Electrification

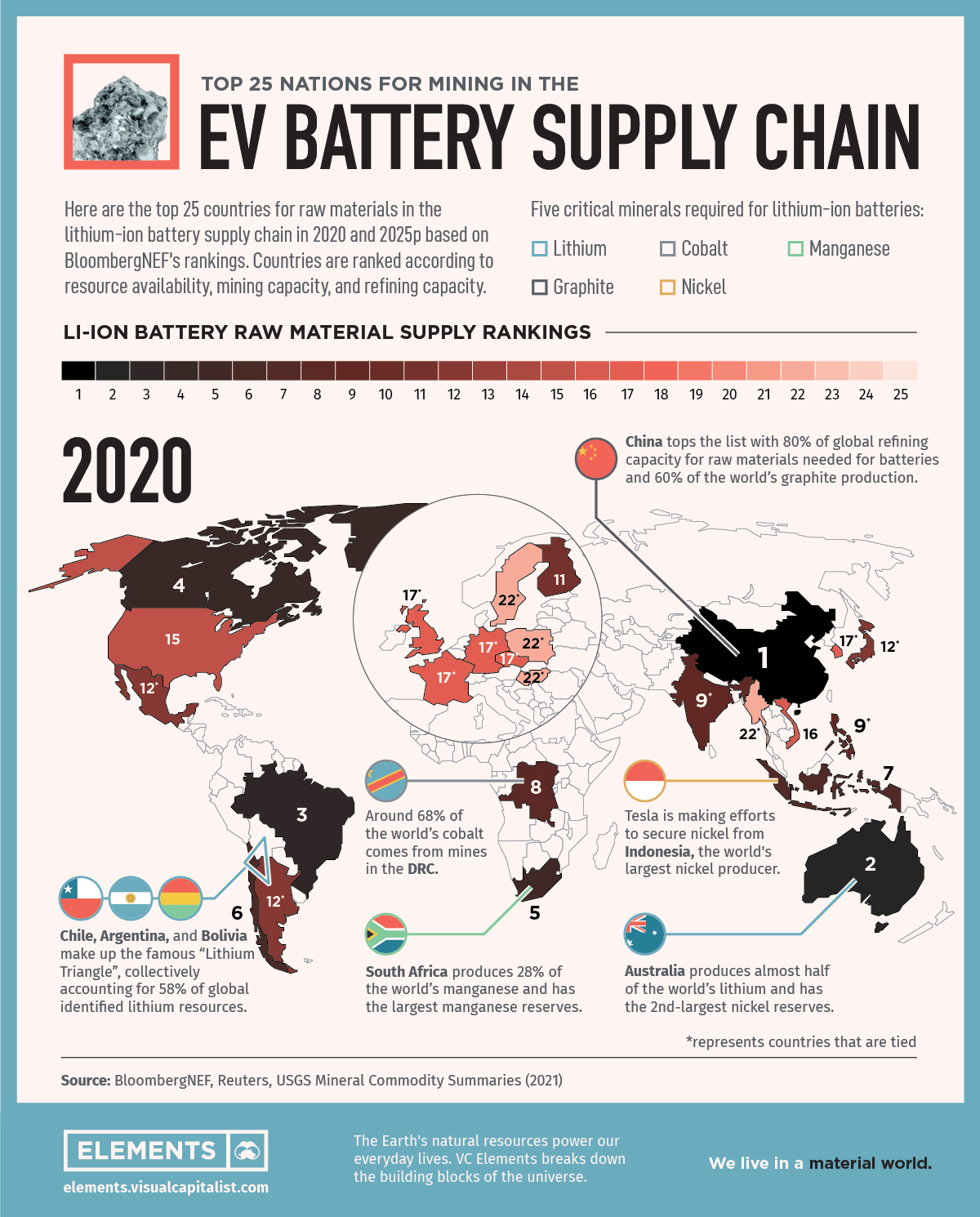

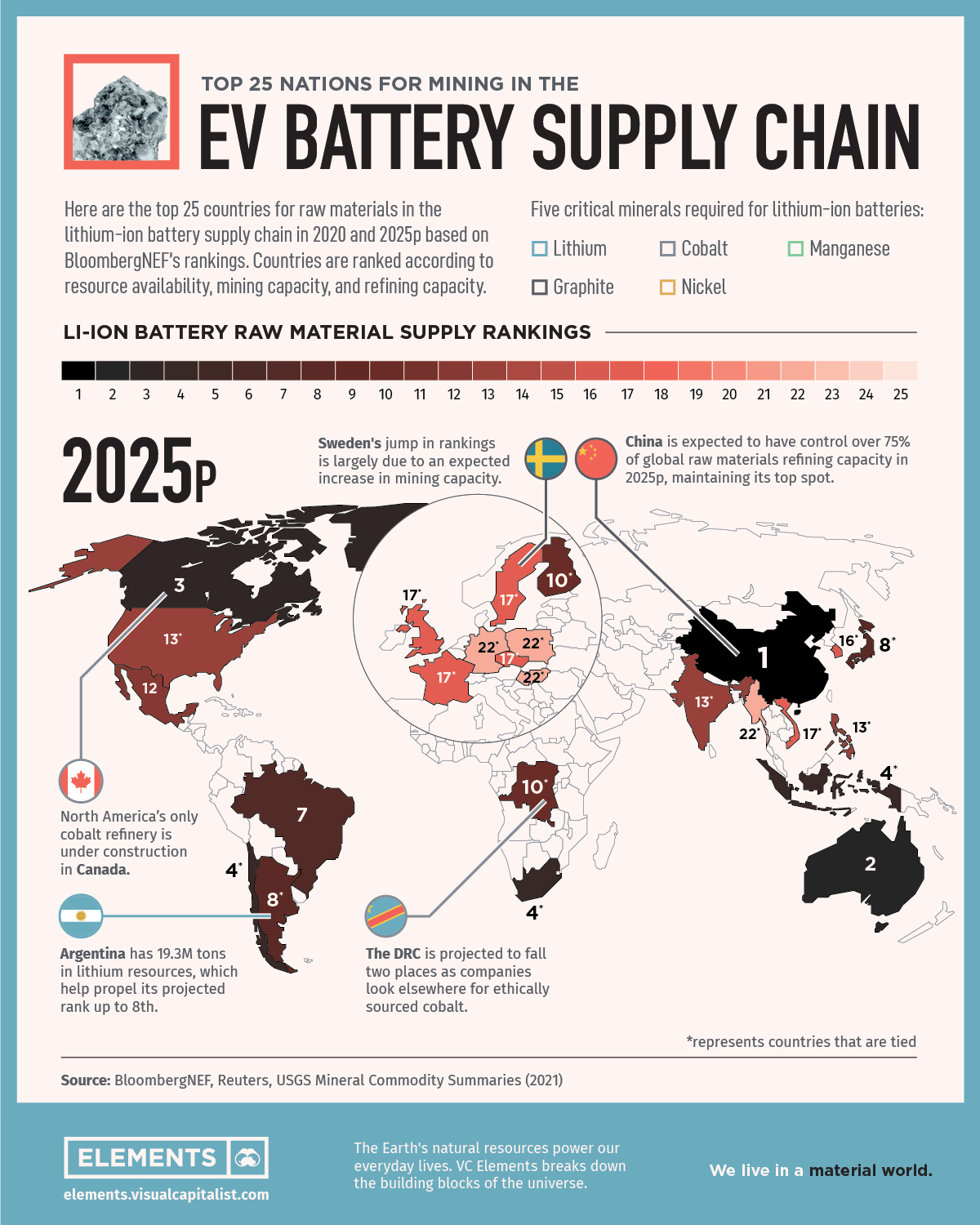

Ranked: Top 25 Nations Producing Battery Metals for the EV Supply Chain

How to Use: Click the arrows on the left/right to navigate between current and projected rankings.

The Role of Mining in the EV Battery Supply Chain

Batteries are one of the most important and expensive components of electric vehicles (EVs). The vast majority of EVs use lithium-ion (Li-ion) batteries, which harness the properties of minerals and elements to power the vehicles. But batteries do not grow on trees—the raw materials for them, known as “battery metals”, have to be mined and refined.

