Urbanization

Shrinking Portions: Visualizing Rising Food Prices

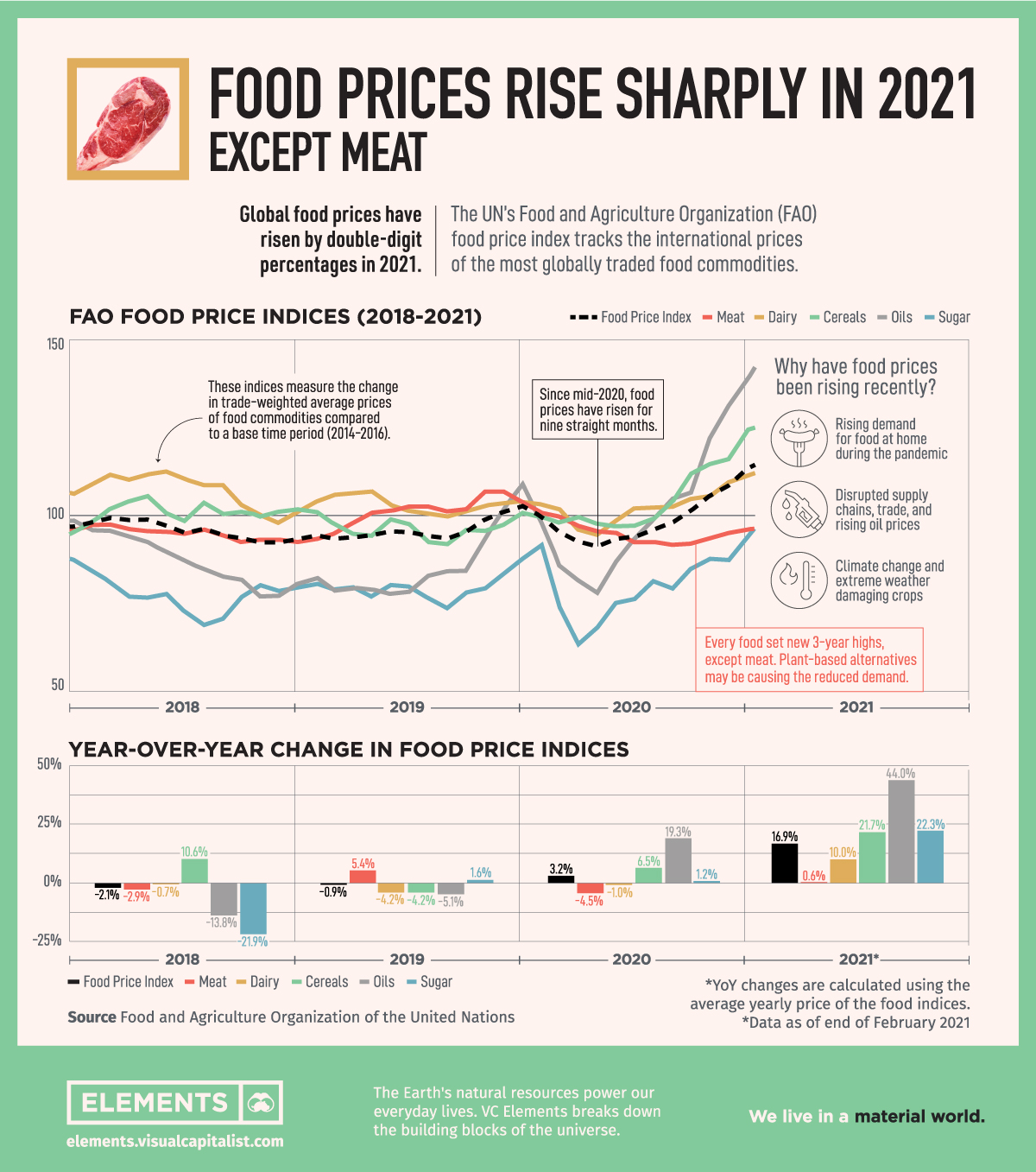

The Global Food Price Index Continues Rising in 2021

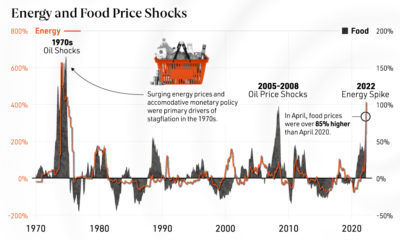

Food expenditures as a portion of disposable income have trended downwards in the U.S. for more than 50 years, but the trend could be reversing as food prices have risen sharply over the past months.

