Electrification

Lithium Consumption Has Nearly Quadrupled Since 2010

Lithium Consumption Has Nearly Quadrupled Since 2010

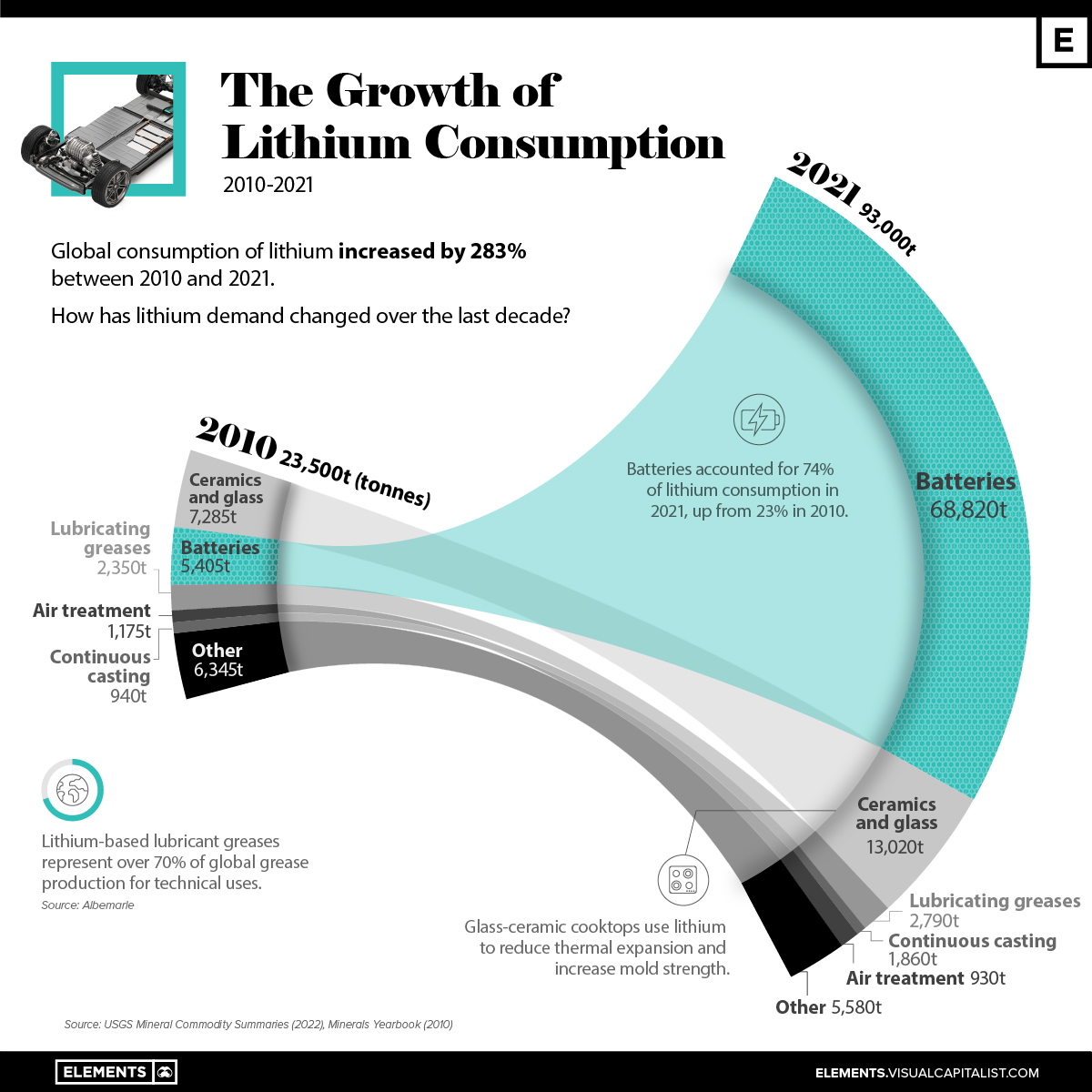

Lithium is well-known as one of the key materials behind the lithium-ion batteries that power electronic devices, electric vehicles, and energy storage technologies.

Because of its role in clean energy technologies, lithium demand hasn’t only increased, it has transformed. From primarily being used for ceramics, battery demand has taken over global lithium consumption and driven an almost four-fold increase since 2010.

The Impact of EV Batteries

Between 2000 and 2010, lithium consumption in batteries increased by 20% on average every year. In the following decade, that figure jumped to 107% per year for batteries, with overall lithium consumption growing 27% annually on average.

The full breakdown from the United States Geological Survey (USGS) shows the impact of battery consumption:

| End-use | Lithium Consumption 2010 (%) | Lithium Consumption 2021 (%) |

|---|---|---|

| Batteries | 23% | 74% |

| Ceramics and glass | 31% | 14% |

| Lubricating greases | 10% | 3% |

| Air treatment | 5% | 1% |

| Continuous casting | 4% | 2% |

| Other | 27% | 6% |

| Total | 100% | 100% |

Back in 2010, the single largest end-use of lithium was in ceramics and glass manufacturing. Adding lithium carbonate to the coatings on ceramics and glassware reduces their thermal expansion, which is often essential for modern glass-ceramic cooktops.