The above graphic uses data from BloombergNEF to rank the top 25 countries producing the raw materials for Li-ion batteries.

Battery Metals: The Critical Raw Materials for EV Batteries

The raw materials that batteries use can differ depending on their chemical compositions. However, there are five battery minerals that are considered critical for Li-ion batteries:

- Cobalt

- Graphite

- Lithium

- Manganese

- Nickel

Miners extract these minerals from economically viable deposits and refine them from their raw forms into high-quality products and chemicals for EV batteries.

The Top 25 Nations Supplying Battery Metals

Some countries are more crucial than others to the battery metal supply chain. BloombergNEF ranked the top 25 countries according to the following methodology:

- First, they tallied the mineral resources, mining capacity, and refining capacity in 2020 and projected commissioned capacity by 2025 for the five key metals listed above in each country.

- Then, to determine the overall score for each country, BloombergNEF categorized the countries’ capacities into five bands. Countries in the lowest band received a score of 1 and those in the highest band received a score of 5.

- The overall score is the result of averaging the scores across the five categories for each country.

Now that we have a better understanding of how the rankings work, here are the top 25 nations for raw materials in the Li-ion supply chain in 2020 and 2025.

| Country | 2020 Rank | 2025 Projected Rank | Change in Rank |

|---|---|---|---|

| China | 1 | 1 | 0 |

| Australia | 2 | 2 | 0 |

| Brazil | 3 | 7 | -4 |

| Canada | 4 | 3 | +1 |

| South Africa | 5 | 4 | +1 |

| Chile | 6 | 4 | +2 |

| Indonesia | 7 | 4 | +3 |

| Democratic Republic of Congo (DRC) | 8 | 10 | -2 |

| India | 9 | 13 | -4 |

| Philippines | 9 | 13 | -4 |

| Finland | 11 | 10 | +1 |

| Japan | 12 | 8 | +4 |

| Argentina | 12 | 8 | +4 |

| Mexico | 12 | 12 | 0 |

| U.S. | 15 | 13 | +2 |

| Vietnam | 16 | 17 | -1 |

| South Korea | 17 | 16 | +1 |

| Germany | 17 | 22 | -5 |

| U.K. | 17 | 17 | 0 |

| France | 17 | 17 | 0 |

| Czech Republic | 17 | 17 | 0 |

| Sweden | 22 | 17 | +5 |

| Poland | 22 | 22 | 0 |

| Hungary | 22 | 22 | 0 |

| Thailand | 22 | 22 | 0 |

China’s dominance in the rankings shows that refining capacity is just as important, if not more, as access to raw materials and mining capacity.

China does not boast an abundance of battery metal deposits but ranks first largely due to its control over 80% of global raw material refining capacity. Additionally, China is the world’s largest producer of graphite, the primary anode material for Li-ion batteries.

Australia comes in at number two due to its massive lithium production capacity and nickel reserves. Following Australia is Brazil, one of the world’s top 10 producers of graphite, nickel, manganese, and lithium.

On the other end of the spectrum, Poland, Hungary, Sweden, and Thailand are tied at rank 22. However, it’s important to note that these are among the top 10 countries for cell and component manufacturing—the next step in the lithium-ion battery supply chain.

Countries on the Rise

Sweden’s rank rises five places between 2020 and 2025p, largely due to an expected increase in its mining capacity with nickel and graphite projects in the pipeline. Argentina is projected to jump up to eighth place thanks to its massive lithium resources and multiple mining projects in advanced stages.

Moreover, Japan is projected to move up four places with its first lithium hydroxide refining plant under construction. In addition, Japanese miner Sumitomo Metal Mining is planning to double battery metal production by 2028.

Although China will likely maintain its dominance for the foreseeable future, other countries are ramping up their mining and refining capacities. Given the increasing importance of EVs, it will be interesting to see how the battery metals supply chain evolves going forward.