Since June 2020, the UN’s Food and Agriculture Organization’s (FAO) food price index has risen for nine consecutive months, with almost every food group setting new three-year highs in 2021. If the trend continues, food prices could begin to outpace income growth and monetary support from governments.

The one outlier in changing food prices has been meat prices, which have lagged behind with a minimal increase since mid-2020.

This graphic tracks the FAO’s food price indices along with their year-over-year (YoY) changes, showing the rapid price increases many of our staple food groups have had over the past year.

The Rising Food Prices of 2020 and 2021

Over the past five years, the FAO’s food price index has fluctuated by a few percentage points, but the arrival of the COVID-19 pandemic brought significant volatility.

Sugar and vegetable oils saw the largest changes, dropping by double-digit percentages (-19.2% and -12.4% respectively) in March of 2020, before recovering with the strongest overall price surges of the various food groups.

Food Price Indices Month-over-Month Change

| Date | Food Price Index MoM Change | Meat Price Index MoM Change | Dairy Price Index MoM Change | Cereals Price Index MoM Change | Vegetable Oils Price Index MoM Change | Sugar Price Index MoM Change |

|---|---|---|---|---|---|---|

| Jan 2020 | 1.49% | -2.81% | 0.29% | 2.40% | 7.09% | 5.42% |

| Feb 2020 | -3.02% | -2.99% | -0.87% | -1.09% | -10.21% | 4.46% |

| Mar 2020 | -4.33% | -1.09% | -1.36% | -1.71% | -12.40% | -19.15% |

| Apr 2020 | -2.84% | -2.52% | -5.62% | 1.64% | -5.03% | -14.48% |

| May 2020 | -1.52% | -1.55% | -1.46% | -1.81% | -4.19% | 7.28% |

| Jun 2020 | 2.31% | -0.63% | 4.13% | -0.82% | 11.31% | 10.47% |

| Jul 2020 | 0.86% | -2.74% | 3.56% | 0.21% | 7.62% | 1.47% |

| Aug 2020 | 2.02% | 0.00% | 0.29% | 2.17% | 5.90% | 6.71% |

| Sep 2020 | 2.19% | -0.76% | 0.20% | 5.05% | 5.98% | -2.59% |

| Oct 2020 | 3.37% | 0.33% | 2.15% | 7.31% | 1.72% | 7.22% |

| Nov 2020 | 4.15% | 1.63% | 0.86% | 2.51% | 14.57% | 3.31% |

| Dec 2020 | 2.94% | 1.61% | 3.61% | 1.31% | 7.55% | -0.46% |

| Jan 2021 | 4.33% | 1.05% | 1.74% | 7.16% | 5.87% | 8.15% |

| Feb 2021 | 2.47% | 0.63% | 1.71% | 1.21% | 6.20% | 6.37% |

The food price index increased by almost 17% YoY going into 2021, and while dairy, cereals, sugar, and vegetable oil prices all increased by double-digit percentages, meat prices rose less than 1% on average in 2021.

Surging Demand for Food at Home Drives Higher Prices

Although food prices have always fluctuated depending on weather conditions and global trade affecting food supply, this year’s increases were especially driven by a weakening U.S. dollar and increased demand due to the COVID-19 pandemic.

The pandemic resulted in severe changes to the world’s eating habits, with restaurant walk-ins and reservations down by more than 60% while demand for food at home increased as people stocked up on essentials.