But over the course of the decade, the EV market grew rapidly, with the global market share of EVs surging from 0.01% in 2010 to 8.6% in 2021. This had a ripple effect on the demand for batteries, which now account for nearly three-fourths of worldwide lithium consumption.

Additionally, the lightweight metal also has other important applications that are less well-known. For instance, lithium-based lubricant greases represent over 70% of global grease production for technical uses. Additionally, it’s also used in die casting, color pigment creation, aluminum smelting, and gas and air treatment.

What’s Next for Lithium Consumption?

With mainstream EV adoption on the horizon, the 2020s could mark another decade of growing lithium consumption.

Multiple countries have pledged to phase out internal combustion engine (ICE) vehicles by 2030, and large automakers like Volkswagen, GM, and Ford plan on rolling out several new EV models.

As EV demand rises, it’s likely that lithium consumption—especially in batteries—will continue increasing, with batteries expected to use 84% of all lithium produced in 2025.

Electrification

White Gold: Mapping U.S. Lithium Mines

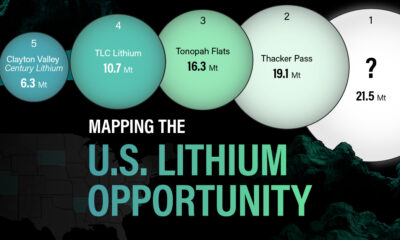

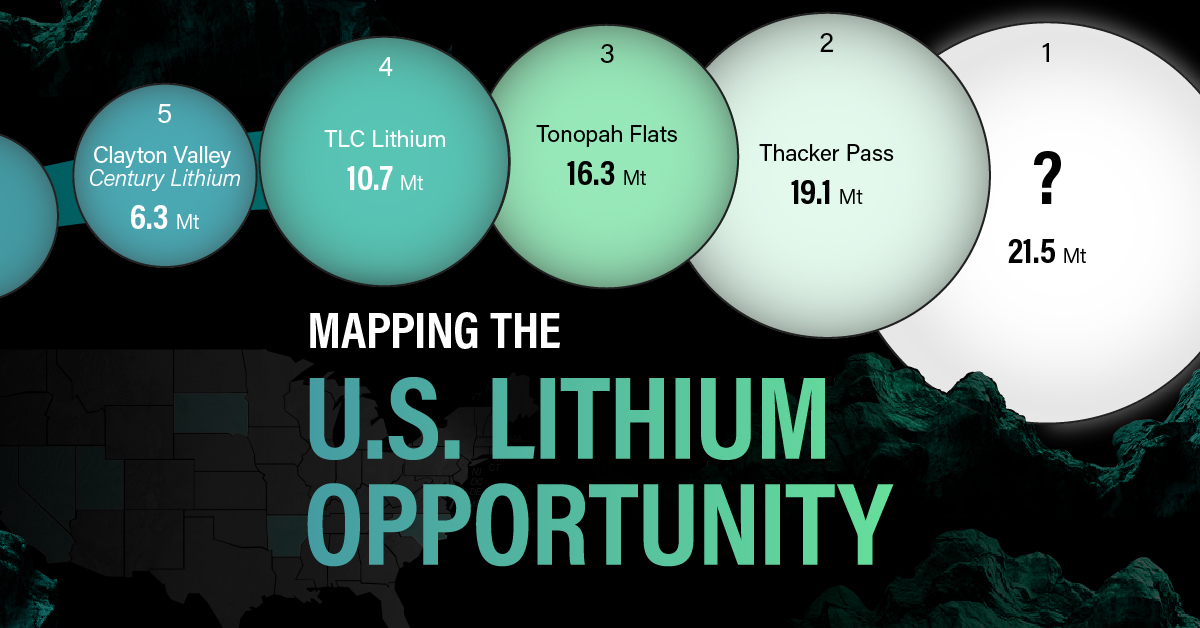

In this graphic, Visual Capitalist partnerered with EnergyX to explore the size and location of U.S. lithium mines.

White Gold: Mapping U.S. Lithium Mines

The U.S. doubled imports of lithium-ion batteries for the third consecutive year in 2022, and with EV demand growing yearly, U.S. lithium mines must ramp up production or rely on other nations for their supply of refined lithium.

To determine if the domestic U.S. lithium opportunity can meet demand, we partnered with EnergyX to determine how much lithium sits within U.S. borders.

U.S. Lithium Projects

The most crucial measure of a lithium mine’s potential is the quantity that can be extracted from the source.