Electrification

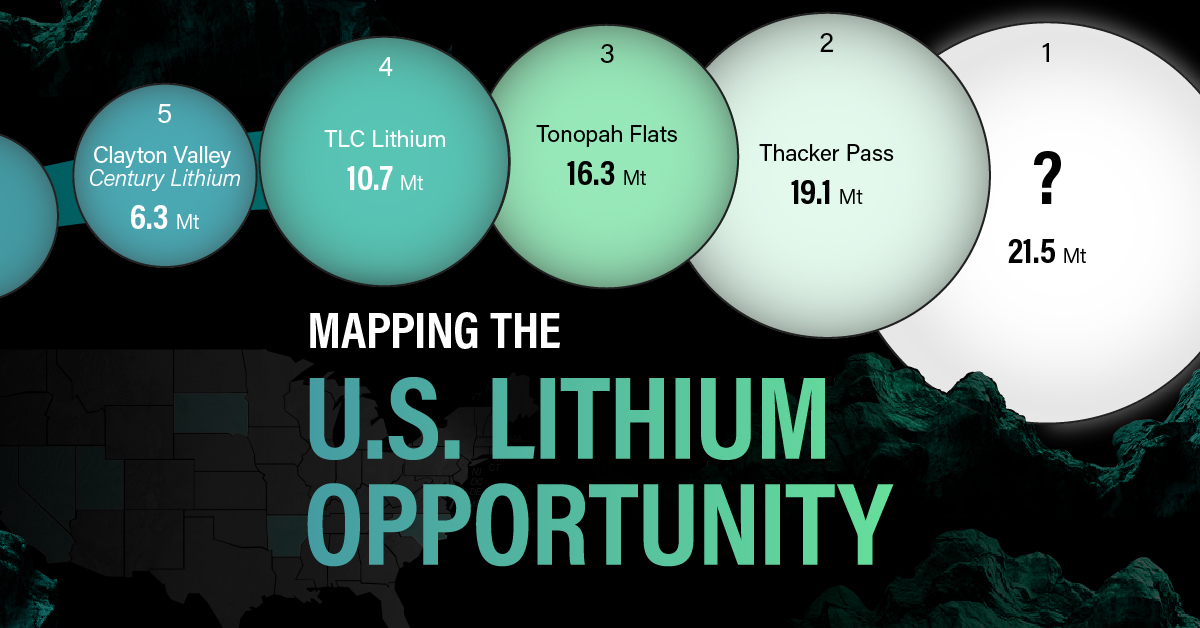

White Gold: Mapping U.S. Lithium Mines

In this graphic, Visual Capitalist partnerered with EnergyX to explore the size and location of U.S. lithium mines.

White Gold: Mapping U.S. Lithium Mines

The U.S. doubled imports of lithium-ion batteries for the third consecutive year in 2022, and with EV demand growing yearly, U.S. lithium mines must ramp up production or rely on other nations for their supply of refined lithium.

To determine if the domestic U.S. lithium opportunity can meet demand, we partnered with EnergyX to determine how much lithium sits within U.S. borders.

U.S. Lithium Projects

The most crucial measure of a lithium mine’s potential is the quantity that can be extracted from the source.

For each lithium resource, the potential volume of lithium carbonate equivalent (LCE) was calculated with a ratio of one metric ton of lithium producing 5.32 metric tons of LCE. Cumulatively, existing U.S. lithium projects contain 94.8 million metric tons of LCE.

| Rank | Project Name | LCE, million metric tons (est.) |

|---|---|---|

| 1 | McDermitt Caldera | 21.5 |

| 2 | Thacker Pass | 19.1 |

| 3 | Tonopah Flats | 18.0 |

| 4 | TLC Lithium | 10.7 |

| 5 | Clayton Valley (Century Lithium) | 6.3 |

| 6 | Zeus Lithium | 6.3 |

| 7 | Rhyolite Ridge | 3.4 |

| 8 | Arkansas Smackover (Phase 1A) | 2.8 |

| 9 | Basin Project | 2.2 |

| 10 | McGee Deposit | 2.1 |

| 11 | Arkansas Smackover (South West) | 1.8 |

| 12 | Clayton Valley (Lithium-X, Pure Energy) | 0.8 |

| 13 | Big Sandy | 0.3 |

| 14 | Imperial Valley/Salton Sea | 0.3 |

U.S. Lithium Opportunities, By State

U.S. lithium projects mainly exist in western states, with comparatively minor opportunities in central or eastern states.

| State | LCE, million metric tons (est.) |

|---|---|

| Nevada | 88.2 |

| Arkansas | 4.6 |

| Arizona | 2.5 |

| California | 0.3 |

Currently, the U.S. is sitting on a wealth of lithium that it is underutilizing. For context, in 2022, the U.S. only produced about 5,000 metric tons of LCE and imported a projected 19,000 metric tons of LCE, showing that the demand for the mineral is healthy.