To go alongside this, trade and supply chain disruptions in essential agricultural materials like fertilizer resulted in an inconsistent output from farmers and food producers, causing issues right as demand surged.

Meat and Dairy Prices Aren’t Keeping Up

As other food prices rise, the lack of significant increases in meat prices could reflect the avoidance of more expensive food products during tighter times, a lack of supply chain disruptions and constraints compared to agricultural sectors, or a larger societal trend of reduced animal product consumption.

Although dairy prices increased by 10% YoY in 2021, this increase was less than half of the price increases of cereals and sugar (21.7% and 22.3% respectively), and less than a quarter of vegetable oils prices which rose by 44%.

Plant-based alternatives are rapidly growing in popularity as nearly one in four Americans are reducing their meat consumption while veganism is rising in select European nations. Interestingly, despite these trends, 2020 also saw U.S. meat purchases rise as 43% of Americans have been buying more meat since the start of the pandemic.

Fighting the Fear of Inflating Food Prices

Whether meat prices catch up soon or not, the general trend of rising food prices poses a new inflationary pressure upon people around the world.

With in-restaurant dining taking a backseat, the increased prices are felt by everyone as they stock their cupboards, and inflation fears have been brewing as nations make their way out of the pandemic.

Rising government deficits and an increasing money supply represent efforts by governments to support citizens and national economies, but could ultimately be a key factor fueling the rising food prices.

One thing is certain, if food prices continue rising by double-digit percentages in the coming months and years, incomes and government support will struggle to keep up.

Urbanization

Ranked: The 20 Most Air-Polluted Cities on Earth

Using 2022 average PM2.5 concentrations, we rank the most polluted cities in the world.

Ranked: The 20 Most Air-Polluted Cities on Earth

According to the World Health Organization (WHO), almost the entire global population (99%) breathes air that exceeds WHO air quality limits.

In the above map, we use 2022 average PM2.5 concentrations from IQAir’s World Air Quality Report to visualize the most air-polluted major cities in the world.

World’s Air Pollution Hot Spots

As one of the standard air quality indicators used by the WHO, the PM2.5 concentration refers to the quantity of fine particulate matter with a diameter of 2.5 micrometers or less in a given volume of air.

Fine particulate matter that is this small can penetrate the lungs when inhaled and enter the bloodstream, affecting all major organs.

Based on annual average PM2.5 concentrations (μg/m³) in 2022, here are the most polluted cities in the world.

| Rank | City | 2022 average PM2.5 concentration (μg/m³) |

|---|---|---|

| 1 | 🇵🇰 Lahore, Pakistan | 97.4 |

| 2 | 🇨🇳 Hotan, China | 94.3 |

| 3 | 🇮🇳 Bhiwadi, India | 92.7 |

| 4 | 🇮🇳 Delhi, India | 92.6 |

| 5 | 🇵🇰 Peshawar, Pakistan | 91.8 |

| 6 | 🇮🇳 Darbhanga, India | 90.3 |

| 7 | 🇮🇳 Asopur, India | 90.2 |

| 8 | 🇹🇩 N'Djamena, Chad | 89.7 |

| 9 | 🇮🇳 New Delhi, India | 89.1 |

| 10 | 🇮🇳 Patna, India | 88.9 |

| 11 | 🇮🇳 Ghaziabad, India | 88.6 |

| 12 | 🇮🇳 Dharuhera, India | 87.8 |

| 13 | 🇮🇶 Baghdad, Iraq | 86.7 |

| 14 | 🇮🇳 Chapra, India | 85.9 |

| 15 | 🇮🇳 Muzaffarnagar, India | 85.5 |

| 16 | 🇵🇰 Faisalabad, Pakistan | 84.5 |

| 17 | 🇮🇳 Greater Noida, India | 83.2 |

| 18 | 🇮🇳 Bahadurgarh, India | 82.2 |

| 19 | 🇮🇳 Faridabad, India | 79.7 |

| 20 | 🇮🇳 Muzaffarpur, India | 79.2 |

With numbers these high, the concentration of some or all of the following pollutants are at dangerous levels in these cities:

- Ground-level ozone

- Particulate matter

- Carbon monoxide

- Sulfur dioxide

- Nitrogen dioxide

At the top of the list, Lahore in Pakistan has a combination of high vehicle and industrial emissions, as well as smoke from brick kilns, crop residue, general waste burning, and dust from construction sites.