For each lithium resource, the potential volume of lithium carbonate equivalent (LCE) was calculated with a ratio of one metric ton of lithium producing 5.32 metric tons of LCE. Cumulatively, existing U.S. lithium projects contain 94.8 million metric tons of LCE.

| Rank | Project Name | LCE, million metric tons (est.) |

|---|---|---|

| 1 | McDermitt Caldera | 21.5 |

| 2 | Thacker Pass | 19.1 |

| 3 | Tonopah Flats | 18.0 |

| 4 | TLC Lithium | 10.7 |

| 5 | Clayton Valley (Century Lithium) | 6.3 |

| 6 | Zeus Lithium | 6.3 |

| 7 | Rhyolite Ridge | 3.4 |

| 8 | Arkansas Smackover (Phase 1A) | 2.8 |

| 9 | Basin Project | 2.2 |

| 10 | McGee Deposit | 2.1 |

| 11 | Arkansas Smackover (South West) | 1.8 |

| 12 | Clayton Valley (Lithium-X, Pure Energy) | 0.8 |

| 13 | Big Sandy | 0.3 |

| 14 | Imperial Valley/Salton Sea | 0.3 |

U.S. Lithium Opportunities, By State

U.S. lithium projects mainly exist in western states, with comparatively minor opportunities in central or eastern states.

| State | LCE, million metric tons (est.) |

|---|---|

| Nevada | 88.2 |

| Arkansas | 4.6 |

| Arizona | 2.5 |

| California | 0.3 |

Currently, the U.S. is sitting on a wealth of lithium that it is underutilizing. For context, in 2022, the U.S. only produced about 5,000 metric tons of LCE and imported a projected 19,000 metric tons of LCE, showing that the demand for the mineral is healthy.

The Next Gold Rush?

U.S. lithium companies have the opportunity to become global leaders in lithium production and accelerate the transition to sustainable energy sources. This is particularly important as the demand for lithium is increasing every year.

EnergyX is on a mission to meet U.S. lithium demands using groundbreaking technology that can extract 300% more lithium from a source than traditional methods.

You can take advantage of this opportunity by investing in EnergyX and joining other significant players like GM in becoming a shareholder.

Electrification

Will Direct Lithium Extraction Disrupt the $90B Lithium Market?

Visual Capitalist and EnergyX explore how direct lithium extraction could disrupt the $90B lithium industry.

Will Direct Lithium Extraction Disrupt the $90B Lithium Market?

Current lithium extraction and refinement methods are outdated, often harmful to the environment, and ultimately inefficient. So much so that by 2030, lithium demand will outstrip supply by a projected 1.42 million metric tons. But there is a solution: Direct lithium extraction (DLE).

For this graphic, we partnered with EnergyX to try to understand how DLE could help meet global lithium demands and change an industry that is critical to the clean energy transition.

The Lithium Problem

Lithium is crucial to many renewable energy technologies because it is this element that allows EV batteries to react. In fact, it’s so important that projections show the lithium industry growing from $22.2B in 2023 to nearly $90B by 2030.

But even with this incredible growth, as you can see from the table, refined lithium production will need to increase 86.5% over and above current projections.

| 2022 (million metric tons) | 2030P (million metric tons) | |

|---|---|---|

| Lithium Carbonate Demand | 0.46 | 1.21 |

| Lithium Hydroxide Demand | 0.18 | 1.54 |

| Lithium Metal Demand | 0 | 0.22 |

| Lithium Mineral Demand | 0.07 | 0.09 |

| Total Demand | 0.71 | 3.06 |

| Total Supply | 0.75 | 1.64 |

The Solution: Direct Lithium Extraction

DLE is a process that uses a combination of solvent extraction, membranes, or adsorbents to extract and then refine lithium directly from its source. LiTASTM, the proprietary DLE technology developed by EnergyX, can recover an incredible 300% more lithium per ton than existing processes, making it the perfect tool to help meet lithium demands.

Additionally, LiTASTM can refine lithium at the lowest cost per unit volume directly from brine, an essential step in meeting tomorrow’s lithium demand and manufacturing next-generation batteries, while significantly reducing the footprint left by lithium mining.

| Hard Rock Mining | Underground Reservoirs | Direct Lithium Extraction | |

|---|---|---|---|

| Direct CO2 Emissions | 15,000 kg | 5,000 kg | 3.5 kg |

| Water Use | 170 m3 | 469 m3 | 34-94 m3 |

| Lithium Recovery Rate | 58% | 30-40% | 90% |

| Land Use | 464 m2 | 3124 m2 | 0.14 m2 |

| Process Time | Variable | 18 months | 1-2 days |

Providing the World with Lithium

DLE promises to disrupt the outdated lithium industry by improving lithium recovery rates and slashing emissions, helping the world meet the energy demands of tomorrow’s electric vehicles.

EnergyX is on a mission to become a worldwide leader in the sustainable energy transition using groundbreaking direct lithium extraction technology. Don’t miss your chance to join companies like GM and invest in EnergyX to transform the future of renewable energy.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets2 years ago

Real Assets2 years agoThe World’s Top 10 Gold Mining Companies

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Electrification3 years ago

Electrification3 years agoThe Biggest Mining Companies in the World in 2021

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021