The Next Gold Rush?

U.S. lithium companies have the opportunity to become global leaders in lithium production and accelerate the transition to sustainable energy sources. This is particularly important as the demand for lithium is increasing every year.

EnergyX is on a mission to meet U.S. lithium demands using groundbreaking technology that can extract 300% more lithium from a source than traditional methods.

You can take advantage of this opportunity by investing in EnergyX and joining other significant players like GM in becoming a shareholder.

Electrification

Will Direct Lithium Extraction Disrupt the $90B Lithium Market?

Visual Capitalist and EnergyX explore how direct lithium extraction could disrupt the $90B lithium industry.

Will Direct Lithium Extraction Disrupt the $90B Lithium Market?

Current lithium extraction and refinement methods are outdated, often harmful to the environment, and ultimately inefficient. So much so that by 2030, lithium demand will outstrip supply by a projected 1.42 million metric tons. But there is a solution: Direct lithium extraction (DLE).

For this graphic, we partnered with EnergyX to try to understand how DLE could help meet global lithium demands and change an industry that is critical to the clean energy transition.

The Lithium Problem

Lithium is crucial to many renewable energy technologies because it is this element that allows EV batteries to react. In fact, it’s so important that projections show the lithium industry growing from $22.2B in 2023 to nearly $90B by 2030.

But even with this incredible growth, as you can see from the table, refined lithium production will need to increase 86.5% over and above current projections.

| 2022 (million metric tons) | 2030P (million metric tons) | |

|---|---|---|

| Lithium Carbonate Demand | 0.46 | 1.21 |

| Lithium Hydroxide Demand | 0.18 | 1.54 |

| Lithium Metal Demand | 0 | 0.22 |

| Lithium Mineral Demand | 0.07 | 0.09 |

| Total Demand | 0.71 | 3.06 |

| Total Supply | 0.75 | 1.64 |

The Solution: Direct Lithium Extraction

DLE is a process that uses a combination of solvent extraction, membranes, or adsorbents to extract and then refine lithium directly from its source. LiTASTM, the proprietary DLE technology developed by EnergyX, can recover an incredible 300% more lithium per ton than existing processes, making it the perfect tool to help meet lithium demands.

Additionally, LiTASTM can refine lithium at the lowest cost per unit volume directly from brine, an essential step in meeting tomorrow’s lithium demand and manufacturing next-generation batteries, while significantly reducing the footprint left by lithium mining.

| Hard Rock Mining | Underground Reservoirs | Direct Lithium Extraction | |

|---|---|---|---|

| Direct CO2 Emissions | 15,000 kg | 5,000 kg | 3.5 kg |

| Water Use | 170 m3 | 469 m3 | 34-94 m3 |

| Lithium Recovery Rate | 58% | 30-40% | 90% |

| Land Use | 464 m2 | 3124 m2 | 0.14 m2 |

| Process Time | Variable | 18 months | 1-2 days |

Providing the World with Lithium

DLE promises to disrupt the outdated lithium industry by improving lithium recovery rates and slashing emissions, helping the world meet the energy demands of tomorrow’s electric vehicles.

EnergyX is on a mission to become a worldwide leader in the sustainable energy transition using groundbreaking direct lithium extraction technology. Don’t miss your chance to join companies like GM and invest in EnergyX to transform the future of renewable energy.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

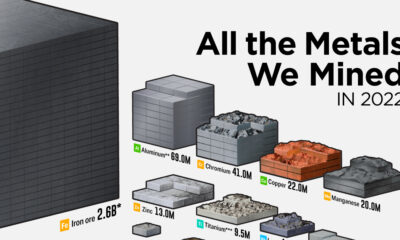

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021