” in the uranium industry. It is a measure of the amount of work required to separate isotopes of uranium during the enrichment process. Source: U.S. Energy Information Administration

Most of the remaining uranium is imported from European countries, while another portion is produced by a British-Dutch-German consortium operating in the United States called Urenco.

Similarly, nearly a dozen countries around the world depend on Russia for more than half of their enriched uranium—and many of them are NATO-allied members and allies of Ukraine.

In 2023 alone, the U.S. nuclear industry paid over $800 million to Russia’s state-owned nuclear energy corporation, Rosatom, and its fuel subsidiaries.

It is important to note that 19% of electricity in the U.S. is powered by nuclear plants.

The dependency on Russian fuels dates back to the 1990s when the United States turned away from its own enrichment capabilities in favor of using down-blended stocks of Soviet-era weapons-grade uranium.

As part of the new uranium-ban bill, the Biden administration plans to allocate $2.2 billion for the expansion of uranium enrichment facilities in the United States.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021