Air pollution levels can also be impacted by practices such as large-scale tree removal in order to build new roads and buildings.

As a result of its growing population and rapidly expanding industrial sector, India has 14 cities on the list, outpacing China, formerly considered the world’s number one air pollution source.

The only African country on the list, Chad, experienced severe dust storms in 2022 that resulted in an 18% increase in PM2.5 concentration in 2022 compared to the previous year.

The Cost of Poor Air Quality

Poor air quality is one of the leading causes of early deaths worldwide, just behind high blood pressure, tobacco use, and poor diet.

According to a 2020 study by the Health Effects Institute, 6.67 million people died as a result of air pollution in 2019.

In addition to the millions of premature deaths each year, the global cost of health damages associated with air pollution currently sits at $8.1 trillion.

Urbanization

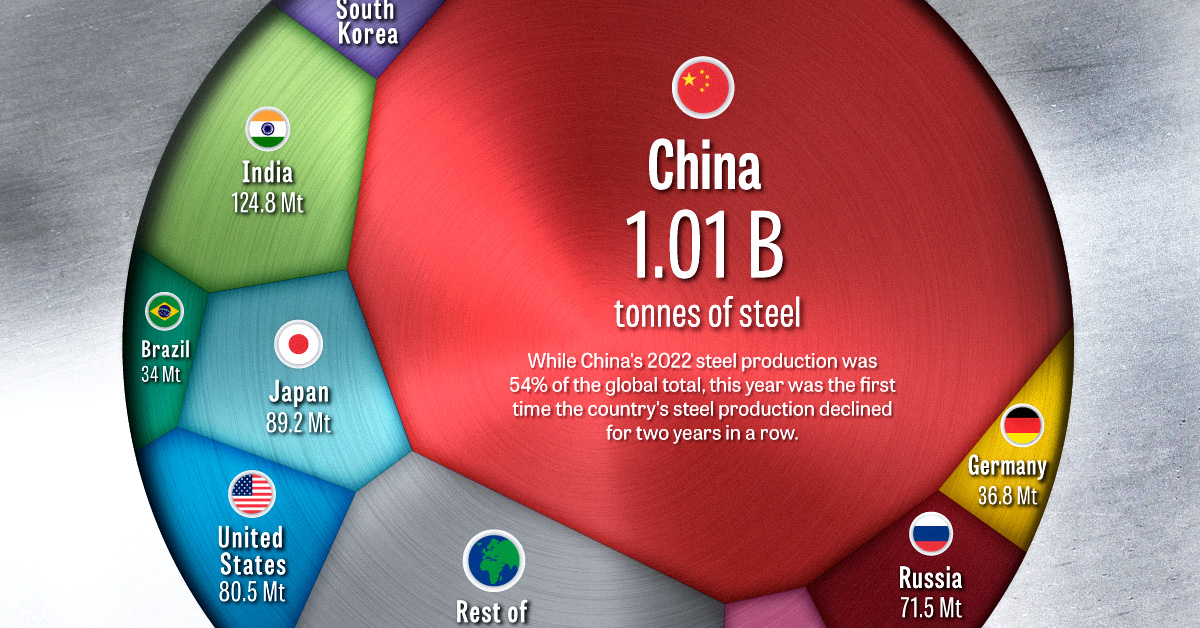

Visualizing the World’s Largest Steel-Producing Countries

China has dominated global steel production the past few decades, but how did the country get here, and is its production growth over?

The Largest Steel-Producing Countries: Visualized

Steel is a critical component of modern industry and economy, essential for the construction of buildings, automobiles, and many other appliances and infrastructure used in our daily lives.

This graphic uses data from the World Steel Association to visualize the world’s top steel-producing countries, and highlights China’s ascent to the top, as it now makes up more than half of the world’s steel production.

The State of Global Steel Production

Global steel production in 2022 reached 1,878 million tonnes, barely surpassing the pre-pandemic production of 1,875 million tonnes in 2019.

| Country | 2022 Production (in million tonnes) | Annual Production Change | Global Share |

|---|---|---|---|

| 🇨🇳 China | 1013.0 | -2.0% | 53.9% |

| 🇮🇳 India | 124.8 | 5.3% | 6.6% |

| 🇯🇵 Japan | 89.2 | -7.9% | 4.8% |

| 🇺🇸 United States | 80.5 | -6.5% | 4.3% |

| 🇷🇺 Russia | 71.5 | -5.8% | 3.8% |

| 🇰🇷 South Korea | 65.9 | -6.9% | 3.5% |

| 🇩🇪 Germany | 36.8 | -8.8% | 2.0% |

| 🇹🇷 Türkiye | 35.1 | -15.0% | 1.9% |

| 🇧🇷 Brazil | 34.0 | -6.5% | 1.8% |

| 🇮🇷 Iran | 30.6 | 6.8% | 1.6% |

| 🇮🇹 Italy | 21.6 | -13.0% | 1.1% |

| 🇹🇼 Taiwan | 20.7 | -12.1% | 1.1% |

| 🇻🇳 Vietnam | 20.0 | -15.0% | 1.1% |

| 🇲🇽 Mexico | 18.2 | -1.9% | 1.0% |

| 🇮🇩 Indonesia | 15.6 | 8.3% | 0.8% |

| Rest of World | 201.0 | -11.2% | 10.7% |

| World Total | 1878.5 | -3.9% | 100.0% |

2022’s steel production marked a significant reduction compared to the post-pandemic rebound of 1,960 million tonnes in 2021, with a year-over-year decline of 4.2%–the largest drop since 2009, and prior to that, 1991.

This decline was spread across many of the world’s top steel producers, with only three of the top fifteen countries, India, Iran, and Indonesia, increasing their yearly production. Most of the other top steel-producing countries saw annual production declines of more than 5%, with Turkey, Italy, Taiwan, and Vietnam’s production all declining by double digits.

Even the world’s top steel-producing nation, China, experienced a modest 2% decline, which due to the country’s large production amounted to a decline of 19.8 million tonnes, more than many other nations produce in a year.

Despite India, the world’s second-largest steel producer, increasing its production by 5.3%, the country’s output still amounts to just over one-tenth of the steel produced by China.

China’s Meteoric Rise in Steel Production

Although China dominates the world’s steel production with more than a 54% share today, this hasn’t always been the case.

In 1967, the World Steel Association’s first recorded year of steel production figures, China only produced an estimated 14 million tonnes, making up barely 3% of global output. At that time, the U.S. and the USSR were competing as the world’s top steel producers at 115 and 102 million tonnes respectively, followed by Japan at 62 million tonnes.

Almost three decades later in 1996, China had successively overtaken Russia, the U.S., and Japan to become the top steel-producing nation with 101 million tonnes of steel produced that year.

The early 2000s marked a period of rapid growth for China, with consistent double-digit percentage increases in steel production each year.

The Recent Decline in China’s Steel Production

Since the early 2000s, China’s average annual growth in steel production has slowed to 3.4% over the last decade (2013-2022), a considerable decline compared to the previous decade’s (2003-2012) 15.2% average annual growth rate.

The past couple of years have seen China’s steel production decline, with 2021 and 2022 marking the first time the country’s production fell for two consecutive years in a row.

While it’s unlikely China will relinquish its position as the top steel-producing nation anytime soon, it remains to be seen whether this recent decline marks the beginning of a new trend or just a brief deviation from the country’s consistent production growth.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies